The beauty of the fixed income market is that there is a lot of choice. Investors can pick from plenty of duration varieties, credit qualities, and other covenants to build their bond portfolios and generate income. And thanks to the rise of ETFs and specialized funds, accessing the entire universe of bonds can now be done easily.

But as we’ve focused on CLOs, emerging market bonds, and the like, one traditional category may be going ignored by investors. We’re talking about the bond market’s ‘sweet’ spot.

Right now, investment-grade intermediate bonds offer the perfect blend of duration risk and yield. The sweet spot for bonds is looking very sweet indeed.

Right In the Middle

When it comes to buying and evaluating bonds, investors have two very basic decisions to make. One is the duration or when the bond matures. The second is credit quality or the chance of a default. While there are many nuances along the credit rating ladder, most bonds fall within two broad categories: investment-grade or high-yield.

When it comes to timeline, long-term debt refers to fixed income securities set to mature more than 10 years from the issue or purchase date. Short-term debt are those bonds that are set to mature within two to five years of issue or purchase. Right smack in the middle are so-called intermediate or medium-term bonds.

After the Treasury suspended the issuance of 30-year debt in the early 2000s, before starting to reissue the bond, this sort of middle ground became the benchmark for the sector. Many funds and bond managers use the 10-year Treasury as their guidepost, with immediate bonds becoming ‘core’ portfolio staples.

It turns out this was a good decision. Intermediate bonds typically offer the best blend of current yield versus duration risk, no matter what the environment. Over the last decade, there have been three periods of rising rates and intermediate bonds have still managed to produce flat to slight gains when it comes to total returns. This has helped the segment be called the sweet spot for bond investors.

The Sweet Spot Gets Sweeter

Last year, however, was not kind to bonds of any kind, with investment-grade intermediate bonds dropping by 12.1%. However, that dip may have uncovered a real opportunity for investors.

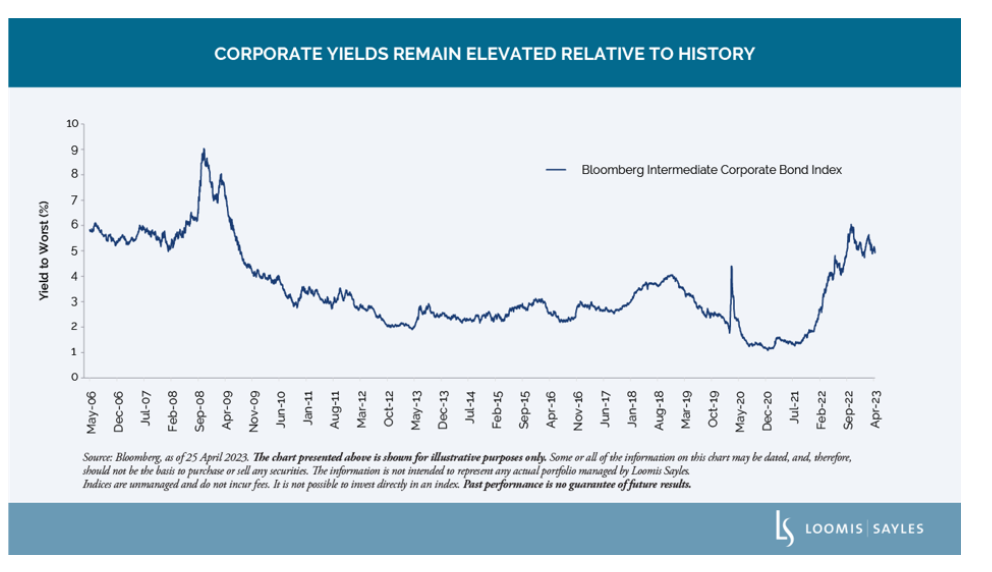

According to bond-focused manager, Loomis Sayles, the Bloomberg Investment Grade Intermediate Corporate Index is now offering yields near 5%. You can see from this chart from the investment manager that you’d have to travel back to the global financial crisis of 2008/2009 to see yields that high in this category. 1

Source: Loomis Sayles.

At the same time, the bond manager highlights the deeply inverted Treasury yield curve and the flattened corporate credit spread curve. The combination of these events has resulted in yields between short- and long-term corporate bonds converging. Typically, yield gets higher as you move out on the curve to compensate for duration and credit risk. Not so today.

The kicker is looking at the value per unit and break-even points. Because of added duration risk associated with long-dated bonds, intermediate bonds will have the edge in the current environment. This is enhanced when looking at break-even points, which suggests that intermediate bonds could have their yields rise by 120 basis points and would still produce a positive return for the next 12 months. For long-term bonds, the number is closer to just 40 basis points.

Looking at the other side of the coin, intermediate bonds win out versus their shorter-term rivals. Investors have been lured by the huge yields offered on the short end of the curve. But with the recent Fed pause and inflation breaking, we may be near the end of the tightening cycle. This will hinder short-term bond prices and help intermediate bonds see a surge in price. Looking at data from the last seven Fed pauses, intermediate bonds have historically outperformed cash and other short-term bonds by a wide margin, outperforming by 3 percentage points after a year and 2 percentage points after three years on average.

Time to Consider the Sweet Spot

So, the middle isn’t such a bad place to be. All in all, intermediate bonds could offer the best blend of current income and gains potential versus both short- and long-term rivals. And with yields still near 5%, the time to buy is now.

Loomis Sayles suggests looking at the corporate space rather than Treasuries. You’re able to pick up some extra yield without taking on much more credit risk. Realistically, a bond issued by Walmart or Coca-Cola is still as good as gold. So, skip funds like the iShares Core U.S. Aggregate Bond ETF.

What to buy? You could go with Loomis Sayles’ own Loomis Sayles Investment Grade Bond Fund or managed SPDR Loomis Sayles Opportunistic Bond ETF. Both seek to outperform the Agg, but bet on corporate bonds that are values. Considering that this is a bond’s sweet spot and long-term performance, there are numerous active choices. The Fidelity Investment Grade Bond Fund and Franklin Investment Grade Corporate ETF are just some top-rated examples.

Here's a list of the low-cost active funds for intermediate bond exposure

| Name | Ticker | Type | Actively Managed? | AUM | YTD Ret (%) | Expense |

|---|---|---|---|---|---|---|

| Loomis Sayles Investment Grade Bond Fund | LSIIX | Mutual Fund | Yes | $5.99 billion | 1.2% | 0.54% |

| SPDR Loomis Sayles Opportunistic Bond ETF | OBND | ETF | Yes | $29.5 million | 1.3% | 0.54% |

| Fidelity® Investment Grade Bond Fund | FBNDX | Mutual Fund | Yes | $8.47 billion | 1.4% | 0.45% |

| Franklin Investment Grade Corporate ETF | FLCO | ETF | Yes | $699 million | 1.4% | 0.35% |

Investors also have plenty of choices when it comes to indexing. The three largest funds in the space are the Vanguard Intermediate-Term Corporate Bond Index Fund, iShares iBoxx $ Investment Grade Corporate Bond ETF, and SPDR Portfolio Intermediate Term Corporate Bond ETF. It’s easy to see why. All three offer broad, low-cost exposure to the sector with large trading volumes.

Here's a list of low-cost index funds for intermediate bond exposure.

| Name | Ticker | Type | Actively Managed? | AUM | YTD Ret (%) | Expense |

|---|---|---|---|---|---|---|

| VANGUARD INTERMEDIATE-TERM CORPORATE BOND INDEX FUND | VCIT | ETF | No | $39.9 billion | 2.1% | 0.04% |

| iShares iBoxx $ Investment Grade Corporate Bond ETF | LQD | ETF | No | $36.7 billion | 2.2% | 0.14% |

| SPDR Portfolio Intermediate Term Corporate Bond ETF | SPIB | ETF | No | $6.9 billion | 1.3% | 0.04% |

| iShares Core U.S. Aggregate Bond ETF | AGG | ETF | No | $91.5 billion | 1.3% | 0.03% |

The Bottom Line

For investors looking for value and income potential, intermediate bonds could be a wonderful bet. Offering a great blend of duration risk and current yield, the sweet spot for the bond market is pretty sweet indeed. With that, investors should consider adding a dose of intermediate bonds either via active or index funds, including those mentioned earlier in the article.

1 Loomis Sayles (May 2023). A Fresh Value Proposition in Intermediate Corporate Bonds Amid an Uncertain Outlook