Arguably, the biggest and fiercest battle in the investment world has to be passive versus active management styles. Passive and indexed funds and ETFs have long won the war, with many active managers falling by the wayside. However, digging deeper, the winner isn’t so clear.

There are certainly battles where active comes out on top.

This includes fixed income and bond investing. A report from J.P. Morgan highlights this fact.

And now, with active ETFs offering plenty of benefits, the choice is clear in fixed income that active management should be preferred to passive funds.

Active Fixed Income Does Win

There are numerous studies and articles professing active management’s death. Particularly, as passive index ETFs have garnered trillions in assets. There’s plenty of evidence to support this. Thanks to higher costs/fees, closet indexing and other factors, many active funds consistently underperform their benchmarks and passive peers. The latest Morningstar active/passive barometer, of the nearly 3,000 active funds, only 43% managed to outperform their average passive peer last year.

But digging deeper into the data, a trend emerges. It turns out much of that outperformance happens on the equity side of the equation. Large-cap U.S.-focused active funds, which make up the bulk of all funds, have been terrible at beating passive rivals over the long haul.

As for fixed income, a hefty dose of active management can seriously help and that’s the results of a new J.P. Morgan study on the sector. Looking at the bond benchmark – the Bloomberg US Aggregate Bond Index (Agg) – and comparing with the Morningstar intermediate core and intermediate core plus fund categories, JPM can and does beat the passive index.

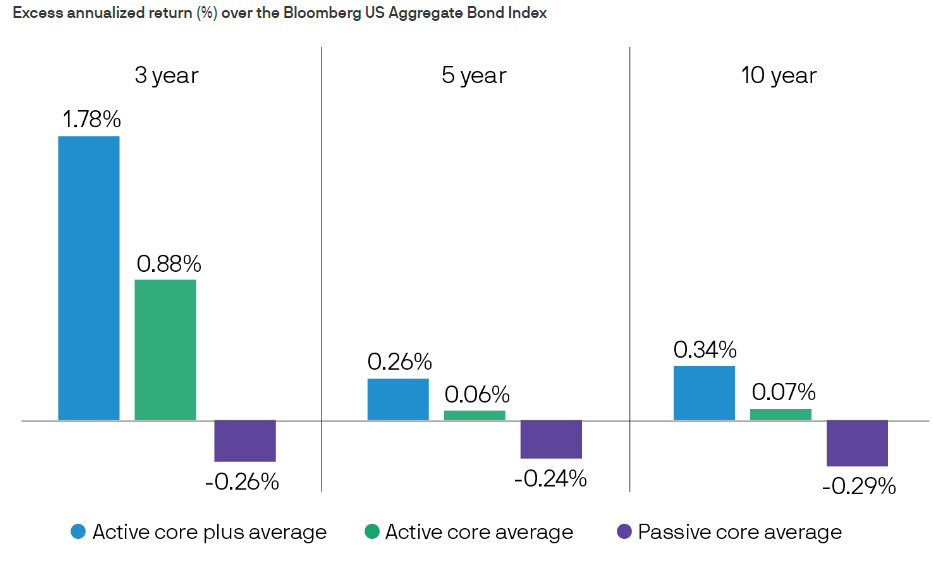

According to the research, over the 3-, 5- and 10-year periods, active intermediate core and intermediate core plus funds managed to provide excess annualized returns versus the parent index. For example, intermediate core and intermediate core plus provided 0.07% and 0.34% in extra return, while the Agg managed to provide a -0.29% return. This chart sums up the outperformance.

Source: JPM Wealth Management

Why the Outperformance?

So, why the outperformance? JPM has a few reasons why. For starters, the Agg index itself is pretty flawed.

We’ve talked before about how many bond indices, like Agg, are weighted based on the amount of debt outstanding. Firms with the most debt get a higher place in the index and you’re basically rewarding the biggest debtors with more pull on the index. The Agg has other specific construction flaws as well. The index only captures 49% of the total U.S. bond market. And even then, U.S. Treasury and agency mortgage-backed securities (MBS) make up 70% of the index. The index includes investment-grade corporate bonds. However, there are still more than 26% of investment-grade corporates that aren’t included in the index according to JPM.

Active management doesn’t have to look like the Agg and can over/underweight these various categories. And depending on mandate, they can add other areas of the U.S. bond market like ABS or high-yield bonds as well as move up/down the duration ladder.

Active ETFs are Helping Push That Narrative Even More

According to JPM, the birth of and adoption of active fixed income ETFs are helping drive the outperformance even more.

Thanks to ETFs’ lower costs and potential tax savings, fixed income investors can be treated to better returns than passive funds. Bonds by nature are a higher tax asset class with coupon payments coming at ordinary income rates. This can be as high as 39% for investors. Any ability to lower taxes gives investors an edge on long-term performance. At the same time, lower fees allow investors to keep much of the gains. This is a problem with equity funds and the rise of “closet indexing.”

JPM also adds that active ETFs in the fixed income space add an additional win for returns and investors – liquidity. Because ETFs trade in the secondary market, this provides a source of liquidity and real-time price discovery of assets. While some bonds are very liquid, like Treasuries, others are not and trade in OTCBB deals. This can create big bid-ask spreads on the underlying holdings. But ETFs reduce this fact and provide additional liquidity factor returns.

Making the Switch to Active Fixed Income ETFs

Given the outperformance and benefits of using active ETFs for your fixed income holdings, investors should consider making the switch for a portion of their portfolios. Luckily, there are plenty of new and top performing options across the space.

Given that JPM’s study focused on active core and core plus funds, investors may want to start there for results. The bank sponsors the JPMorgan Income ETF, which has the flexibility to invest across a variety of bonds. For investors looking for more of a core replacement, the Fidelity Total Bond ETF, PIMCO Active Bond ETF and the new T. Rowe Price QM U.S. Bond ETF are all designed to outperform the broader Agg index but tweak its holdings and exposures.

List of some top performing active fixed income ETFs

| Name | Ticker | Type | Actively Managed? | AUM | YTD Ret (%) | Expense |

|---|---|---|---|---|---|---|

| SPDR® DoubleLine Total Return Tact ETF | TOTL | ETF | Yes | $2.36 billion | 2.1% | 0.55% |

| PIMCO Active Bond ETF | BOND | ETF | Yes | $3.38 billion | 2% | 0.55% |

| JPMorgan Income ETF | JPIE | ETF | Yes | $450 million | 1.9% | 0.42% |

| T. Rowe Price QM U.S. Bond ETF | TAGG | ETF | Yes | $36 million | 1.9% | 0.08% |

| Fidelity Total Bond ETF | FBND | ETF | Yes | $2.29 billion | 1.8% | 0.36% |

Keep in mind this is not an exhaustive list and there are numerous top-performing active ETFs across the entire fixed income space, from munis to junk bonds.

The bottom line is that active strategies can work in certain sectors – and fixed income is one of them. J.P. Morgan’s recent study puts data to that fact. Active management can beat passive by a wide margin. For investors, it means making the switch and adding active ETFs to their portfolios.