You might be thinking to yourself, “I don’t want to do all that analysis if market experts have already done it”, and you don’t! These fair value metrics are often translated into ratios, like Price Targets and Price to Earnings (P/E) expectations, and are broadcast via Yahoo Finance, CNBC, and other news outlets.

Once you have the numbers, the first step in understanding what they mean is to compare them to an index like the S&P 500. This will give you an overall sense for where the company is positioned relative to everyone else. Next you can compare the company to its sector (e.g. for Apple look at the broader Technology Sector), and to its peer group (Apple versus Microsoft, IBM, Facebook, etc). These next steps will give you a good sense of relative valuation, where the company stands versus a set of comparable companies.

Let’s say after doing this, we’re still excited about the company…is it a good buy?

Even in the best of times it can be hard to tell. Big drawdowns and market turbulence only confuse this estimation further, because nearly everything will look like a diamond in the rough.

So, What’s an Investor to Do?

By understanding a company’s business—who their customers are, what they produce, who they compete with, etc, you can better understand where they fit in the world. Understanding the core qualitative parts of the business will help you figure out how they fit into the current picture of what’s happening in the world.

In the financial crisis, even though banks “looked cheap”, there was a reason—they had many fundamental and structural issues which helped cause the crisis and wouldn’t be fixed anytime soon. Even though they might have screened as undervalued, they were justifiably so. By reading a bit about the different business lines of industrial companies like General Electric, you would have understood that they too had business lines that acted like banks, and should thus be avoided.

So how might we think about our current COVID-19 environment?

In our mass social-distancing and quarantined world, most people are stuck at home. One of the first winners of WFH was Zoom, as business life moved online. Given the renewed interest in home life, will people find that they’ve misused space and redecorate, helping out companies like Ikea and Williams-Sonoma? Perhaps Hasbro and the Parker Brothers will find that there’s a newfound interest in Monopoly, or Nintendo in video-gaming.

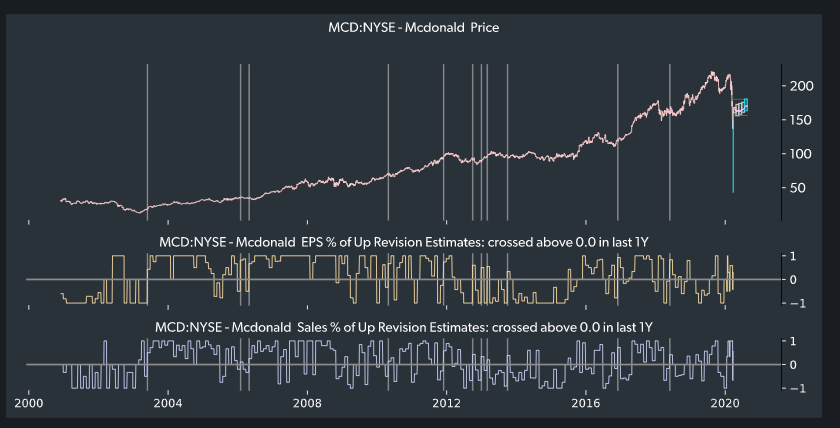

Like nearly all stocks, McDonald’s share price has been meaningfully impacted, causing many valuation metrics to flag as being “cheap” versus fair value.

Even in our socially distant world the world’s gotta eat, and when you can’t dine-in, you drive through. Besides looking undervalued, companies like McDonald’s could be beneficiaries of cabin fever, closed sit-down restaurants, and empty grocery store shelves.

Not only that, many Wall Street experts believe the fundamental picture for McDonald’s has turned a corner, with both Sales & Earnings estimates improving.

Looking through history, McDonald’s has actually seen changing fundamentals like this a number of times in the last 20 years, spanning September 11, 2 recessions, a .com bust, and a Eurozone financial crisis.

This framework can help you identify hidden pockets of opportunity that might just turn out in your favor. Panning for gold is tough, but if you bite hard enough you can tell the real thing from the fool’s version.

RJ Assaly is the Head of Business Development at TOGGLE.