As passive index funds took the world by storm, many asset managers began to quake with fear – and for good reason. Fund flows have continued to support passive index funds and ETFs, while many active strategies blend assets. If it wasn’t for market gains, many asset managers would have shown a major decrease in overall assets under management.

But that was then and this is now. And now, asset managers are embracing ETFs for their next evolution.

According to the latest survey by market researcher Cerulli Associates, many asset managers see ETFs as their future, prepping new fund launches and strategies with an active twist. For investors, it underscores the potential of active ETFs and improves their tool box for returns.

Fund Flows Paint a Dark Picture

For investors, the creation and widespread adoption of low-cost passive ETFs has been a godsend. These days, investors of all sizes have the ability to build a portfolio for dirt cheap, covering a wide range of asset classes. For asset managers offering higher cost active funds, it hasn’t been such a boon.

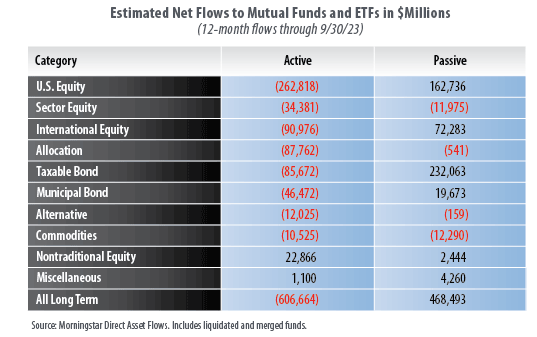

Fund flows paint a grim picture. Over the last 12 months through the end of September, passive mutual funds and ETFs have managed to pull in an estimated $468.49 billion in fund flows. Active funds? They saw more than $606 billion in outflows during that time. This follows about $960 billion in outflows last year and continues the big downward trend.

And those outflows pretty much hit every category of active management and sector. This chart from First Trust underscores the bleeding.

Source: First Trust

To that end, many active asset managers have begun to fret. Clearly, the trend is in favor of low-cost ETFs.

Embracing the “Darkside”

However, despite ETFs winning the battle, active managers aren’t ready to be counted out. ETFs are very much on their menu.

That’s the gist according to the latest The Cerulli Edge—U.S. Monthly Product Trends survey from industry group Cerulli. Active managers are embracing active ETFs in a big way, with many planning on using the fund vehicle in the future. 1

For the first time, the vast bulk of asset managers who offer active ETFs view them as the largest opportunity for their practices. Nearly 74% of asset managers fall within this category. For those that don’t offer them, the data also suggests that active ETFs rank high on their radar. According to Cerulli, of the managers who don’t have ETFs, 20% plan on building them over the next 12 months, while 50% are considering them but don’t have official formal plans.

Another win for active ETFs?

Becoming share classes of mutual funds. Vanguard has long held a patent that allowed its ETFs to be considered share classes of mutual funds. This has allowed them tax advantages and reduced costs. With Vanguard’s patent expiring back in May, several asset managers have filed for relief for their funds. Cerulli’s report showed that 65% of managers are considering offering ETFs as a share class of mutual funds going forward.

A Big Win for Investors

With more asset managers starting to embrace ETFs for their active strategies, the big winners will be investors. Active managers can and do beat their respective benchmarks, but have faced several structural issues that ETFs help fix.

This includes the so-called fee-hurdle most active managers can beat the market, but only by a few percentage points per year. The problem is the costs of running the fund are paid by those returns. So, if a fund charges high expenses, a manager needs to consistently clear of that amount to make his shareholders additional returns. Often throughout the history of mutual funds this hasn’t been the case. But with active ETFs costing much less and some even as cheap as 0.35%, the hurdle becomes easier.

Another ETF win is taxes. In a mutual fund structure, no matter what happens inside the fund, investors are on the hook for those taxes. If an active manager sells a stock or bond, even if an investor doesn’t sell their shares, they get hit with a capital gains distribution and are forced to pay the tax.

This is not the case with an ETF. Thanks to the secondary market and authorized participant structure, taxes can be passed-through and avoided. As such, active ETFs are far more tax efficient. Investors only pay gains tax when they choose to do so and sell their shares.

These attributes – along with no cash drag – have ETFs winning out over their mutual fund twins. You can see that when comparing many of the copycat ETFs run by the same manager versus their run of mutual funds.

Top-Performing Active ETFs

These funds were selected based on YTD total return, which ranges from 5% to 64%. They have expenses between 0.09% and 0.75%, and assets under management between $6B and $30B. They are currently yielding between 0% and 9.3%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| ARKK | ARK Innovation ETF | $6.8B | 63.3% | 0% | 0.75% | ETF | Yes |

| DFUS | Dimensional U.S. Equity ETF | $6.6B | 23.7% | 1.37% | 0.09% | ETF | Yes |

| AVUV | Avantis U.S. Small-Cap Value ETF | $6.65B | 20.3% | 1.6% | 0.25% | ETF | Yes |

| DFAC | Dimensional U.S. Core Equity 2 ETF | $20.9B | 19.6% | 1.43% | 0.17% | ETF | Yes |

| DFAT | Dimensional U.S. Targeted Value ETF | $7.8B | 18.3% | 1.4% | 0.28% | ETF | Yes |

| DFUV | Dimensional US Marketwide Value ETF | $8.2B | 10.7% | 1.91% | 0.22% | ETF | Yes |

| JEPI | JPMorgan Equity Premium Income ETF | $29.1B | 7.6% | 9.33% | 0.35% | ETF | Yes |

| JPST | JPMorgan Ultra Short Income ETF | $23B | 4.1% | 5.3% | 0.18% | ETF | Yes |

| MINT | PIMCO Enhanced Short Maturity Active ETF | $9.7B | 5.1% | 5.5% | 0.35% | ETF | Yes |

| FTSM | First Trust Enhanced Short Maturity ETF | $7.5B | 5% | 4.9% | 0.45% | ETF | Yes |

Ultimately, the fact that asset managers have finally started to turn towards ETFs rather than fight them is wonderful news for portfolios. Lower costs, higher returns and better outcomes await investors. With the structure, investors now have the ability to get the best active management has to offer.

Bottom Line

Passive has been all the rage with investors, and in that wake, active management has seen major outflows. But according to Cerulli, asset managers are starting to embrace ETFs for their active strategies. And that’s a great thing for portfolios and long-term returns.

1 Cerulli (October 2023). ETFs Look to Become Investment Vehicle of Choice for Managerst