Many consumers are experiencing red-hot inflation, with gas prices reaching a nationwide average of more than $5.00 per gallon and grocery prices rising at their fastest clip ever. But at a higher level, cooling inflation in April and more dovish comments from the Federal Reserve have investors thinking about the next economic phase.

Let’s take a closer look at these dynamics and how you might adjust your portfolio.

Be sure to check our Portfolio Management Channel to learn more about different portfolio rebalancing strategies.

Inflation Remains Volatile

The annual U.S. inflation rate fell from a 41-year high of 8.5% in March to 8.3% in April after seven months of relentless price increases. However, the peak in inflation was short-lived after May’s rate unexpectedly soared to 8.6% – the highest levels since 1981. Energy prices rose 34.6%, food costs surged 10.1%, and rents continued to rise at a 5.5% clip.

The Federal Reserve has embarked on the fastest series of interest rate increases in more than 30 years, with expectations in place to increase rates by 0.50% over at least the next two meetings (June and July). By increasing the cost of borrowing for households and businesses, the central bank hopes to cool the economy without throwing it into a recession.

Recession fears may also give the Federal Reserve some pause. While the economy is nowhere near a recession this year, a Bloomberg survey of 37 economists found a 30% probability of a recession over the next 12 months, and these odds rise even higher when looking into 2024 when the impact of higher rates reverberates.

Gauging the Fed’s Response

The futures market projects that the Federal Reserve will hike interest rates by 50 basis points to a 125 to 150 basis point range during its June meeting and to a 175 to 200 basis point range during its July meeting. However, the market is less convinced that the central bank will continue raising rates as aggressively by September, with a 34% chance of a 50 point hike.

In its minutes from the May meeting, the Federal Reserve suggested that there was an urgency to tackle inflation by raising interest rates and reducing the size of its balance sheet. However, the central bank also said it would be more ‘data dependent’ moving forward due to the impact of the Russia-Ukraine conflict and China’s COVID-19 lockdowns.

BlackRock’s Bob Miller told Barron’s that the Fed will be looking for a downward trajectory on inflation and reduced labor-market imbalances as key determinants of the pace of future rate hikes. If these factors improve in June, the Fed could reduce its adjustments to 25 basis points in September and beyond rather than maintaining a 50 basis point clip.

On the other hand, former Treasury Secretary Larry Summers recently released a whitepaper with other economists suggesting that the central bank may need to go further than the market anticipates. In particular, he argues that the current situation is closer to the 1980s inflationary bout than it appears due to differences in the CPI calculation.

Adjusting Your Portfolio

Most investors have been piling into inflation-protected securities and funds given the red-hot inflation readings over the past few months. For example, gold prices soared to more than $2,000 per Troy ounce in March and late April before moving off of their highs. Similarly, actively-managed taxable bond funds saw record inflows over the past couple of quarters.

With cooling inflation and a less hawkish Federal Reserve, some of these investments could become less compelling for investors. For instance, gold may become less attractive if inflation falls and bond prices could start to recover if interest rate expectations are revised lower. As a result, investors may want to tread more carefully in these assets if June’s CPI improves.

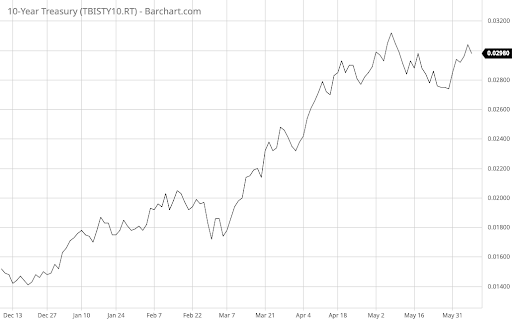

On the other hand, many investors are tempted to jump back into out-of-favor sectors, such as technology stocks, given the steep drop and a potential annualized inflation peak. Unfortunately, the Treasury market remains volatile, making it difficult to price assets. Over the past couple of months alone, 10-year yields have fluctuated between 2.74% and 3.13%.

A balanced approach may be the best bet in today’s market given the uncertainty. In addition, investors may consider international stocks and bonds along with actively-managed funds to reduce risk. These securities and funds have less exposure to U.S. inflation and interest rates and may be better positioned to manage exposure over time.

The Bottom Line

Inflation is back on investors’ minds after a higher than expected reading in May, but it’s a good idea to start planning for both elevated and falling inflationary scenarios. For instance, investors may want to consider reducing their exposure to some inflation hedges and looking toward actively-managed funds. And, of course, continue to watch labor market reports and the CPI.

Make sure to visit our News section to catch up with the latest news about income investing.