According to the Natural Gas Intel reports, Texas leads the nation in oil and gas bankruptcies, after oil and gas activity suffered a bloodbath of sorts in April as the state began to register the full effects of the COVID-19 lockdowns, with upstream jobs tumbling to the largest monthly decline on record.

The situation is also getting worse with our northern neighbors, since Alberta’s economy relies heavily on oil production and its exports, where more and more oil companies are halting oil production and laying off thousands of workers.

In this article, we will take a closer look at how the oil crash will impact local government operations and also warning signs for investors to analyze.

The Natural Gas and Oil Industry in 2020

Frankly, it wasn’t a concept that many investors understood. Let’s dissect that for a moment: The falling demand for oil in the world is nothing new, and it has been the cause of concern for many oil producers around the world. In 2020, the impact of COVID-19 worsened the problem by 100 fold for many of these producers, as the demand for oil and its consumption levels fell drastically when the world came screeching to a halt.

- Oil production wasn’t cut, but demand for oil fell to historic levels, which also meant that many entities had already reached their maximum storage capacities.

- Oil trading happens in future contracts. which means that a buyer would enter into a contract to purchase oil at a future time-frame. This means that given the low demand due to COVID-19, the buyers were letting the future contracts expire due to their inability to store oil and low demand, sending the per barrel prices into negative territory.

All these events had a significant impact on both regional and national oil and gas producers in North America, ultimately, leading to a surge in layoffs and insolvencies.

Local Government Dependency on the Oil Sector

For the City of Calgary, the already struggling oil and gas sector was hit hard by COVID-19. The Calgary Herald reported: “It has been a difficult week for Alberta’s oil and gas sector, with news that Ovintiv, the company formerly known as Encana, has laid off 25 per cent of its workforce due to the effects of COVID-19 and the global oil price crash. Ovintiv, which moved its corporate domicile from Calgary to Denver earlier this year and now has around 2,100 employees and contractors, said the job losses would be evenly spread across its offices in Calgary, Denver and The Woodlands, Texas.”

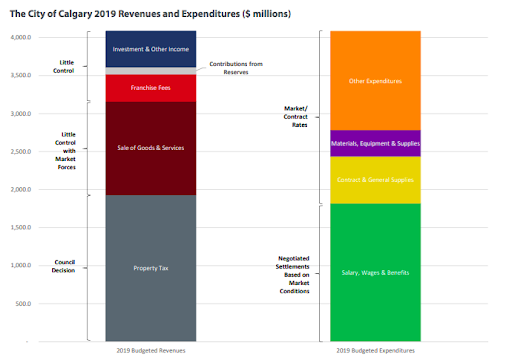

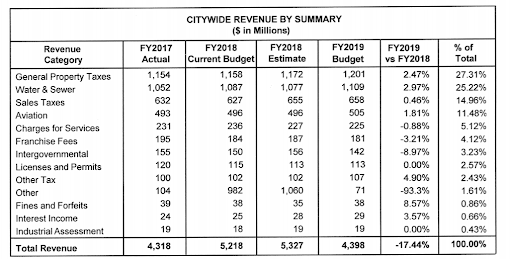

The cities of Calgary and Houston rely heavily on their property and sales tax revenues, as shown in their 2019 budget documents, with both revenue sources accounting for over 75% of the total revenue for Calgary and 42% for Houston.

What does this mean as more and more oil companies are either laying off employees or going bankrupt?

- A drastic decrease in the consumer spending, in turn affecting sales tax revenues.

- The financial hardships caused by layoffs may spill over into the real estate market, adversely affecting property values, plus possible foreclosures that will have a significant impact on the property tax revenues for the local and state governments.

The events leading up to the recent oil market crash and its aftermath are going to shake up the City of Calgary’s finances, and they will need to revisit their expenditure priorities. For instance, Calgary will not only need to cut their revenue forecasts for the upcoming years, but also thoroughly analyze how these revenues are allocated and what service levels will be cut.

The economic downturn and the oil crash will have a severe impact on these two areas. City officials will need to figure out ways to either cut service levels or use their reserve funds to make ends meet until the economy turns around. The chart below shows the major revenue sources for Houston.

The Bottom Line

Investors should watch closely for any budget updates adopted by City Council or boards, and also keep an eye on any updates from rating agencies on revenue forecasts.