When it comes to investing, it pays to think small. Small-cap stocks, that is. Over the long haul, small-cap stocks have managed to outperform their larger brethren by a wide margin. After all, many small-cap stocks have plenty of growth left in front of them. A few extra million in revenue could be all it takes to send shares skyrocketing. As such, they’ve powered portfolios for decades.

But there is a way to juice even more returns from a small-cap sleeve in a portfolio.

And that is via active management. Small-cap investing remains one of the best areas in which active management can play a huge role in delivering benchmark-beating returns. For investors, getting active here can lead to a lifetime of benefits.

Exploiting Obscurity & Quality

Everyday it seems like there are hundreds of articles, blog posts, pundit comments, videos and other stories about Apple. This doesn’t even include the 36 professional analysts covering the stock at various investment banks and fund companies. However, for firms like American Woodmark or Kearny Financial… not so much.

This can be an advantage for active managers.

Small-cap stocks are typically defined as those with market caps between $250 million to $2 billion in size. There are thousands of firms within these boundaries, which make up the bulk of publicly traded companies. Over the longer term, these firms have been powerful growth engines for portfolios – offering strong returns as they grow and expand. Moreover, a small cap doesn’t have to equal a start-up. Many are mature firms with steady cash flow and dividends.

And yet, most investors tend to ignore them.

Given the sheer size of the segment, digging through the thousands of firms can be a real hassle, particularly if you are a large investor. Secondly, a pension fund or large endowment would have a hard time buying enough shares of a small-cap firm to really move the needle on the fund’s returns or assets.

For those managers that actually dig into the segment, this obscurity can be exploited with market-beating returns.

The Proof Is in the Pudding

While there is plenty of debate between active vs. passive indexing for portfolios, small caps seem to fall on the side of active investing.

According to data from Morningstar, small-cap active managers beat their benchmarks the bulk of the time. Looking at rolling three-year periods from 2005 to 2019, the average small-cap manager outperformed the Russell 2000, the segment’s top benchmark, 86.7% of the time. 1 This crushes both mid- and large-cap active managers in terms of consistent “benchmark beats.” The best part is that small-cap active managers did so by providing average excess returns of 1.5% gross of fees. Managers that focused strictly on small-cap growth or value styles did even better, beating their respective benchmarks more than 90% of the time.

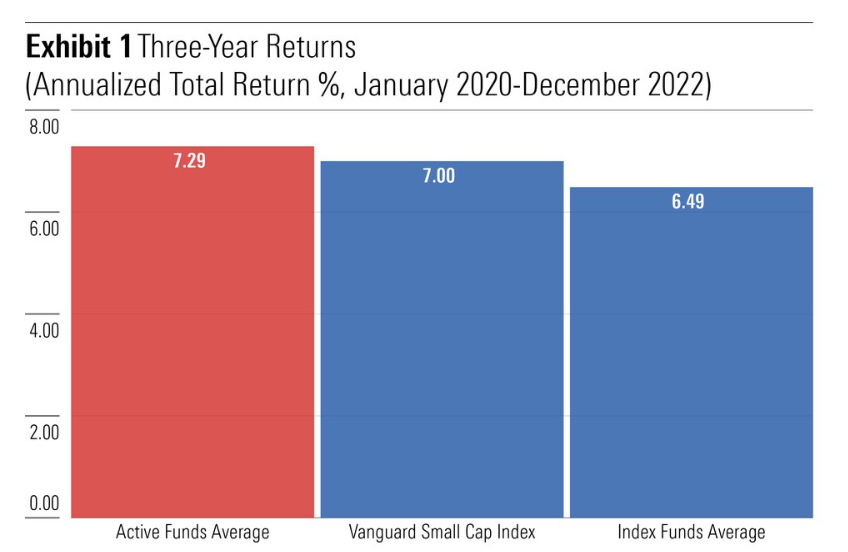

Looking at new data, Morningstar again shows that active management in the space is better than indexing. You can see by this chart that since the pandemic, active small-cap managers have continued to beat their benchmarks.

Source: Morningstar

Like many areas of fixed income, the small-cap space features plenty of pricing discrepancies, lack of research and hidden quality. And that can be exploited by managers to help boost returns.

Active ETFs Make Small-Cap Stocks Better

So, with active small-cap funds consistently beating their passive rivals, the choice is clear to get active with a portfolio’s exposure to the segment. Exchange traded funds (ETFs) could be the preferred vehicle to do just that. Active ETFs provide two main benefits that are very advantageous when it comes to small-cap investing.

For starters, ETFs have lower fees than mutual funds. This lower fee hurdle enhances the already strong excess returns driven by active small-cap management. Secondly, capital gains are reduced to zero.

Typically, small-cap funds are large generators of capital gains. Stocks get bought out by larger firms, managers have high turnover, etc. Thanks to their creation/redemption mechanism, ETFs are able to pass gains out of the fund. This gives them a huge advantage on taxes versus mutual funds. Active small-cap management could now find its way into a taxable account.

The win is that the active ETF boom has seen a ton of new small-cap funds launch over the last few years. Investors now have a plethora of choices in the space, covering a wide variety of styles, concentrations and focus. This includes domestic and international funds.

Here's a list of some top performing of small-cap active ETFs

| Name | Ticker | Type | Actively Managed? | AUM | YTD Ret (%) | Expense |

|---|---|---|---|---|---|---|

| Avantis U.S. Small Cap Value ETF | AVUV | ETF | Yes | $6 billion | 6% | 0.25% |

| Dimensional U.S. Small Cap ETF | DFAS | ETF | Yes | $5.51 billion | 7.9% | 0.26% |

| AlphaMark Actively Managed Small Cap ETF | SMCP | ETF | Yes | $24.5 million | 8.5% | 1.21% |

| JPMorgan Active Small Cap Value ETF | JPSV | ETF | Yes | $10 million | 0% | 0.74% |

| Dimensional US Small Cap Value ETF | DFSV | ETF | Yes | $1.42 billion | 5% | 0.31% |

| T. Rowe Price Small-Mid Cap ETF | TMSL | ETF | Yes | $16.3 million | 0.05% | 0.55% |

The Bottom Line

Small-cap funds have long been powerful portfolio additions, adding excess returns and long-term gains. Active management plays a huge role in that outperformance. Now, with the rise of active ETFs, investors can enhance those benefits and returns. Lower taxes and higher gains await those who take the active plunge.

1 Canterbury (April 2020). ACTIVE SMALL-CAP MANAGEMENT: LONG-TERM STRENGTH