Now, regular investors have plenty of opportunities to take advantage of ESG and real estate.

A plethora of new mutual funds, exchange-traded funds (ETFs) and other investment vehicles now exist to unlock the potential of socially responsible investing (SRI) within their real estate holdings. And given the benefits, this is one area where investors should focus.

Be sure to check out our ESG Channel to learn more.

Real Estate & ESG

Source: State Street

And it turns out, this has been a boon for property developers.

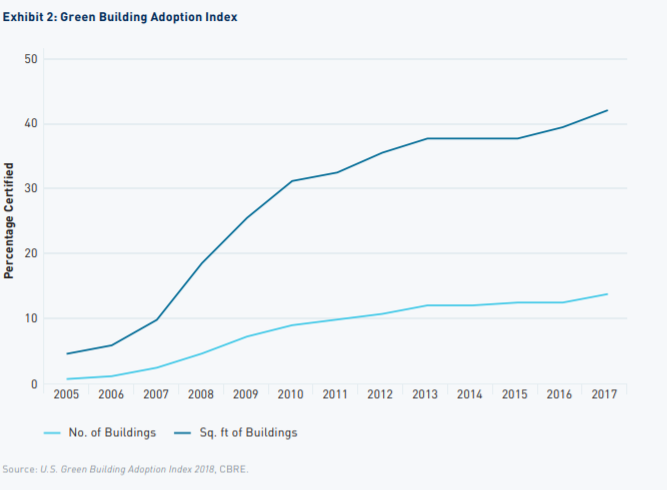

For one thing, rents and occupancy demand for green buildings continue to rise. According to a new report from real estate services firm, Cushman & Wakefield, LEED-certified (Leadership in Energy and Environmental Design) properties consistently command higher rents than their non-LEED peers. Since 2015, rents for LEED buildings have managed to have rents that are 11% higher on average than non-LEED buildings. Better still is that demand for these buildings is higher as well. Cushman & Wakefield’s report shows that vacancies for LEED properties are much lower than their non-LEED peers. And post-pandemic, the gap between the two has widened. Overall, LEED-properties average about 29.6 percentage points higher RevPAF (revenues per available foot) growth vs. non-LEED peers.

In addition to the higher rents and higher demand for LEED properties, values for the buildings themselves have also been higher than non-LEED peers.

Be sure to check our Portfolio Management Channel to learn more about different portfolio rebalancing strategies.

The Future for ESG & Real Estate

According to NAREIT’s Global Real Estate Sustainability Benchmark system, 100% of firms report having ongoing community engagement programs. Those programs stem beyond just volunteer events. Many property developers have continued to look at real estate as a community aspect, including how a building functions in a neighborhood, the social impacts of a building and the actual pros/cons rather than just buying/developing a “shiny” object. The focus on smart cities and living has only expanded in the post-pandemic world.

Secondly, inclusion and diversity metrics at the board and workforce levels are becoming big focus points as well. It turns out that this has performance impacts as well. Millennials are finally moving into leadership roles within many corporations, and because of that, business decisions – like what properties to rent or where to set up shop – now include how a firm does business. Those real estate developers and property owners that lead on diversity and inclusion metrics are starting to see higher occupancy and demand for their buildings.

In addition, in the post-pandemic world, health & safety are becoming revenue drivers as well for property owners. Renters are looking for more ways to keep their workers and consumers safe. This includes not only pandemic-related changes to healthier buildings, but also areas like gun control and reducing the impacts of threats. Here again, property developers are adding these factors to their designs and buildings are winning.

Making An ESG Real Estate Play

However, that does take time. With the surge in ESG demand, Wall Street has continued to roll out new products with an SRI tilt. Real estate is no different.

The Invesco MSCI Green Building ETF (GBLD) focuses on property owners/builders that are leading the way with LEED certification, green buildings and energy efficiency. The fund is new, so returns have roughly tracked the broader REIT indexes. However, over time, GBLD should be able to pull ahead as property values, rents and occupancy continue to climb as the ETF’s holdings win on the ESG front.

Additionally, investors have ESG real estate options from fund houses like TIAA-CREF, Nuveen, BlackRock and others. In some cases, real estate mutual funds don’t explicitly say “ESG” on their labels, but they are managed in a way that includes the metrics in their investment decisions. Some due diligence may be necessary to find the right fit.

In the end, ESG is working in the real estate sector. Property developers that focus on the theme are seeing results to their bottom lines. And that’s a good thing for investors. Taking the ESG plunge with your real estate holdings should generate better returns.

Make sure to visit our News section to catch up with the latest news about income investing.