Despite the Federal Reserve’s decisions to hike interest rates to a historic five percent, gold prices held the psychologically important $2,000 level and retested their mid-April highs on May 3, 2023.

So, is now the time to buy or sell?

What Really Drives Gold Prices?

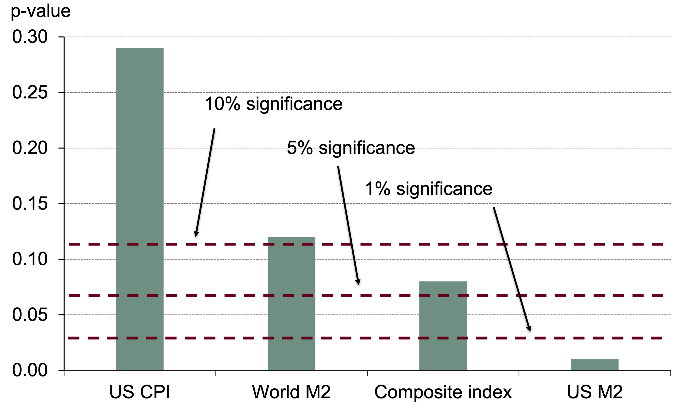

However, the same analysis found that gold prices are highly correlated with the M2 money supply, which reflects all currency held by the non-bank public plus savings and deposits and shares in retail money market mutual funds. In other words, gold prices increase proportionally to the amount of spendable money in circulation.

This explains its long-term effectiveness as a hedge. With a two to four percent real return since the 1970s, the growth in gold prices is consistent with the increase in the money supply and correlates more with economic growth and risk.

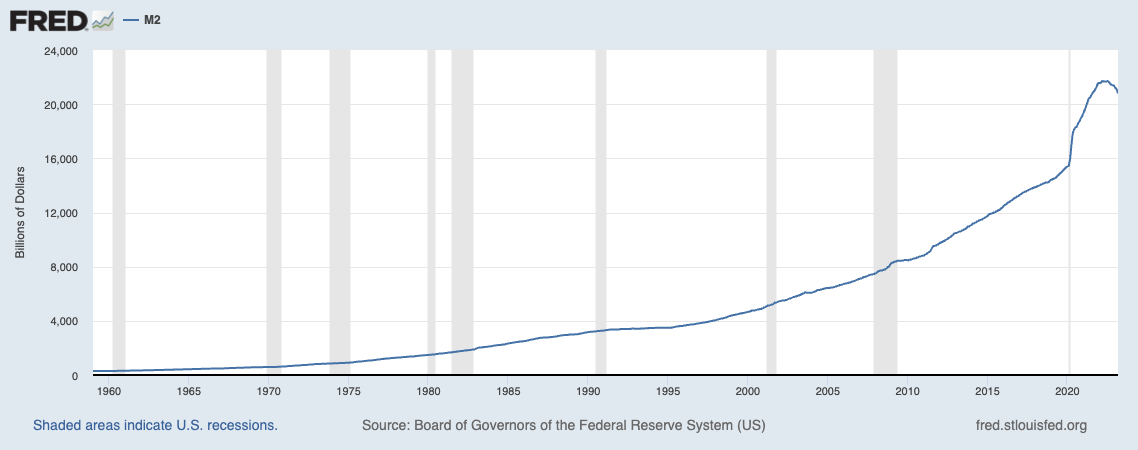

M2’s Record-Breaking Decline

Many economists expect the M2 money supply to fall again with the recent stress on the banking sector. However, inflation tends to lag the M2 money supply by one or two years, meaning inflation could remain elevated for a few months to a year. As a result, the Federal Reserve opted to continue raising rates to contain inflation in the interim.

What M2 Money Supply Means for Gold Prices

In addition to the banking crisis, the Federal Reserve’s recent actions could take a toll on the M2 money supply over the coming months. Last year, the central bank announced plans to let securities ‘roll off’ of its balance sheet without reinvesting much of the principal it receives. And Jerome Powell doesn’t see a need to change these policies yet.

These trends could be bearish for gold prices, which tend to mirror the M2 money supply.

How to Bet on Gold and Its Alternatives

Lastly, investors seeking a more effective hedge against inflation may want to consider other alternatives, including treasury inflation protected securities or TIPS, equity strategies expected to benefit from rising rates or other actively managed strategies that can invest in a broad range of inflation-hedging commodity futures rather than exclusively gold.

Here are the lists of mutual funds and ETFs, sorted by their YTD performance.

Long Gold Commodities

| Name | Ticker | Type | Active? | AUM | YTD Ret (%) | Expense |

| GraniteShares Gold Trust | BAR | ETF | No | $0.99 Bn | 10.9% | 0.17% |

| SPDR Gold MiniShares Trust | GLDM | ETF | No | $5.15 Bn | 10.8% | 0.10% |

| abrdn Physical Gold Shares ETF | SGOL | ETF | No | $2.64 Bn | 10.8% | 0.17% |

| iShares Gold Trust | IAU | ETF | No | $30.7 Bn | 10.7% | 0.25% |

| Goldman Sachs Physical Gold ETF | AAAU | ETF | No | $0.56 Bn | 10.7% | 0.18% |

| SPDR Gold Shares | GLD | ETF | No | $63.1 Bn | 10.6% | 0.40% |

| Gold Bullion Strategy Investor | QGLDX | Mutual Fund | Yes | $0.15 Bn | 9.4% | 1.42% |

Don’t forget to check out other Long Gold Commodity based mutual funds and ETFs.

Long Gold Equities

| Name | Ticker | Type | Active? | AUM | YTD Ret (%) | Expense |

| VanEck Gold Miners ETF | GDX | ETF | No | $12.6 Bn | 23.4% | 0.51% |

| USAA Precious Metals and Minerals | USAGX | Mutual Fund | Yes | $0.58 Bn | 22.4% | 1.12% |

| Gabelli Gold A | GLDAX | Mutual Fund | Yes | $0.37 Bn | 20.9% | 1.49% |

| VanEck International Investors Gold A | INIVX | Mutual Fund | Yes | $0.80 Bn | 19.6% | 1.34% |

| Oppenheimer Gold & Special Minerals A | OPGSX | Mutual Fund | Yes | $2.17 Bn | 18.5% | 1.05% |

| Fidelity Advisor® Gold A | FGDAX | Mutual Fund | Yes | $1.63 Bn | 18.5% | 1.07% |

| Sprott Gold Equity Investor | SGDLX | Mutual Fund | Yes | $0.97 Bn | 18.4% | 1.41% |

| VanEck Junior Gold Miners ETF | GDXJ | ETF | No | $4 bn | 17.6% | 0.52% |

| First Eagle Gold A | SGGDX | Mutual Fund | Yes | $2.18 Bn | 17.3% | 1.22% |

| Franklin Gold and Precious Metals A | FKRCX | Mutual Fund | Yes | $1.23 Bn | 17.3% | 0.90% |

Explore mutual funds and ETFs from the Precious Metals Industry to consider more equity options.

Short Gold

| Name | Ticker | Type | Active? | AUM | YTD Ret (%) | Expense |

| DB Gold Short ETN | DGZ | ETF | No | $0.003 Bn | -8.4% | 0.75% |

| ProShares UltraShort Gold | GLL | ETF | No | $0.03 Bn | -17.1% | 0.95% |

| DB Gold Double Short ETN | DZZ | ETF | No | $0.005 bn | -17.7% | 0.75% |

Other Inflation-hedging Alternatives

| Name | Ticker | Type | Active? | AUM | YTD Ret (%) | Expense |

| WisdomTree Managed Futures Strategy ETF | WTMF | ETF | Yes | $0.15 Bn | 7.7% | 0.65% |

| DFA Inflation-Protected Securities I | DIPSX | Mutual Fund | Yes | $6.93 Bn | 4.3% | 0.11% |

| TIAA-CREF Inflation Link Bd Instl | TIILX | Mutual Fund | Yes | $2.93 Bn | 3.5% | 0.25% |

| iShares TIPS Bond ETF | TIP | ETF | No | $31.9 Bn | 3.4% | 0.19% |

| Vanguard Inflation-Protected Secs Inv | VIPSX | Mutual Fund | Yes | $38.3 Bn | 3.2% | 0.20% |

| American Funds Inflation Linked Bd A | BFIAX | Mutual Fund | Yes | $13.6 Bn | 3.0% | 0.67% |

| BlackRock Inflation Protected Bond Inv A | BPRAX | Mutual Fund | Yes | $3.21 Bn | 3.0% | 0.60% |

| FlexShares iBoxx 3Yr Target Dur TIPS ETF | TDTT | ETF | No | $2.14 Bn | 3.0% | 0.18% |

| Vanguard Short-Term Infl-Prot Secs ETF | VTIP | ETF | No | $61.7 Bn | 2.6% | 0.04% |

| PIMCO 1-5 Year US TIPS ETF | STPZ | ETF | No | $1.6 Bn | 2.6% | 0.20% |

| T. Rowe Price Ltd Dur Infl Focus Bd | TRBFX | Mutual Fund | Yes | $9387 Bn | 2.3% | 0.39% |

| SPDR® SSgA Multi-Asset Real Return ETF | RLY | ETF | Yes | $0.43 Bn | -0.1% | 0.50% |

| Horizon Kinetics Inflation Beneficiaries ETF | INFL | ETF | Yes | $1.28 Bn | -1.5% | 0.85% |