Federal Reserve officials believe that much higher interest rates may be necessary to stop inflation. With the iShares Core US Aggregate Bond ETF (AGG) already down nearly 11% since January, fixed-income investors could be in for much more pain over the coming quarters. As a result, investors may want to look at alternatives to hedge their portfolios.

Let’s look at two new exchange-traded funds (ETFs) that could help protect your portfolio against rising interest rates.

See our Active ETFs Channel to learn more about this investment vehicle and its suitability for your portfolio.

Interest Rates on the Rise

Inflation unexpectedly accelerated to 8.6% in May 2022, representing the fastest growth rate since December 1981. Energy prices were the largest contributor to the increase with a 34.6% gain due to gasoline and fuel oil, although big increases were also seen in food, shelter, airlines, and household furnishings.

The futures market expects the Federal Reserve to increase interest rates to a 225 to 250 basis point range on July 27 before reaching a 350 to 375 basis point range by December’s meeting. In fact, the market projects a 15% chance that rates could go even higher to 375 to 400 basis points by the end of the year.

Senior Floating Rate Loans

PIMCO’s Senior Loan Active ETF (LONZ) invests in floating-rate bank loans with low durations and interest rate sensitivity. In addition to being an effective counterweight to rising interest rates, these loans have a historically low correlation to most core fixed-income sectors, helping diversify conventional investment-grade or sovereign portfolios.

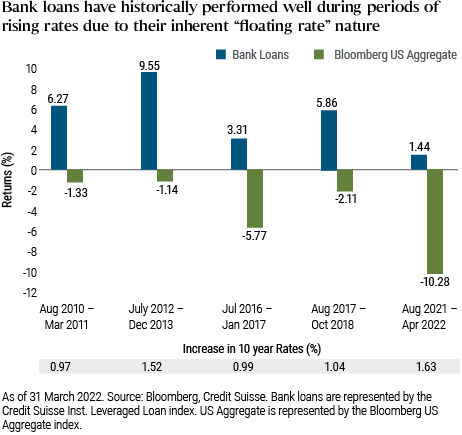

Bank loans have been strong performers during rising interest rate environments due to their floating rate nature. Source: PIMCO

Currently, the fund holds just over 100 senior loans with an effective duration of 0.10 years and an effective maturity of 3.76 years. While the Bloomberg US Aggregate Bond Index fell 10.28% between August 2021 and April 2022, bank loans returned a positive 1.44%. And the fund’s 0.5% net adjusted expense ratio makes it an affordable option.

Collateralized Loan Obligations

The VanEck CLO ETF (CLOI) invests in collateralized loan obligations, or CLOs, offering higher relative yields and a history of strong risk-adjusted returns. Over the long term, CLOs have outperformed other corporate debt categories with higher yield spreads, providing investors with a valuable alternative to conventional high-yield bonds.

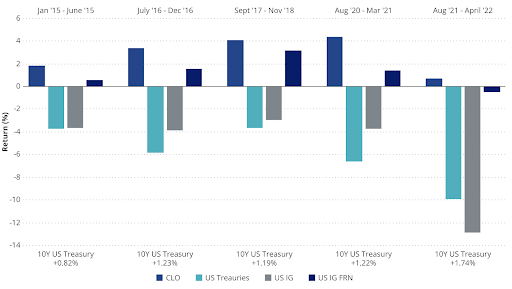

Collateralized loan obligations have outperformed IG bonds, Treasuries, and other fixed-income asset classes over time. Source: VanEck

Currently, the fund holds about 20 CLOs with a 5.96% yield to maturity and a 2.74% 30-day SEC yield, making it a much higher-yielding alternative to the LONZ ETF. The fund also offers monthly distributions and a modest 0.40% expense ratio, making it an excellent low-cost choice for retirees seeking a regular income.

The Bottom Line

The Federal Reserve will likely continue raising interest rates over the coming year, which could translate to more pain for fixed-income investments. While some analysts believe the market is pricing in these risks, the Federal Reserve could raise rates even faster than expected if inflation rises over the coming months.

Investors that want to hedge against these risks while still retaining fixed-income exposure may wish to consider PIMCO’s Senior Loan Active ETF or VanEck’s CLO ETF. Both funds have outperformed during rising interest rate environments while providing fixed-income investors with positive returns.

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.