Bonds have quickly become the asset class of the moment. With cash and many fixed income securities now yielding amounts not seen in decades and the potential for capital appreciation on the table, investors of all stripes have rushed into the asset class. These days, many portfolios are now overweight cash and fixed income assets, much to the chagrin of equities.

However, that may not be such a great thing.

According to the latest missive from J.P. Morgan’s Private Bank, overweighting fixed income for the long haul—despite the current tailwinds—may be a bad thing. Investors still need equities to do the heavy lifting.

Too Many Bonds

Surging inflation and Fed’s policy shift toward monetary tightening has had a major effect on the fixed income market. Bonds are back with a vengeance. With their inverse relationship, the rise in interest rates sent many bond prices lower and subsequently pushed yields higher. The 13%+ drop in the Bloomberg U.S. Aggregate Bond Index last year has helped the index now yield over 4%. Meanwhile, cash and short-term bonds are paying close to 5%.

With that, investors have gone gaga for fixed income assets.

According to investment data provider Investment Company Institute, bonds saw more than $16 billion in net inflows in May, with aggregate funds and government funds adding over $9 billion each. Inflows to cash and ultra-short-term bonds have reached more than $837 billion year to date.

Those continued inflows have shifted investor allocations in a big way. Data from Bank of America shows that investors are now overweight bonds by a net 10%. This is the highest level of overweight positions since March 2009. Allocations to cash have stayed at levels above 5% for 17 consecutive months. This is the second longest period on record. The longest period was the dot-com bear market, during which cash allocations stayed that high for 32 months. 1

Too Much Too Soon?

It’s easy to see why investors have looked toward bonds for a larger portion of their portfolio, particularly when considering a potential recession is on the horizon. And that might be good in the short term,but for the longer term it might not be such a great idea.

J.P. Morgan’s Private Bank sets out the case for still having the bulk of your portfolio in equities for the long term. Simply put, bonds can’t fuel the growth needed to provide long-term wealth generation or meet retirement goals.

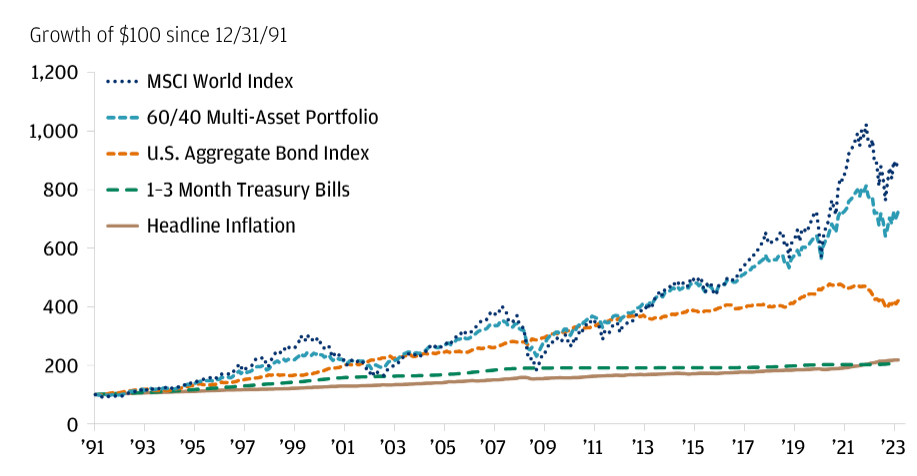

Looking at returns data, an investor who simply purchased Treasury bills (T-bills) or government debt maturing in less than one year would have just preserved their purchasing power for the last three decades. That is, until this year when inflation finally took the lead. Even with rate hikes, investors in cash/T-bills are still losing out to inflation.

Fixed income hasn’t done much better. While the Bloomberg U.S. Aggregate Bond Index has managed to keep up with inflation and provide a slightly better return, over the long haul, growth from the sector hasn’t been enough to outperform changes to the CPI.

Stocks have been better on these fronts, with a 60/40 portfolio and overweighting equities doing much better. Looking at the annualized return of a 60/40 stock-bond allocation, JPM shows that the portfolio would have outperformed cash in every 20-year rolling period since 1975. It’s done much better than just holding bonds as well. 2

This chart from JPM shows the growth of $100 in the asset classes since the 1990s. You can see that bonds and cash simply don’t hold their own.

Source: J.P. Morgan Private Bank.

Don’t Ignore Stocks

So, what should investors do? Don’t forget equities in your portfolio. While no one can predict the future, the historical evidence is clear that stocks will and do outperform over the long haul. Investors need them to actually beat inflation and generate wealth. To that end, J.P. Morgan suggests that investors make sure their allocations are within their risk profiles or stick to the classic 60/40 split. That means perhaps selling some bond exposure and buying equities. Incidentally, the bank suggests that stock declines last year have perhaps given them an entry point for longer-term investors.

Simply adding a broad-based fund like the Vanguard Total Stock Market Index Fund or the iShares Core S&P 500 ETF could be all you need. JPM suggests global exposure with equities via the MSCI All-World Index and a fund like * iShares MSCI ACWI ETF*.

Another choice could be a broad dividend growth fund like the Vanguard Dividend Appreciation Index Fund or JPMorgan Equity Premium Income ETF. Here, investors can still get the income they would from bonds while still maintaining the growth aspects of equities.

All in all, investors shouldn’t be so quick to throw away stocks and rush into fixed income.

Here's a list of ETFs available for reducing bond exposure and adding easy equity access.

| Name | Ticker | Type | Active? | AUM | YTD Ret (%) | Expense |

|---|---|---|---|---|---|---|

| iShares Core S&P 500 ETF | IVV | ETF | No | $329 billion | 16.5% | 0.03% |

| Vanguard Total Stock Market Index Fund | VTI | ETF | No | $306 billion | 15.7% | 0.06% |

| Vanguard Dividend Appreciation Index Fund | VIG | ETF | No | $68.5 billion | 6.4% | 0.06% |

| JPMorgan Equity Premium Income ETF | JEPI | ETF | Yes | $28.7 billion | 2.5% | 0.35% |

| iShares MSCI ACWI ETF | ACWI | ETF | YES | $17.6 billion | 12.7% | 0.32% |

The Bottom Line

With bonds yielding the most they have in a decade and the potential for a recession growing, it’s easy to see why bonds have become the asset class of the moment. However, investors need to think about their goals before overweighting fixed income. According to J.P. Morgan, that could be a bad decision over the long term.

fn1. Bloomberg (April 2023). Investors Are the Most Bearish on Stocks Versus Bonds Since 2009

2 J.P. Morgan Private Bank (May 2023). Could too much fixed income be a bad thing?