These are certainly interesting times for fixed income investors. A variety of dynamics have made the bond market a problematic environment to navigate. But in all that volatility, surging yields, and monetary policy uncertainty, there are pockets of real opportunity to add strong income to a portfolio.

One of those opportunities is mortgage-backed securities (MBS).

Bonds issued by government-sponsored entities Freddie Mac, Fannie Mae, and Ginnie Mae are now yielding some of the best returns in years. According to a new Manulife report, the dynamics in the MBS market support buying the bonds and adding them to a portfolio for meaningful returns.

Volatility & Underperformance

MBS are essentially pools of mortgages tied to homes or commercial properties. Banks and other lenders issue mortgages. The government trio of Freddie Mac, Fannie Mae, and Ginnie Mae buy these loans and then combine them into mortgage-backed securities, which are then sold to investors. These keep the flow of money going for the lenders via this process. The kicker is that these firms guarantee the timely payment of principal and interest on the loans.

As a result, agency mortgage-backed securities often feature very high credit ratings and tend to be very liquid. This fact often has them seen as a safe haven during periods of duress.

However, lately, MBS have underperformed and have featured plenty of volatility. Last year, the broader MBS segment fell by 10.8%. This year, they have fallen behind their safe haven rival Treasuries.

Three Big Factors

The reasons for the underperformance? Life insurer and asset manager Manulife has three.

The obvious one is rising rates. As a long-dated bond, MBS have suffered as the Fed has continued to raise benchmark rates. Bond prices have an inverse relationship with interest rates and mortgage-backed securities are no different.

But that only explains part of their underperformance recently. Other long-dated bonds such as municipal bonds and even Treasury bonds haven’t suffered as much this year. Manulife suggests that the Fed is playing another role here as well.

In addition to the Fed’s action on rates, the central bank has begun unwinding its huge balance sheet. During the throes of the Great Recession, the Fed bought billions of dollars’ worth of bonds. This created a price floor for bonds and rates. Well, now the Fed has begun selling bonds.

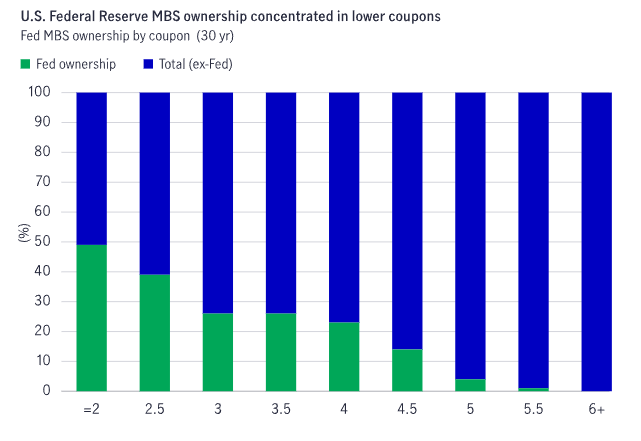

And MBS are on the top of its list. Part of the issue is that the Fed’s balance is full of low coupon MBS bonds. In fact, more than 71% of its MBS holdings are in coupons of 2.5% bonds or lower. This chart from Manulife highlights the lower coupon holdings from the Fed.

Source: Manulife

These bonds when sold by the Fed are already adjusted lower to match current higher coupon bonds on the market. This creates downward pressure on the MBS sector as a whole and explains why they have underperformed.

Finally, housing has hurt the MBS market. It’s no secret that home prices, selling activity, and the housing sector have suffered in recent weeks. Default risks have risen. And while agency MBS do have some guarantees, there is default risk with the bonds. With risks of foreclosure and default now rising coupled with declining home values in some key areas, mortgage-backed bonds have continued to be repriced with these additional risks.

All in all, the combination of the three factors have put pressure on the bonds.

Opportunity Awaits

But these downward pressures may reveal some interesting opportunities according to Manulife and investors may want to ignore the noise. Overall, MBS bonds may be a big buy.

For starters, spreads between agency MBS and other investment-grade bonds are at their widest points since the Great Recession. Looking at data back to 2000—which included two major housing crashes—Manulife found that corporate credit spreads have historically widened two to four times more than agency MBS spreads. However, in this cycle they have widened by more pronounced amounts. This could signal that the bonds are a historical value compared to previous cycles.

At the same time, MBS yields are high. These days, MBS as represented by Bloomberg MBS Index are offering a yield-to-maturity of over 5%. This puts it on par with investment-grade corporate bonds. However, the credit quality of MBS bonds is higher due to the government’s implicit guarantees of payment. So, investors get high 5%+ yields and lower credit risk.

Moreover, many of the risks to the housing market may be thawing. It seems that consumers have just accepted higher rates and housing activity may have bottomed. Moreover, those with mortgages already in place are staying put, removing repayment risk from the MBS sector.

Buying Some MBS Bonds

Given the yield and high credit quality of mortgage-backed securities, investors may want to add the sector to their portfolios. The key is to focus on agency bonds. Credit quality, and therefore risks, associated with non-agency debt are higher. Moreover, commercial MBS are a different animal completely and are analyzed through a different lens.

Buying the bonds remains the realm of funds. Individually, supplies of MBS tend to get snagged quickly via larger institutional investors, pension funds, and endowments. So it’s easier for you and I to buy them via a fund.

Active management may be advantageous as managers can analyze the credit quality and underlying property fundamentals of the bonds and truancies in each bond to determine value and payment risks.

Mortgage-backed Securities (MBS) ETFs

These funds are selected based on their ability to tap into MBS at a low cost. They are sorted by their YTD total return, which ranges from 3.2% to 5.4%. Their expense ratio ranges from 0.04% to 0.66%, and yield between 3.23% and 4.3%. Their AUM is between $290M and $26B.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| LMBS | First Trust Low Duration Opportunities ETF | $4B | 5.4% | 3.82% | 0.66% | ETF | Yes |

| JMBS | Janus Henderson Mortgage-Backed Securities ETF | $1.9B | 4.6% | 4.31% | 0.28% | ETF | Yes |

| GNMA | iShares GNMA Bond ETF | $290M | 4.5% | 3.39% | 0.11% | ETF | No |

| MBB | iShares MBS ETF | $25.9B | 4% | 3.38% | 0.05% | ETF | No |

| VMBS | Vanguard Mortgage-Backed Securities ETF | $17.4B | 3.5% | 3.25% | 0.04% | ETF | No |

| SPMB | SPDR Portfolio Mortgage Backed Bond ETF | $4.3B | 3.2% | 3.23% | 0.05% | ETF | No |

The Bottom Line

Despite their high credit quality, mortgage-backed securities haven’t kept up with other investment-grade bonds this year. The combination of higher rates, housing woes, and the Fed’s balance sheet reduction has hit the bonds. But according to Manulife, that could signal a big buying opportunity for investors.

1 Manulife (September 2023). New opportunities in today’s volatile agency mortgage-backed securities market