Stock picking has become a popular pastime since the COVID-19 pandemic. While meme stocks captured the headlines, broader retail trading soared to a record 23% of total volume in early 2023, according to JPMorgan analysis published by Forbes. And, as investors take money into their own hands, thematic ETFs offer an easier way to invest in macro trends without building a portfolio from scratch.

In this article, we’ll take a look at thematic ETFs and how they’re faring among this new wave of retail investors.

What Are Thematic ETFs?

Thematic ETFs make it easy for investors to participate in disruptive macroeconomic trends. Rather than researching and building an entire portfolio, they can buy a single ETF consisting of tens or hundreds of securities providing exposure to a specific theme. And these portfolios are kept up-to-date over time for a nominal expense ratio.

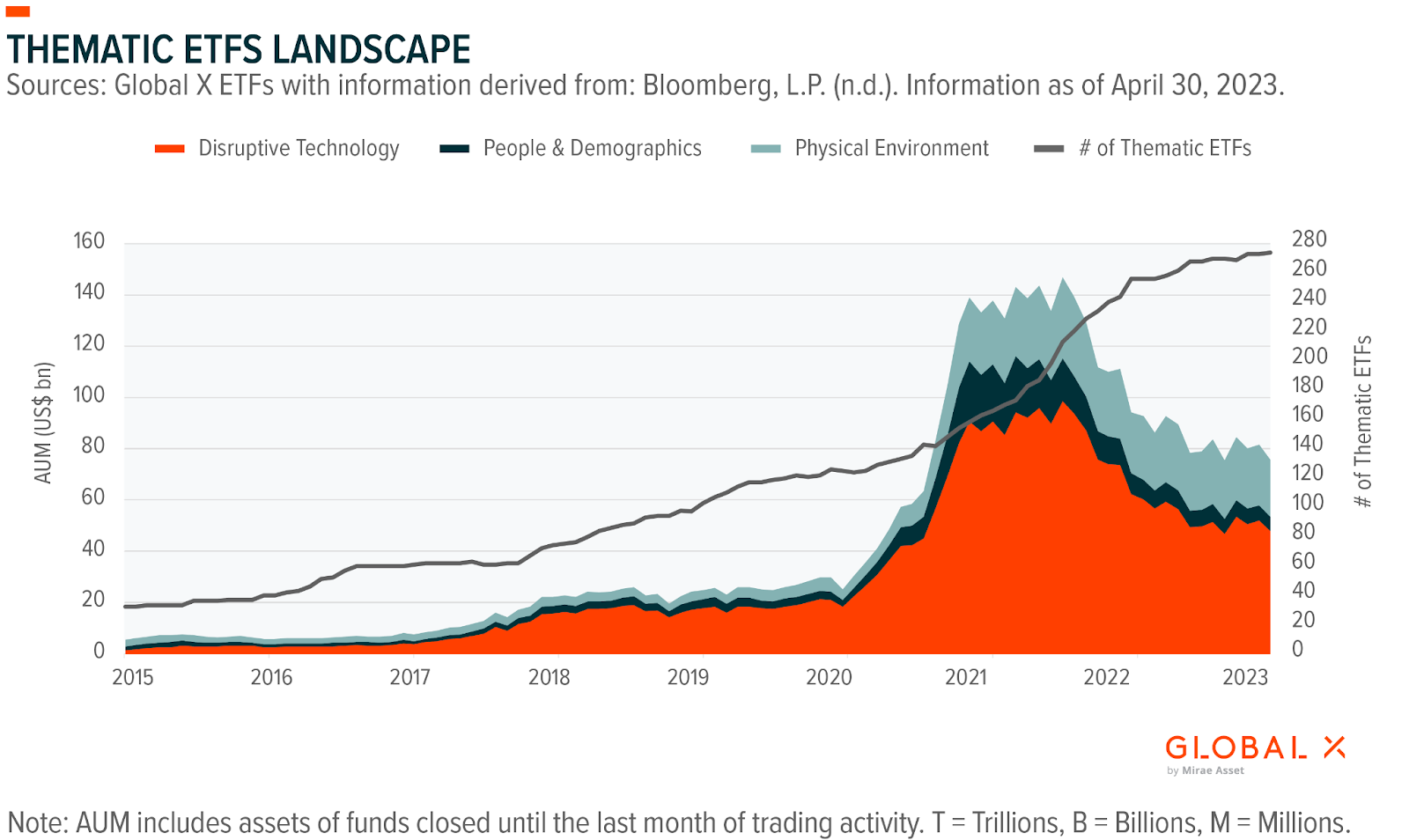

As of April 2023, the market consists of about 274 thematic ETFs representing approximately 1.1% of the U.S. ETF industry, with about $76 billion in assets under management. These themes span everything from categories, like the ARK Innovation ETF (ARKK) focus on disruptive technologies to specific niches like aging populations.

These ETFs include actively managed and passively managed varieties. For example, the Bitcoin Strategy ETF (BITO) is an actively managed fund where managers invest in Bitcoin futures contracts. In contrast, the Bitwise Crypto Industry Innovators ETF (BITQ) is a passively managed fund tracking the Bitwise Crypto Innovators 30 Index.

Thematic ETF Performance

Thematic ETFs focus on a specific market subset, meaning they diversify less than a typical ETF. As a result, thematic ETF performance varies widely depending on the theme.

List of some top performing actively-managed thematic ETFs

| Name | Ticker | Type | Actively Managed? | AUM | YTD Ret (%) | Expense |

|---|---|---|---|---|---|---|

| Valkyrie Bitcoin Miners ETF | WGMI | ETF | Yes | $2.78M | 133.1% | 0.75% |

| VanEck Bitcoin Strategy ETF | XBTF | ETF | Yes | $21.1M | 58.1% | 0.76% |

| Valkyrie Bitcoin Strategy ETF | BTF | ETF | Yes | $18.2M | 56.9% | 0.95% |

| Spear Alpha ETF | SPRX | ETF | Yes | $2.1M | 45.5% | 0.75% |

List of some top performing passive thematic ETFs

| Name | Ticker | Type | Actively Managed? | AUM | YTD Ret (%) | Expense |

|---|---|---|---|---|---|---|

| Valkyrie Digital Transformation ETF | DAPP | ETF | No | $17.6M | 104.9% | 0.5% |

| Global X Blockchain ETF | BKCH | ETF | No | $45.2M | 85.5% | 0.5% |

| Invesco Alerian Galaxy Crypto Economy ETF | SATO | ETF | No | $2.8M | 83.2% | 0.61% |

| iShares Blockchain & Tech ETF | IBLC | ETF | No | $4M | 82.7% | 0.47% |

Crypto ETFs may have clocked in some of the highest gains so far in 2023, but they aren’t the largest thematic ETFs. Broader tech and clean energy funds have far more assets with still-strong performance. For example, ARKK is up roughly 25% since the beginning of the year, with just under $8 billion in assets under management as of late-May 2023.

Here are some of the larger thematic ETFs

| Name | Ticker | Type | Actively Managed? | AUM | YTD Ret (%) | Expense |

|---|---|---|---|---|---|---|

| FlexShares Morningstar Global Upstream Natural Resources ETF | GUNR | ETF | No | $8.89B | -8.6% | 0.46% |

| ARK Innovation ETF | ARKK | ETF | Yes | $8.85B | 25.2% | 0.75% |

| iShares Global Clean Energy ETF | ICLN | ETF | No | $5.03B | -6.8% | 0.4% |

| ARK Genomic Revolution ETF | ARKG | ETF | Yes | $2.5B | 12.3% | 0.75% |

| Nuveen Growth Opportunities ETF | NUGO | ETF | Yes | $2.33B | 23% | 0.55% |

Should You Invest in Thematic ETFs?

Thematic ETFs offer a convenient way to invest in megatrends that could impact society for years. While these sectors may not always be in vogue, long-term investors confident in the bigger picture can add targeted exposure to an otherwise diversified portfolio. And speculators can use them for short-term strategic exposure as needed.

When choosing between thematic ETF options, you should consider the issuer’s approach, past performance and the fund’s expense ratio. For example, a passively managed fund may have a lower expense ratio but less flexibility for fund managers to capitalize on emerging opportunities with concentrated positions or hedges against risk.

The Bottom Line

Thematic ETFs represent a nearly $75 billion asset class. While that’s just a fraction of the broader ETF market, these funds provide investors with a way to gain targeted exposure to specific opportunities without building their own portfolio from scratch. But it pays to be discerning when choosing between different fund options.