Passive investing, or indexing, has grown to immense popularity as the number of exchange-traded funds (ETF) have grown exponentially over the last decade. With investors – both big and small – favoring these vehicles, passive investing has quickly overtaken active management in many sectors of the market. However, for fixed income, active management can play a significant roll in determining better outcomes.

The best part is that investors don’t have to choose between the two styles.

Using passive ETFs in an active fashion can help retail, institutional and financial advisors build those outcomes as well – often with lower costs, enhanced liquidity, tax advantages and strong yield/income potential. Active works well when you go passive.

Active Management Works With Bonds

While there is plenty of debate on the effectiveness of active management on the equity side of the equation, the fixed income side is more of a sure thing. Active management can play a significant role in boosting returns. This comes down to the fact of poor index construction and credit research.

The major bond benchmark – the Bloomberg US Aggregate Bond Index – doesn’t fully represent the total universe of bonds and fixed income assets, even investment-grade ones, and overweights the biggest debtors. Secondly, credit research and a human touch can actually uncover values with bonds. The fact that they traded over-the-counter prevents information from being disseminated both quickly and by all parties.

Because of this, many active bond managers are able to outperform. According to Morningstar, 70% of low-cost, high-yield fund managers beat their index, while just 60% of low-cost, intermediate-core bond managers do as well. 1

Building a Passive Active Portfolio

There’s certainly nothing wrong with choosing an active vehicle for your fixed income exposure. There are plenty of fine funds that deliver additional alpha and yield, thanks to the rise of active ETFs, now at a lower cost. But there is another way investors can get active with the fixed portfolios and that is by using passive ETFs. For some investors, this may actually be the better choice.

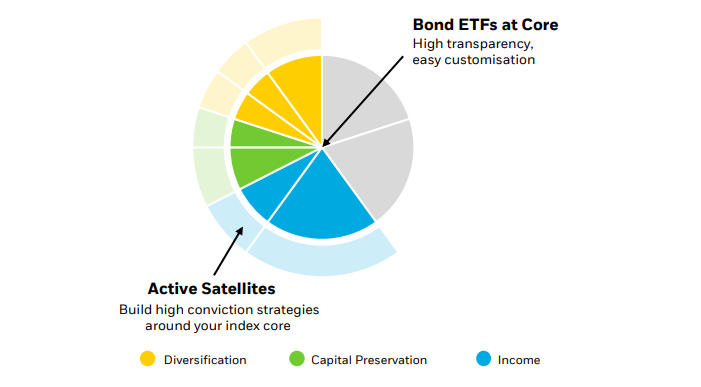

Just because you own a core fund like the iShares Core U.S. Aggregate Bond ETF doesn’t mean that you’re stuck simply tracking it and that’s the end of it. Just as an active manager, investor and advisor can “tweak” their exposures and make it not look like anything in the index. Passive ETFs make this easy. This is called a core-satellite approach. The following chart from BlackRock shows how it plays together.

Source: BlackRock

What investors and advisors can do is build around a core index like the Bloomberg US Aggregate Bond Index, adding additional passive ETFs that track different bond sectors and securities. This is an active decision and can help boost returns.

For example, the Agg Index is underweight corporate bonds. Investors can add an index fund like the SPDR Portfolio Corporate Bond ETF to overweight investment-grade corporates. Investors can take it a step further and focus on credit rating or duration potential with passive ETFs like the iShares Aaa – A Rated Corporate Bond ETF or Vanguard Short-Term Corporate Bond Index Fund.

Investors can add other esoteric bond varieties as well to boost yield, provide diversification and potential.

Why Be Passively Active?

So, why do it yourself and not hire a dedicated manager? The answer may lie in the trio of liquidity, taxes and lower costs.

It’s true that active ETFs have changed the game when it comes to lower fees and overcoming fee hurdles. However, they still aren’t super cheap in many cases. The average fixed income active mutual fund charges around 0.71% in fees, while active bond ETFs clock in around 0.40%. A decade ago, we would be cheering for that low cost. However, these days, the average passive fixed income fund charges just half that amount, and some can be had for even less. For example, the previously mentioned SPBO can be had for just 0.03%. There is no fee hurdle, meaning investors can keep more of their yield as income.

Secondly, liquidity is better with ETFs. The beauty of using ETFs to be active is that buy and sell decisions can happen instantly. Because of their creation/redemption mechanism, investors don’t have to worry about unloading the individual bonds. Now, while active ETFs offer the same top-line liquidity, within the fund, managers still need to find buyers in order to exchange their holdings if there is a change in strategy. For some esoteric bond asset classes that may be difficult.

While ETFs are way more tax efficient than mutual funds, investors have the ability to control their capital gains and tax-loss harvest as they see fit. By using passive ETFs in an active manner, investors can harvest losses in a more controlled manner. Again, the added liquidity of using an ETF to get exposure to an asset class comes in handy at this point.

Using Passive ETFs to be Active

Given the potential benefits for going active in fixed income, investors and advisors should consider going beyond the Agg and being active with their bond portfolios. And perhaps the best way to do it is by using passive ETFs.

Starting with a core fund like the previously mentioned AGG or Vanguard Total Bond Market Index Fund, investors can then build upon several different areas, durations and bond types as they see fit. If an investor thinks high-yield bonds are going to outperform, the iShares Broad USD High Yield Corporate Bond ETF can be added. Looking for tax-free income? The VanEck Intermediate Muni ETF can be used.

Passive Bond ETFs

These funds are selected based on year-to-date total return performance. Their expense ratios range between 0.03-0.24%. They are yielding between 2.5-7% and have AUM between $700mn to $300bn.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| USHY | iShares Broad USD High Yield Corporate Bond ETF | $9.4B | 6.7% | 6.9% | 0.22% | ETF | No |

| VCSH | Vanguard Short-Term Corporate Bond Idx Fd ETF | $43.22B | 2.3% | 3.3% | 0.04% | ETF | No |

| SPBO | SPDR Portfolio Corporate Bond ETF | $704.5M | 2.2% | 5% | 0.03% | ETF | No |

| QLTA | iShares Aaa - A Rated Corporate Bond ETF | $935.1M | 1.5% | 3.8% | 0.15% | ETF | No |

| BND | Vanguard Total Bond Market Index Fund ETF | $297.11B | 0.9% | 3.3% | 0.03% | ETF | No |

| ITM | VanEck Intermediate Muni ETF | $1.81B | 0.8% | 2.5% | 0.24% | ETF | No |

Ultimately, building a fixed income portfolio is an active decision in the first place. There might be no need to move beyond passive ETFs to get that exposure.

The Bottom Line

Active management works well in fixed income because of its ability to add different bonds and sectors than the broader indexes. Investors have that ability too, by using passive ETFs. By adding various bond ETFs themselves, they gain valuable benefits and potential better returns.