Munis have suffered from some high bouts of volatility.

Several factors have helped munis become a pretty sector since the end of the summer. While that may dampen some of munis’ appeal, the reality is bonds are still a good deal and may even be a better buy for the future ahead. In the end, don’t let some increased volatility persuade you from moving out of the municipal bond sector.

Be sure to check our Municipal Bonds Channel to stay up to date with the latest trends in municipal financing.

A Flood of Activity

Munis are often free from federal and, in some instances, state and local taxes. As a result, they are often used by higher income investors to help reduce their overall tax burdens. With the recent Biden win and massive stimulus plans enacted to help move past the pandemic, higher taxes are in the crosshairs of many Democratic lawmakers. With this in mind, many investors moved heavily into muni bonds on the Biden win. Through the first three quarters of the year, investors moved more than $89 billion into muni bond ETFs and mutual funds, a record for inflows into the sector. This pushed yields to lows not seen in years.

But munis have been volatile the other way as well.

Thanks to the Fed, munis have been bouncing in the other direction. With inflation rising, expectations for higher rates are growing. The Federal Reserve has already started tapering its asset purchases and gave a soft deadline for ending the program. Meanwhile, the odds are growing that the Fed eventually begins to normalize its pace of rate hikes sooner rather than later. Munis, for the most part, are long-dated bonds as such durations tend to be longer. They get sold as rates rise or the expectations of rates rising grows. And in this regard, they’ve acted very much like regular Treasury bonds.

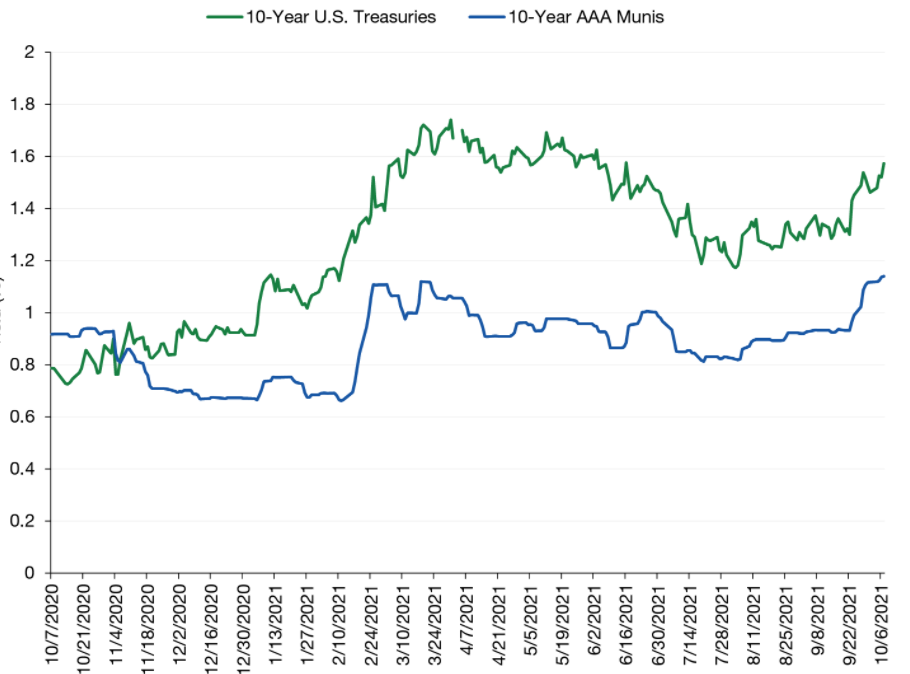

You can see the moves in the muni market in this chart from Lord Abbott.

Source: Lord Abbott

Normally, munis can go nearly a whole month without seeing any sort of significant move to their yields. Not so, since the taper talk over the summer.

Higher Taxes

The U.S. Senate recently approved a $1 trillion infrastructure spending package. Early this year, a COVID-19 package costing $1.9 trillion was passed, while the CARES Act in 2020 was nearly $2.2 trillion. There are additional spending packages in the works as well.

With that, the Biden Administration and Congressional Democrats have a slew tax proposal on the docket. This includes adding corporate taxes as well as targeting capital gains and even removing some of the benefits that ETFs offer.

And while many of the proposals target upper income earners, some middle-class investors will be impacted by the proposals. For example, higher corporate taxes could reduce dividend income and additional capital gains taxes may hurt long-term savers.

With their tax savings, munis are still a great way to win against many of the tax proposals. According to Morningstar and S&P Global, the 20 largest municipal bond ETFs yield an average of 1.95%. That’s an impressive 2.99% if you’re in the 35% tax bracket. Heck, that yield is still 2.56% if you’re in the 24% tax bracket. This beats both the yield on the S&P 500, which would be subjected to higher capital gains taxes, as well as the yield on taxable treasury bonds.

Don’t forget to check our Muni Bond Screener.

Stay the Course With Munis

Perhaps ignore the noise and stay the course with munis. Right now, investors are confused with what’s going on. We have a very weird market with inflation, stock gains, the threat of rising rates, etc. It’s not normal. But the odds of higher taxes are increasing.

And that’s just the point. Investors need to remember why they were attracted to munis in the first place. They are a steady-eddy income play that provides significant tax savings. To that end, munis are still a good buy.

Sign up for our free newsletter to get the latest news on municipal bonds delivered to your inbox.