However, there are a few roadblocks as well.

From high energy costs to links to crime/unscrupulous activities, cryptocurrencies don’t often mesh well with socially responsible investing (SRI) and ESG. For investors looking to integrate ESG into their portfolios, this poses a big problem.

Can ESG and crypto coexist in the same portfolio? Or do investors need to choose one of the trends and potentially miss out on the other?

Be sure to check out our ESG Channel to learn more.

Progressing Mankind

The basic idea behind cryptocurrencies is that these “coins” don’t exist in a tangible form. They are stored in a digital key or on the cloud and, with no central bank or regulatory authority backing them up, they use cryptography/encryption to secure transactions. This allows them to decentralize and potentially democratize finance for the people.

ESG investing is about making positive changes as well. By applying various screens, pressuring management via proxies and focusing on new greener technologies, investors hope they can change the world while also making a profit.

With the similar focus of the two trends, it’s easy to see why investors could be interested in both. After all, Bitcoin and other cryptocurrencies seem to fit the same social aims of SRI/ESG investing. Progressing mankind and removing some of the problems that exist in the world are sort of the core between the two.

Don’t Forget the “E”

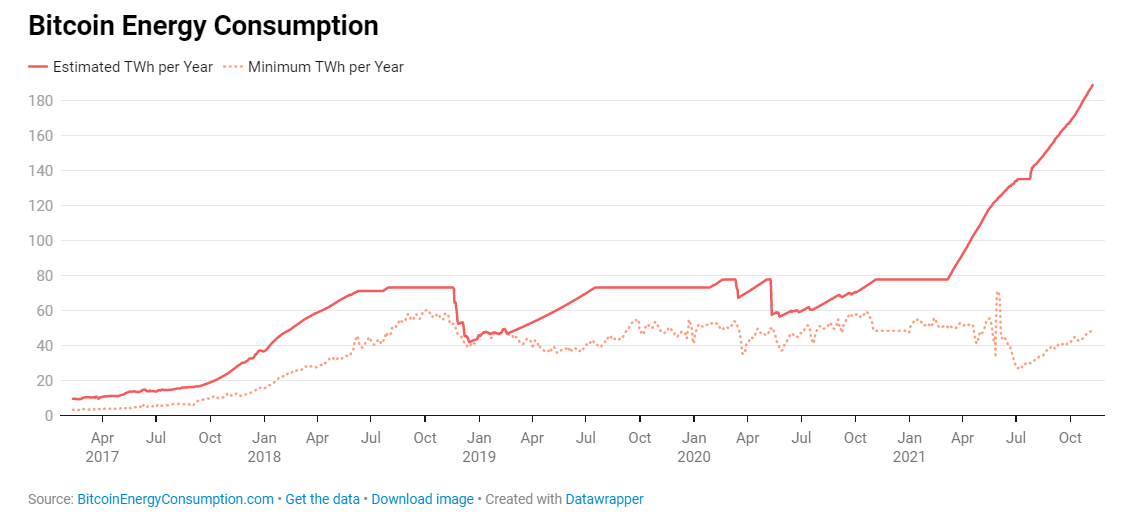

No matter how you slice it, cryptocurrency uses a lot of energy. From mining new coins to the complex calculations that keep the blockchain ledger running, energy use for the sector is immense. According to the The New York Times, the intense process of creating Bitcoin consumes around 91 terawatt-hours of electricity annually. That’s more than the entire nation of Finland and its 5.5 million residents’ use per year. This chart from group Digiconomist, highlights the growth in Bitcoin energy demand over the last few years as calculations have continued to become more complex and adoption has grown.

Source: Digiconomist

Digiconomist has pegged that a single bitcoin transaction has a carbon footprint of 745.18 kg CO2. That’s the equivalent of 1,651,581 transactions over payment-provider Visa’s network. It also generates about 23 kilotons worth of e-waste. Graphics cards and other components used in mining and blockchain need to be replaced frequently. And this is only focusing on Bitcoin, which is the most popular cryptocurrency.

Additionally, cryptocurrencies may have some issues with the “S” and “G” (social and governance) in ESG as well. Because of its anonymous nature and global ease of movement, Bitcoin and the like have been used in some less-than-legal transactions. It has become a medium of exchange for criminal activities. According to the Federal Trade Commission (FTC), these sorts of transactions are on the rise.

Meanwhile, governance issues are raised as well. Firms that have exposure to cryptocurrencies or start taking them as payment need to think differently about their risk management policies. Ratings agencies like Standard & Poor’s and Moody’s are beginning to incorporate this into their analysis.

Be sure to check our Portfolio Management Channel to learn more about different portfolio rebalancing strategies.

Getting Better

Secondly, digital currency miners have started to go green in their own right. Many large miners have begun to use solar, wind and other green energy sources to help lighten the power load of the currency. And big backers are helping with the transition. For example, payments firm Square recently committed $10 million to a new Bitcoin Clean Energy Investment Initiative. Others have done the same. The hope is that, one day, bitcoin and other cryptocurrencies will be 100% mined via renewable energy sources.

Meanwhile, there are calls for bitcoin and other currencies to move to a “proof of stake” model on the blockchain ledger. This organizes the cryptocurrency based on how much of the currency a user owns, not based on which miner solved a problem. According to experts, this could reduce the amount of energy consumed by nearly 99%.

Can ESG & Crypto Play Together?

Moreover, if larger ESG-focused institutional investors adopt crypto and push for change, we could get there faster. Forcing equipment-makers to manufacture more environmentally-/energy-efficient products, make utilities adopt renewables at a faster rate or even target payment networks/brokerages that deal in crypto to do better could actually make a difference. And that is what ESG investing is all about.

The bottom line is that, today, crypto may not be a great ESG choice. But there is plenty of potential for change in the sector, and ESG investors can lead the way.

Make sure to visit our News section to catch up with the latest news about income investing.