If one word could be used to describe the current market and economic environment, it would have to be uncertainty. Investors have plenty of reasons to be on edge. Every day, it seems, data points to a different picture. From the drumbeat of recession and rising inflation to dwindling data and the threat of global conflict, uncertainty is everywhere.

And that’s created a lot of volatility in both the equity and bond markets. But there may be a way to calm that volatility and reduce risk.

We’re talking about bread & butter Treasury securities. Despite the recent downgrades, U.S. Federal debt is still as good as gold. That fact could make it a key play for fixed income investors in the months ahead.

A Quick Primer on Treasuries

Treasuries are bonds issued by the U.S. government, specifically the Treasury department. This is different from other government agency bonds or mortgage-backed securities issued by Freddie Mac or Fannie Mae. As with any bond, you’re lending an entity money. In this case, it’s Uncle Sam. Treasury bonds are issued to help the government pay for its various programs and spending initiatives.

In exchange for lending Uncle Sam money, he promises to pay you back with interest at a later date.

Treasuries come in two basic flavors: Notes/Bonds and Bills. Notes have maturities ranging from one to ten years, while bonds can have maturities of up to 30 years. Both pay interest every 6 months at a rate that is set when you buy the bond. Bills are a little different. They have maturities as short as four weeks and are sold at discounts to their face value. When the bond matures, investors get this face value back representing the interest earned.

Thanks to the United States standing as the global financial powerhouse, Treasuries remain one of the most liquid markets around, with more than $25 trillion in debt outstanding and $750 billion exchanging hands each day.

A Top-Notch Recessionary Play

Treasury bills, notes and bonds are considered a safe haven in times of duress. That’s because of the claims paying ability of the U.S. government. Now, over the summer, Fitch ratings downgraded the U.S. government and its bonds one notch over the brinkmanship of the debt ceiling.

However, it’s important to realize that the Feds have plenty of wiggle room when it comes to spending and raising money. The government could, in theory, become draconian in its cuts, slashing a variety of programs, and realistically tackling big budget items like military spending. At the same time, both corporate and personal taxes could be raised in order to fill Uncle Sam’s coffers. Not to mention, Uncle Sam owns plenty of real estate and other assets it could sell.

Even battles of the debt ceiling in Washington have historically ended with a last-minute compromise and funding gap bills.

As a result, the U.S. government claim’s paying ability is still 99.9999999% good.

This is key when it comes to rising risks. With economic data starting to dwindle, inflation still going strong and equity market volatility rising, Treasuries are emerging as a top-notch safe play for portfolios.

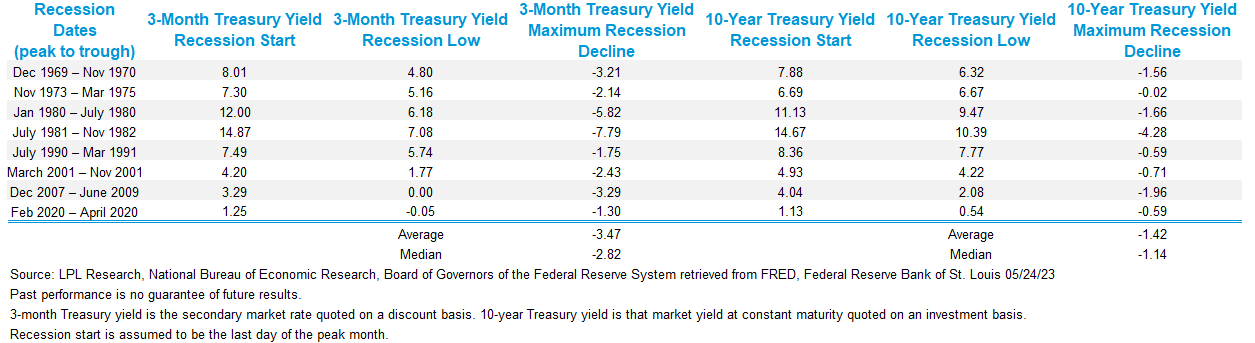

Two factors come into play. Normally, during recessions, the Federal Reserve will decrease rates to make borrowing cheaper for investors. Bonds of any kind have an inverse-relationship with rates. This causes bonds already on the market to rise in price to match newly issued bonds in terms of yield. This creates a total return effect and provides ballast to the asset class. According to LPL Financial Research, looking at the last eight recessions, the median maximum yield decline for the 3-month T-bill was 2.82% and 1.14% for the 10-year Treasury bond. That yield decline means that bond prices rose. 1

This chart from the financial advisor group shows the data for the last eight recessions.

Source: LPL

The second factor is the ability of Uncle Sam to make good on its debts. Even the bedrock of America-style firms like Walmart or Microsoft can only do so much to pay back their debts. So, while default risk is low, it’s still there. The implicit guarantee of payback during times of stress makes Treasury bonds a go-to asset class for investors. Investors will abandon riskier assets and buy U.S. Treasury bonds and bills. This effect is exacerbated when yields are high to begin with, like today.

Adding Treasury Debt

Given the rising risks presented today, investors looking for the ultimate safety play may want to focus on Treasury debt over other kinds. Yes, Treasuries pay less in yield than a comparable investment-grade corporate bond and much less than junk bonds. But that lower yield is because of the safety net factor. And with yields currently riding high after the Fed’s recent interest rate hikes, investors are still getting a lot of income potential.

Getting a hold of individual Treasury bonds is really easy. Both a healthy secondary market as well as regularly issued auction schedules allow investors to buy bonds with ease. This can be through Treasury Direct or any good brokerage account.

For most of us, using a fund is still the easiest way to add Treasuries to a portfolio. The one-ticker solution could be the iShares U.S. Treasury Bond ETF, which owns Treasury bonds with maturities of 1 to 30 years. Other than that, the focus becomes various duration bands. For example, the iShares 7-10 Year Treasury Bond ETF and Vanguard Intermediate-Term Treasury Index Fund bet on the middle of the maturity spectrum, while the SPDR Portfolio Long Term Treasury ETF and iShares 0-3 Month Treasury Bond ETF bet on both the long and the short end, respectively. Investors can customize their durations how they see fit. However, the middle ground seems to be the best place to balance reinvestment risk and duration risk.

Also, Treasury bonds seem to be a place where indexing overtakes active management. Thanks to the liquidity and tradability of these bonds, active managers can’t really add any additional mojo. There’s no credit discrepancies to be had. As such, there aren’t really any active choices when it comes to Treasury bonds. But that’s not a bad thing as investors have very low-cost index access to the asset class.

Treasury Bond ETFs & Mutual Funds

These funds were selected based on their low-cost and YTD total return, which range from -11% to 4.5%. They have expenses between 0.03% to 0.55% and assets between $1B and $27B. They are currently yielding between 1.6% and 5.1%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| SGOV | iShares 0-3 Month Treasury Bond ETF | $12B | 4.46% | 4.9% | 0.13% | ETF | No |

| SHV | iShares 0-3 Month Treasury Bond ETF | $19.9B | 3.92% | 5.1% | 0.16% | ETF | No |

| TBLL | Invesco Short Term Treasury ETF | $1.45B | 3.85% | 5.1% | 0.08% | ETF | No |

| GBIL | Goldman Sachs Access Treasury 0-1 Year ETF | $5.45B | 3.80% | 4.9% | 0.14% | ETF | No |

| FUMBX | Fidelity® Short-Term Treasury Bond Index Fund | $4.08B | 1.19% | 1.6% | 0.03% | MF | No |

| IEI | iShares 3-7 Year Treasury Bond ETF | $13.417B | -0.58% | 2.6% | 0.15% | ETF | No |

| VSIGX | Vanguard Intermediate-Term Treasury Index Fund Admiral | $3.149B | -1.26% | 2.9% | 0.07% | MF | No |

| SCHR | Schwab Intermediate-Term US Treasury ETF | $7.382B | -1.34% | 3.5% | 0.03% | ETF | No |

| GOVT | iShares U.S. Treasury Bond ETF | $23.181B | -2.16% | 2.7% | 0.05% | ETF | No |

| LUTAX | Columbia U.S. Treasury Index Fund A | $1.11B | -2.42% | 2.8% | 0.55% | MF | No |

| IEF | iShares 7-10 Year Treasury Bond ETF | $27.456B | -3.98% | 3.2% | 0.15% | ETF | No |

| SPTL | SPDR Portfolio Long Term Treasury ETF | $6.793B | -11.04% | 3.9% | 0.07% | ETF | No |

The Bottom Line

With risks rising, bread & butter Treasury bonds could be a great portfolio addition. Thanks to Uncle Sam’s claims-paying ability, strong yields, and ballast during recessions and other downturns, Treasury bonds could be a top-notch play for any investor looking to reduce their risk.

1 LPL (May 2023). Treasury Yields During Recessions