Due to the aforementioned reasons, some local governments are considering current market conditions as a double whammy on their finance – both from financing a project at an increased cost and the need to allocate more capital for the project that perhaps would have cost less in normal market conditions.

In this article, we will take a closer look at current market conditions and their adverse impacts on municipal debt markets.

Be sure to check our Municipal Bonds Channel to stay up to date with the latest trends in municipal financing.

A Closer Look at Municipal Debt Issuances in CY2022

Hilltop Securities, a leading municipal debt underwriter in the U.S., revised their earlier forecast for municipal debt issuance from $495 billion to $410 billion mid-year, and now the revised forecast seems a bit out of reach for this year. There are a few key factors attributed to the slowdown of municipal debt issuances: high cost of capital due to sustained interest rates hikes by the Federal Open Market Committee (FOMC) and low economic growth in the U.S., with a looming fear of widespread recession, causing local governments to pause before funding and/or approving large capital projects funded with municipal debt.

In addition, Hilltop Securities also reports, “The reality of lower economic growth is setting in as well. One of the key reasons we expected record issuance for 2022 initially back in November was because growth forecasts from many economists were coming in at 4.0% or higher. Now forecasts for 2022 U.S. GDP growth are mostly lower. The Organization for Economic Cooperation and Development published one of the latest revisions indicating U.S. growth is likely to come in at 2.5% (versus 3.7%) in 2022 and 1.2% in 2023 (versus 2.4%).” Some of these trends have persistently hinted toward an upcoming recession in the U.S. economy. Furthermore, although we have started to see the peak of inflation, it’s not clear whether there will be a rapid decline fostered by interest rate hikes.

For 2023, there is a mixed bag of reports on the overall issuance performance of municipal debt. Where Bank of America is predicting the total volume of municipal debt issuance to hit around $500 billion and Citi predicts $450 billion to $480 billion, Hilltop Securities estimates the volume to be $350 billion.

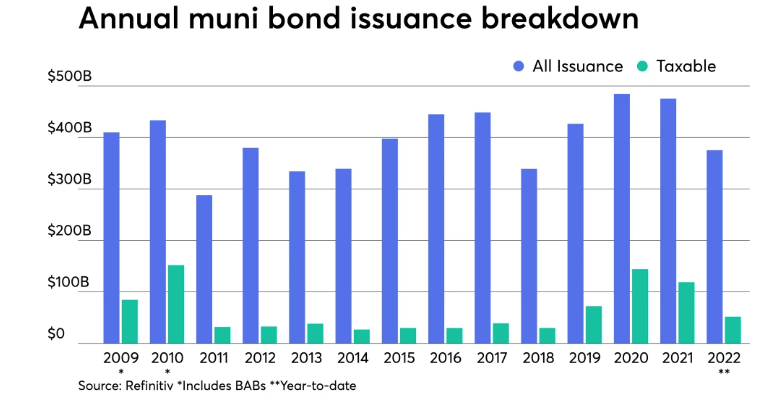

Again, these issuance numbers are driven by different factors of the economic outlook and the strength and willingness of local economies to take on new capital projects. The chart below shows the year-to-date performance of the actual volume of municipal issuances in CY2022.

Local Government Approach to Debt Issuance

This analysis can be very different depending on the market conditions and the economic outlook. In a favorable outlook, a local government can raise capital at a reasonable interest rate and either lower their overall cost of capital or raise additional capital. On the opposite side, in unfavorable market conditions, you’d see higher cost and less access to capital—similar to a home mortgage, where a borrower can borrow a larger loan amount in a low interest rate environment versus in a high interest rate environment—considering a fixed income in both scenarios.

In addition, local governments are very cognizant of planning their capital projects and garnering low interest cost. This means the timelines and source of capital can be different or can vary. A depressed economic outlook may prompt an agency to prolong the timing of debt issuance and fund the project with on-hand liquidity or identify other sources including financings available at the state or federal level. For example, in a lot of utility capital projects, many state governments are providing low cost capital financings to local governments and there is no need to go through the formal debt issuance process.

The Bottom Line

For investors, high borrowing costs (interest rates) is an opportunity to lock in high rates for longer periods of time and limit their reinvestment risk, while also being cognizant that rates may keep rising depending on the inflation levels and economic outlook.

Sign up for our free newsletter to get the latest news on municipal bonds delivered to your inbox.