Artificial intelligence (AI) breakthroughs are transforming everything from writing essays to driving a car. While machine learning has been around for decades, computer vision and large language models (LLMs) open the door to exciting new technologies like OpenAI’s ChatGPT and Tesla’s AutoPilot. And similar concepts are appearing in the investment world.

In this article, we’ll look at how a growing number of AI-powered ETFs are performing and whether they can help you generate alpha in your portfolio.

AIEQ: The Oldest AI-Powered ETF

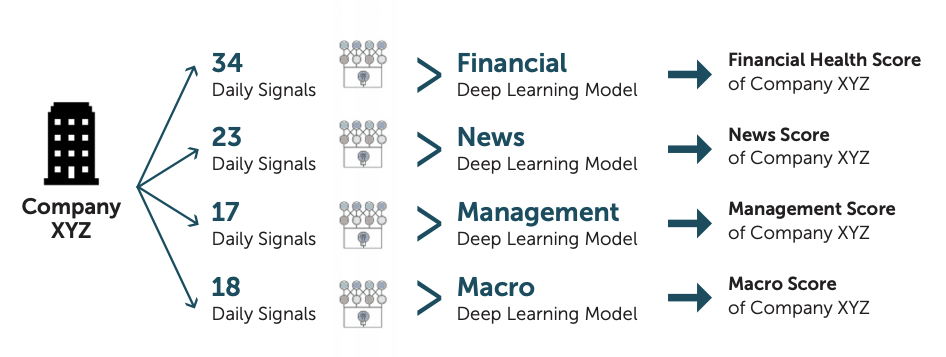

The actively managed AIEQ® AI Powered Equity ETF (AIEQ) launched back in October 2017, leverages IBM Watson to pick stocks. Using machine learning and natural language processing, the fund analyzes millions of data points across news, social media, industry report, and financial statements on over 6,000 U.S. companies to maximize risk-adjusted returns.

In this case, investors have been much better off with the S&P 500 Index. In addition to underperforming the index every year since inception, AIEQ has a lower Sharpe ratio and higher standard deviation than its category and benchmark, suggesting it’s riskier, too. As a result, investors may want to look elsewhere, especially given the fund’s relatively high expense ratio of 0.75%.

Qraft Technologies AI ETFs

Qraft Technologies has been pioneering the use of AI in security selection and portfolio construction since 2016. In 2019, the company launched a series of AI-powered ETFs targeting various strategies, ranging from value to momentum strategies.

The company’s list of actively managed AI focused ETFs include:

- The Qraft AI-Enhanced U.S. Large Cap ETF (QRFT) launched in May 2019, using AI to continuously learn the correlation of five factor returns with various macroeconomic and valuation conditions. Then, the AI weights the portfolio in line with the targeted weight factors to optimize risk-adjusted returns over time.

- The Qraft AI-Enhanced U.S. Large Cap Momentum ETF (AMOM) launched in May 2019, combining human intuition oversight with the superior processing and analytical depth of AI. Using AI technology, the fund managers adjust the portfolio weights of momentum stocks based on predictions of the impact of momentum on performance.

- The Qraft AI-Enhanced U.S. Next Value ETF (NVQ) launched in December 2020, leveraging AI to develop a portfolio of investments that adjusts book value by taking into account future intangible assets in addition to traditional value investing strategies.

These funds have a mixed track record since their inception, having outperformed in 2020, underperformed in 2021, and outperformed again in 2022. Generally, the value-focused NVQ seems adept at minimizing losses but could miss out on some gains. Meanwhile, the momentum-focused AMOM outperforms during bull markets.

DIP: A New AI-Driven Approach

The actively managed DIP ETF (DIP) launched last year, providing investors with an AI-driven approach to “buying the dip.” The fund uses a proprietary ARC® (AI Risk Containment) system to buy oversold equities expected to experience a mean reversion. The ARC® system is constantly self-evolving with two billion discrete examinations per day.

While the fund has only been around since December 2022, its year-to-date return clocked in at -4.81%, as of November 20, 2023, versus an 18.9% return for the S&P 500 Index. With a lofty 1.25% expense ratio and lackluster performance thus far, investors may want to wait for more data before taking a position in one of the newer AI-driven funds.

Alternatives to Consider

Investors may be better off investing in AI companies than relying on their products to select securities – at least for now. Microsoft, NVIDIA and other AI-adjacent companies have posted some of the strongest returns in the S&P 500 Index over the past year or two.

Actively Managed & Indexed AI-Related ETFs

These ETFs are selected based on their YTD total return, which ranges from 14% to 46%. They have expenses between 0.18% and 0.75% and have assets under management between $145M and $6.9B. They are currently yielding between 0% and 1.1%.

| Name | Ticker | Type | Actively Managed? | AUM | YTD Total Ret (%) | Yield (%) | Expense |

|---|---|---|---|---|---|---|---|

| Global X Artificial Intelligence & Technology ETF | AIQ | ETF | No | $568M | 45.7% | 0.20% | 0.68% |

| iShares U.S. Tech Independence Focused ETF | IETC | ETF | Yes | $147M | 45.3% | 1.1% | 0.18% |

| ARK Innovation ETF | ARKK | ETF | Yes | $6.88B | 43.7% | 0% | 0.75% |

| ARK Autonomous Technology & Robotics ETF | ARKQ | ETF | Yes | $1B | 28.4% | 0% | 0.75% |

| iShares Robotics and Artificial Intelligence Multisector ETF | IRBO | ETF | No | $475M | 27.1% | 0.9% | 0.47% |

| WisdomTree Artificial Intelligence and Innovation Fund | WTAI | ETF | No | $145M | 28.9% | 0.20% | 0.45% |

| Global X Robotics & Artificial Intelligence ETF | BOTZ | ETF | No | $2.12B | 26% | 0.40% | 0.69% |

| First Trust Nasdaq Artificial Intelligence and Robotics ETF | ROBT | ETF | No | $416M | 14.9% | 0% | 0.65% |

The Bottom Line

The data is clear: AI-driven ETFs seem to be more hype than substance thus far. But it would be a mistake to dismiss them forever. Advances in AI and innovative new approaches to harnessing AI in the ETF space could lead to breakthroughs in the future. In the meantime, investors may be better off investing in AI companies themselves through AI-focused ETFs.