These days, investors have plenty of choice when it comes to finding yield and much-needed income. The Fed’s path to tightening has helped push up yields in a variety of places – and some even come with juicy tax benefits.

In this case, we’re talking about preferred stock.

These hybrid securities are yielding close to 8% and offer the chance to gain some high income while still reducing their equity risk. And with preferred stock payments as tax-advantaged income, their benefits as a portfolio tool are expanded. For those looking to position themselves in the new year, preferred stock makes an ideal choice.

A Primer on Preferred Stock

There are stocks and there are bonds. And then there are some interesting securities that seemingly blend the two asset classes. It’s in these often-overlooked hybrid securities that investors can find good deals if they get the timing right. One of them happens to be preferred stock.

Preferred stock acts like an IOU while still providing an equity stake in the company. On the bond side, preferred stock is issued with a par value – usually $25 or $1,000 per share. This par value acts as the price floor for many preferred shares, since when the shares mature – often 15 or 30 years later – investors get this principal back. At the same time, preferred shares are issued with a coupon value that is paid to its shareholders. However, because a firm’s bonds have priority over preferred shares in the bankruptcy ladder, the dividend rate is often higher on preferred stock than its issued bonds. This is done to compensate for the extra risk.

On the stock side, preferred stock does represent an equity stake. In the case of issues, preferred stockholders get paid first in instances of bankruptcy over common shareholders. Another added feature is that if for some reason a firm stops paying dividends, preferred stockholders must be paid first before common stockholders, and in some cases, they must be paid back all the suspended dividends as well.

This combination of attributes makes preferred stock a unique asset class for income seekers.

Big Current Yields

The present could be the best time to purchase preferred stock for portfolios. And that’s because a combination of factors has made the sector tantalizing on several fronts.

For starters, their yields haven’t been this juicy since the credit crisis/Great Recession. While preferred stocks have attributes of bonds and stocks, they tend to follow the bond market. So, with the Fed raising rates, preferred stocks have since seen their prices fall, thereby raising their yields. Secondly, preferred stocks are generally issued by banks. Thanks to last spring’s banking rout, the collapse of SVB Bank, and worries about solvency/contagion, many of the preferred stocks issued by banks have plunged and stayed at bargain levels.

Today, investors can snag yields over 6%.

New preferred shares coming to the market have also enjoyed high yields. Goldman Sachs Group, Wells Fargo and Citigroup – all banks who passed their Fed stress tests with flying colors – issued new preferred stock this year at yields over 7.5%.

Other Preferred Stock Advantages

So, investors get a high yield today with preferred stock. But there’s more to that yield than meets the eye. It also comes with big tax advantages.

For the vast bulk of the preferred sector, their dividends count towards the lower tax treatment of qualified dividends. For investors in the top tax bracket, that’s just 23.8%, including the Medicare surcharge. This is very advantageous when compared to other forms of investment-grade debt. For example, investors in the top tax bracket would have to earn over 9% in investment-grade bonds to get the same yield as preferred stock today – a nearly impossible feat. Not even junk bonds are paying that much.

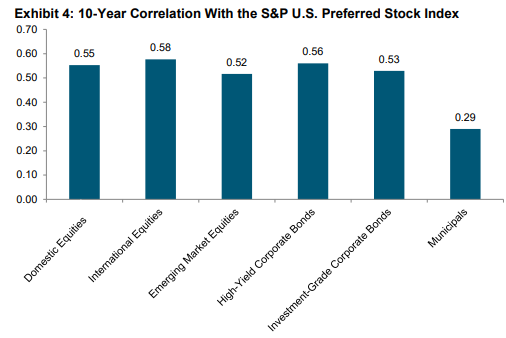

Another bonus remains preferred stock’s low correlation with other asset classes. You can see by this chart from S&P Global that preferred stock doesn’t have a high correlation to equities or other corporate bond varieties. This low correlation also comes with generally low volatility relative to other asset classes. This makes preferred stock a top choice for diversifying an income portfolio.

Source: S&P Global

Adding Some Preferred Muscle

Given the yield and tax-advantage of preferred stock, investors may want to consider adding some to their portfolios today. Buying individual preferreds can be difficult with large bid/ask spreads and limited research. To that end, funds make the most sense for portfolios. Luckily, there are numerous preferred ETFs out there. Investors may also find benefits in active management of preferred stock as managers can buy preferreds at big discounts to their NAV or find values in the sector.

Preferred Stock ETFs

These funds are selected based on their ability to tap into preferred stock and their assets under management. They are sorted by their YTD total return, which ranges from 5.2% to 9.7%. Their expense ratio ranges from 0.23% to 0.85%, while they have AUM between $585M and $13B. They are yielding between 4.3% and 7.4%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| PFXF | VanEck Preferred Securities ex Financials ETF | $1.2B | 9.7% | 7.3% | 0.41% | ETF | No |

| PFF | iShares Preferred & Income Securities ETF | $12.7B | 9% | 7.38% | 0.46% | ETF | No |

| PGX | Invesco Preferred ETF | $4.4B | 6.8% | 7.2% | 0.50% | ETF | No |

| PREF | Principal Spectrum Preferred Securities Active ETF | $587M | 5.9% | 4.31% | 0.55% | ETF | Yes |

| PFFD | Global X U.S. Preferred ETF | $2.2B | 5.3% | 6.48% | 0.23% | ETF | No |

| FPE | First Trust Preferred Securities & Income ETF | $5.1B | 5.2% | 6.09% | 0.85% | ETF | Yes |

The Bottom Line

For investors looking for high, tax-advantaged yields, preferred stock could be a top play. Right now, the asset class is offering some of the best yields in decades. Investors looking to beef up their incomes should consider using the asset class in their fixed income portfolios.