For a long time, the debate among financial pundits was active or passive management. Thanks to higher cost hurdles, index funds often won out. Exchange traded funds (ETFs) certainly helped turn the tide with boosting index funds appeal. But now ETFs are quickly using their low costs to change the debate.

Now we are looking at an ETF versus a mutual fund.

And it looks like active ETFs are winning this war as well. The latest fund flow data from several providers shows that active ETFs are quickly growing and eating active mutual funds’ lunch. The real winners in all of this are investors, who are able to realize additional alpha from their portfolios at rock-bottom costs.

The Latest Data

Investors continue to find benefits within using the ETF structure for active management. And they are voting with their dollars. Fund flows for active ETFs have continued to surge, while active mutual funds have seen wide redemptions. That’s the gist from investment research group Cerulli Associates, Morningstar, and another handful of other providers’ latest looks at U.S. asset and wealth management trends.

In a few short years, active ETFs have grown in number and now stand at over 1,160 different actively managed funds. According to the latest data from Morningstar, more than $47 billion now sits in active ETFs. In total, U.S. ETFs (active and passive) now hold more than $7.4 trillion as of the end of September. The trio of mutual-fund-to-ETF conversions, new product launches, and copycat ETFs have helped accelerate the growth in the sector.

But another major factor is also helping the trend. Investors simply prefer the structure to mutual funds.

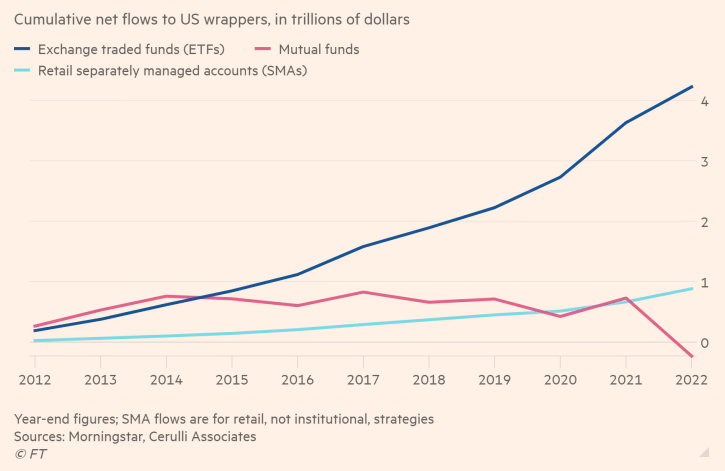

Looking at fund flow data, investors have continued to pull money out of mutual funds at an alarming rate. Excluding money market funds, American mutual funds suffered net outflows of about $960 billion last year. Those outflows have continued this year as well. Through August, Morningstar shows that more than $243 billion have fled mutual funds. But investors didn’t just flee to cash. Inflows show that they’ve chosen ETFs as their structure. Last year, ETFs pulled in more than $592 billion in inflows. So far this year, they’ve added over $289 billion. 1

This chart from the Financial Times highlights the flow trends.

Source: FT.com

Increasingly, those flows have come to active ETFs. So far, active funds have accumulated roughly $82 billion in net inflows. That’s about 25% of the total, an annual record. Moreover, for the third quarter alone, active ETFs accounted for more than 29% of all fund flows.

Easy to See Why

According to Cerulli, investors like active ETFs for a handful of reasons.

For starters, we often talk about the fee-hurdle associated with mutual funds and active management. Most active managers can beat the market, but only by a few percentage points per year. The problem is the costs of running the fund are paid by those returns. So, if a fund charges high expenses, a manager needs to consistently clear that amount to make his shareholders additional returns. Often throughout the history of mutual funds, that hasn’t been the case. But with active ETFs costing much less and some even as cheap 0.35%, the hurdle becomes easier.

Second, taxes play a big role. In a mutual fund, no matter what happens inside the fund, investors are on the hook for those taxes. Again, active management tends not to be buy & hold. If an active manager sells a stock or bond, even if an investor doesn’t sell their shares, they get hit with a capital gains distribution and are forced to pay the tax.

This is not the case with an ETF. Thanks to the secondary market and authorized participant structure, taxes can be passed-through and avoided. Investors only pay gains tax when they choose to do so and sell their shares. As such, active ETFs are far more tax efficient.

This also allows active ETFs to avoid cash drag as they can be fully invested. This is something mutual funds cannot be. In theory, this should help drive higher returns.

No Stopping Active ETFs

The best part is we could still be in the early days of active ETFs. Already, fund flows into active ETFs have been swift and mutual funds have continued to bleed assets. Going forward, Cerulli estimates this trend should continue. Particularly interesting is Vanguard’s patent expiration and the recent filings by several big players—Fidelity, DFA—to make ETFs a share class of their mutual funds. This should help drive demand if more firms follow suit.

The real winners in all of this are investors. Lower costs and tax efficiency are major wins. And if active can deliver on their promises, the ETF structure should help them realize true gains for their shareholders.

Some of the Top-Performing Active ETFs

These funds were selected based on YTD total return, which range from 1% to 31%. They have expenses between 0.09% and 0.75%, and assets under management between $6B and $30B. They are currently yielding between 0% and 9.3%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| ARKK | ARK Innovation ETF | $6B | 31% | 0% | 0.75% | ETF | Yes |

| DFUS | Dimensional U.S. Equity ETF | $6.6B | 15% | 1.37% | 0.09% | ETF | Yes |

| DFAC | Dimensional U.S. Core Equity 2 ETF | $20.45B | 9.6% | 1.43% | 0.17% | ETF | Yes |

| JEPI | JPMorgan Equity Premium Income ETF | $29.1B | 4.8% | 9.33% | 0.35% | ETF | Yes |

| MINT | PIMCO Enhanced Short Maturity Active ETF | $10.8B | 4.8% | 4.59% | 0.35% | ETF | Yes |

| FTSM | First Trust Enhanced Short Maturity ETF | $7.5B | 4% | 4.38% | 0.45% | ETF | Yes |

| JPST | JPMorgan Ultra Short Income ETF | $23B | 3.4% | 4.2% | 0.18% | ETF | Yes |

| DFAT | Dimensional U.S. Targeted Value ETF | $7.8B | 3.4% | 1.53% | 0.28% | ETF | Yes |

| AVUV | Avantis U.S. Small-Cap Value ETF | $6.65B | 3% | 1.95% | 0.25% | ETF | Yes |

| DFUV | Dimensional US Marketwide Value ETF | $8.2B | 1% | 1.91% | 0.22% | ETF | Yes |

Ultimately, shareholders are voting with their dollars. And those votes are going toward active ETFs. Their low costs, tax efficiency, and lack of cash drag makes them ideal for portfolios looking to get active with their investment choices.

The Bottom Line

Mutual funds continue to bleed assets. And active ETFs continue to mop up the fund flows. Thanks to numerous factors like lower fees and taxes, ETFs could be putting the final nail in mutual funds’ coffins. In the end, that might not be a bad thing for our portfolios.

1 FT.com (October 2023). ETFs viewed as large opportunity by 74% of US asset managers, poll says