Most investors rely on passively-managed index funds for market exposure. While these funds perform well in bull markets, they struggle in volatile bear markets when certain sectors or asset classes outperform. As a result, investors should consider adding active funds in today’s uncertain investment climate to boost risk-adjusted returns.

BlackRock Inc., the world’s largest ETF issuer, recently launched two new active ETFs that could fit the bill. The BlackRock Large Cap Value ETF (BLCV) and the BlackRock Flexible Income ETF (BINC) offer exposure to two critical asset classes in today’s market with expense ratios of just 0.40% and 0.55%, which is significantly lower than many other active funds.

BlackRock Large Cap Value ETF (BLCV)

The BlackRock Large Cap Value ETF (BLCV) invests in undervalued large-cap companies typically found in the Russell 1000 Value Index. In particular, the fund managers invest in a concentrated portfolio of 50 to 60 companies with relatively low price-to-book ratios, conservative balance sheets, and strong free cash flows.

The largest holdings include:

- Cisco Systems Inc. (CSCO) – 4.01%

- Wells Fargo Inc. (WFC) – 3.67%

- Cardinal Health Inc. (CAH) – 3.56%

- Leidos Holdings Inc. (LDOS) – 3.25%

- Ralph Lauren Corp. (RL) – 3.18%

Source: Squire Wealth Advisors

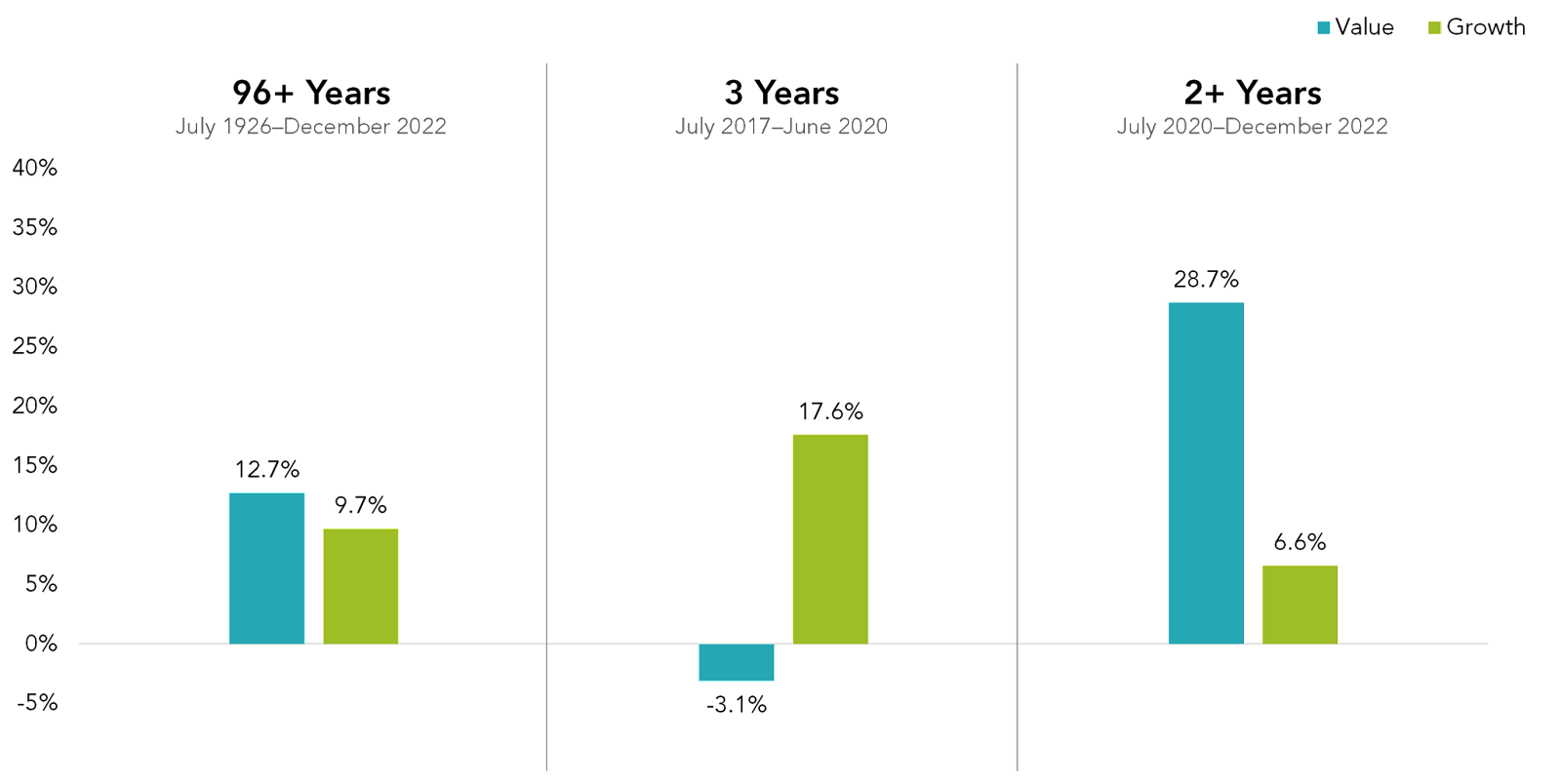

Value stocks have historically outperformed growth stocks. According to Squire Wealth Advisors 1, value stocks have risen 12.7% annually over the past 100 years compared to 9.7% for growth stocks. And between July 2020 and December 2022, that outperformance became even greater, with value stocks rising 28.7% compared to 6.6% for growth.

While some passive funds offer value exposure, value investing involves more than looking at financial ratios or quantitative factors. Active managers can assess a company’s position within an industry and an industry’s susceptibility to new risks. And these efforts can help reduce risk and enhance risk-adjusted returns.

BlackRock Flexible Income ETF (BINC)

The BlackRock Flexible Income ETF (BINC) invests in harder-to-reach fixed-income sectors to provide enhanced yield potential. In particular, the fund managers focus on debt and income-producing securities, including high-yield securities, government bonds, mortgage-backed securities, securitized assets, and emerging market debt.

The largest holdings include:

- iShares iBoxx Dollar High Yield Corporate Bond Fund – 5.07%

- Uniform MBS – 3.45%

- Mexico Government – 1.61%

- Goldman Sachs Group – 0.82%

- AT&T Inc. – 0.79%

With interest rates on the rise, fixed-income investing has become more challenging. Currently, the fund managers are focusing primarily on U.S. high-yield credit (26%), non-U.S. credit (20%), U.S. IG credit (15%), CLO securities (13%), and emerging market debt (10%). And about 40% of the portfolio’s securities are outside the United States.

The fund also pays a monthly distribution, making it uniquely suited for income investors seeking regular payments. As of June 14, 2023, the weighted average coupon was 4.82%, with a weighted average maturity of 5.58 years. As a result, the fund offers an attractive yield without the interest rate risk of longer-term fixed-income holdings.

The Bottom Line

Active funds could offer investors an attractive way to navigate today’s volatile markets. With its two newly launched ETFs, BlackRock’s Large Cap Value ETF (BLCV) and Flexible Income ETF (BINC) offer unique opportunities to target the right equity and fixed-income sectors to maximize risk-adjusted returns and yields in today’s market.

1 Squire Wealth Advisors Should we stay invested in value stocks with growth outperforming so far in 2023?