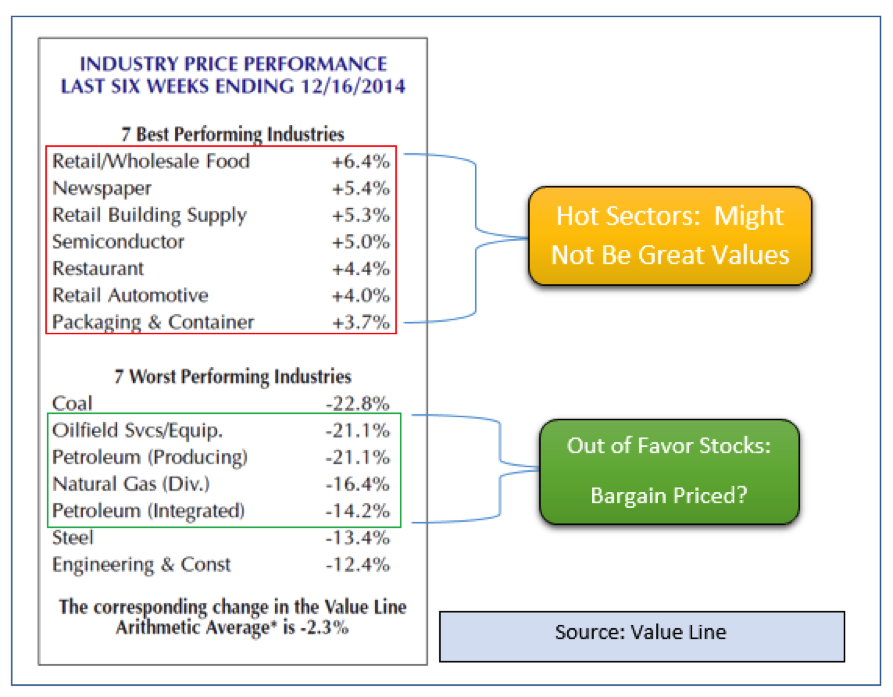

Sources that show which segments of the market are hot, or not, are easy to find. In the six weeks ended Dec. 16, 2014, Value Line reported that all five of the worst performing sectors were energy related. I’m not playing coal because it may be “down for the count” due to changes in environmental regulations. Oil and gas stocks, however, appear mighty tempting for those with time horizons of 6–24 months.

They could easily go higher much quicker than that.

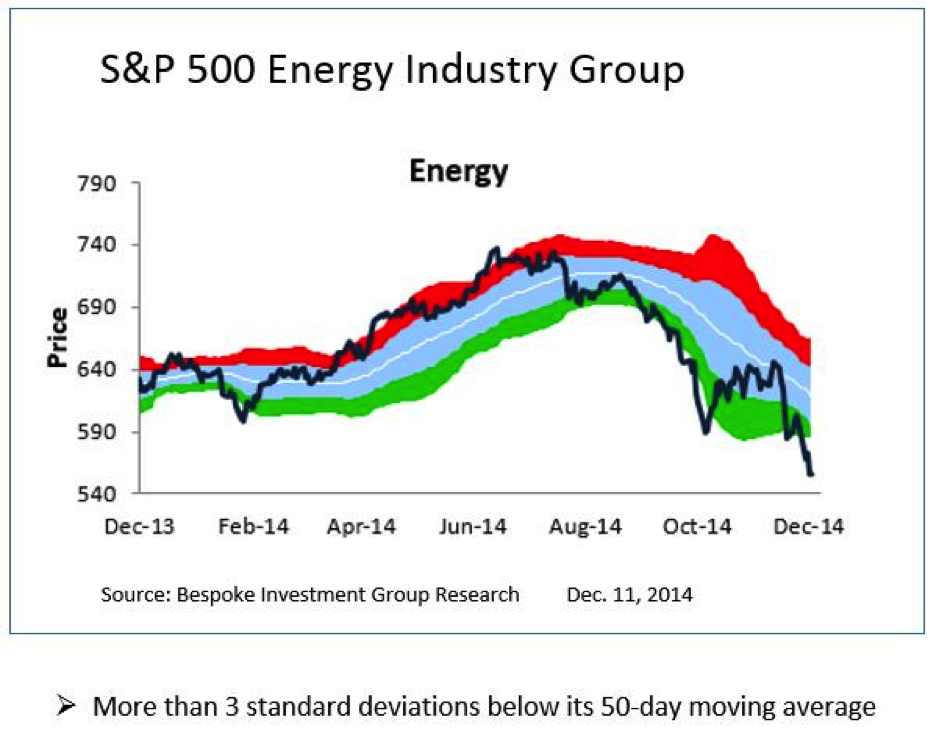

Moves like that are extremely rare. They are typically followed by major reversions to the mean. Mutual fund investors and traders alike should be positioning now for the inevitable rebound in oil prices.

Funds to Play

Pro Funds Oil Equipment Service & Distribution Fund (OEPIX) is a bit more specialized and was even harder hit than the broader based oil funds. Its rebound potential is huge over time. Invesco’s Energy Investor Fund (FSTEX) is another time-tested, long-term winner.

Players wanting direct exposure to crude oil pricing can use the US Oil Fund L.P. (USO) or the iPath Crude Goldman Sachs ETN (OIL) as ways to profit from a recovery.

The Bottom Line

Disclosure: Long shares of oil-related stocks BWP, CBI, DNR, DO, ESV, HAL, HFC, HP, SDRL, SLB