In the case with munis, we’re talking about the dreaded alternative minimum tax or AMT.

But for those who don’t need to worry about the AMT – which is the vast bulk of us – munis subjected to the alternative tax scheme can offer big yields and big discounts to the broader muni sector. And here, investors can win some hefty tax-free income.

What is The Alternative Minimum Tax?

For municipal bonds, this poses an interesting problem. Most munis fall under general obligation (GOs) bonds or revenue-backed categories. These are bonds issued by state or local governments to fuel general spending or a project like a sewer system or toll bridge. However, there is a third category, dubbed private activity bonds. These are bonds issued to court businesses or to finance a special project that’s beneficial for the public good but won’t be owned by the municipality or state. These are things like football stadiums, airports, private hospitals, a shopping mall, etc.

The problem is that GOs and most revenue bonds are used in the AMT calculation. However, many PABs count under the AMT and investors must include the interest under the secondary tax system. For higher income earners, this can be a major issue and result in having to pay more tax.

The Opportunity for Investors

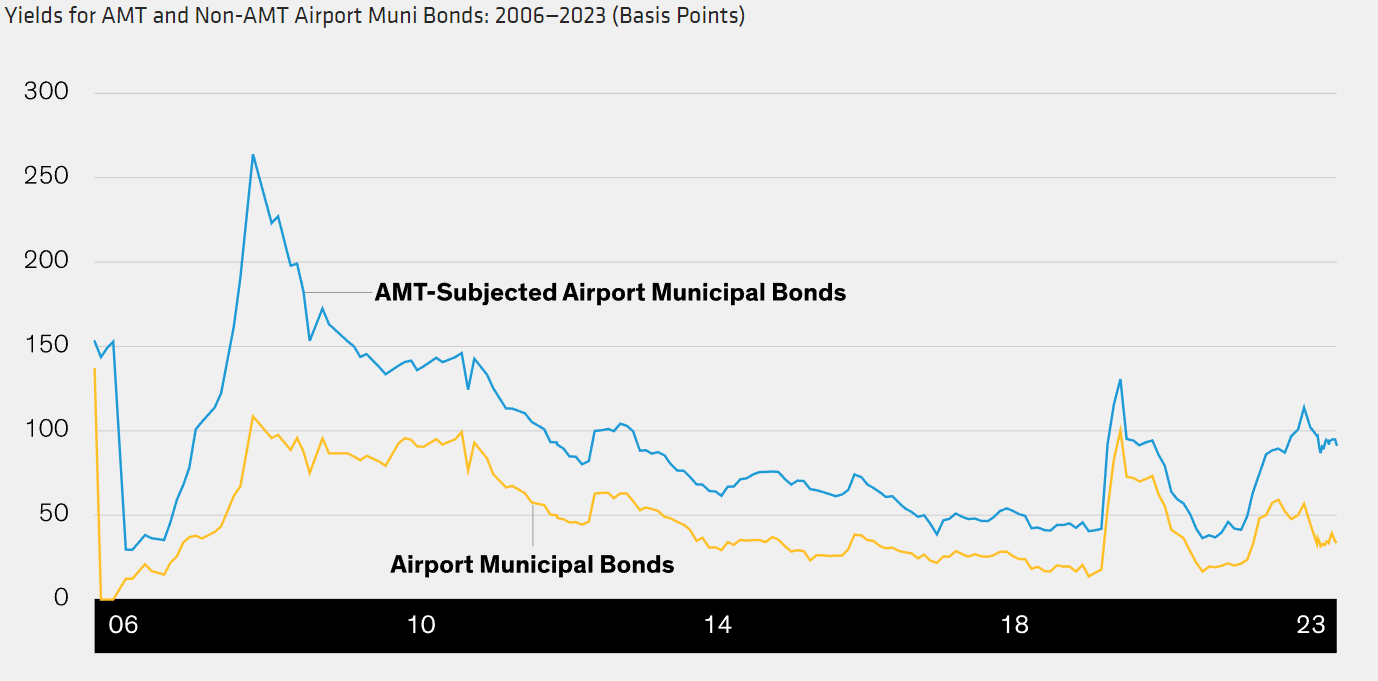

This chart from AllianceBernstein looks at AMT and non-AMT airport municipal bonds. As you can see, since 2006, the AMT subject bonds have traded at higher yields, solely because of the tax potential for high-income investors. This is just one example, but the pattern is the same for the bulk of AMT bonds.

Source: AllianceBernstein

The kicker is that the majority of investors are not subjected to the AMT in any way. The Tax Cuts and Jobs Act of 2017 made that number even less, pushing income limits even higher than before. When the Act was passed, more than 5.2 million taxpayers were subjected to the AMT. According to IRS data, only 150,000 filers had to use the AMT after the bill. So, unless your last name is Rockefeller or Walton, there’s a good chance that you’ll never have to worry about the AMT.

This creates an interesting proposition in AMT bonds for many investors – there’s the ability to score a higher tax-free yield.

Getting Exposure

The second caveat? Getting pure exposure. Because most historical muni buyers have been focused on not being subjected to the AMT, the majority of funds specifically look for AMT-free bonds as part of their mandate and fund titles. The same applies for major muni indexes.

Right now, there is no 100% AMT-focused muni fund of any kind. But there are plenty that include or have the bulk of their portfolios in these bonds. For indexers, this includes the SPDR Nuveen Bloomberg High Yield Municipal Bond ETF and the VanEck Short High Yield Muni ETF.

For investors looking for an AMT discount, active management could be the best opportunity. With managers being able to exploit discounts and buy higher yielding bonds that are subjected to the AMT, an actively managed fund is a great choice. The AB High Income Municipal Portfolio has about 13% of its holdings exposed to AMT bonds to give it a yield boost, while the Oppenheimer Rochester High Yield Muni A has about 42% of its portfolio in non-rated private activity bonds.

Finally, closed-end funds (CEFs) could be an interesting way to get exposure at a discount. Thanks to their tradability, they can often be had for less than their net asset values, allowing investors to buy $1 worth of assets for 80 or 90 cents. Many also offer exposure to AMT bonds. For example, the Nuveen Municipal Credit Income Fund has about 16% of its assets in AMTs and can currently be purchased at a 15% discount to its NAV.

Some Top Performing AMT-Holding Bond Funds

| Name | Ticker | Type | Active? | AUM | YTD Ret (%) | Expense SPDR® |

| Nuveen Bloomberg High Yield Municipal Bond ETF | HYMB | ETF | No | $1.84 billion | 0.9% | 0.35% |

| Oppenheimer Rochester® High Yld Muni A | ORNAX | Mutual Fund | Yes | $8.01 billion | 0.7% | 0.95% |

| PIMCO High Yield Municipal Bond | PHMIX | Mutual Fund | Yes | $2.67 billion | 0.4% | 0.57% |

| Nuveen Municipal Credit Income Fund | NZF | CEF | Yes | $2.01 billion | 0.2% | 2.2% |

| AB High Income Municipal Portfolio | ABTHX | Mutual Fund | Yes | $3.48 billion | -0.2% | 0.85% |

| VanEck Short High Yield Muni ETF | SHYD | ETF | No | $421 million | -0.3% | 0.35% |

| BlackRock High Yield Muni Income Bond ETF | HYMU | ETF | Yes | $25 million | -4.4% | 0.53% |