For many investors, bonds and fixed income assets are all about safety. Thanks to their steady coupon payments and placement in the bankruptcy ladder, bonds often form the backbone of a portfolio. Stability and lower volatility is the name of the game. As such, investment-grade corporates and U.S.-backed Treasuries are the go-to allocations.

But investors may be ignoring one of the best opportunities in the sector.

While they are riskier, high-yield or junk bonds could be a top way for investors to win over the long haul. As they offer benefits that go beyond regular investment-grade bonds, adding them to a portfolio makes sense. Every investor should have some strategic exposure to junk.

High Yield Defined

Just like you and I, bonds also have a credit rating. For most investors, the focus tends to be on so-called investment-grade sectors of the market. These are bonds backed by strong underlying fundamentals or the infinite taxing authority of a state/federal authority. Here, corporate, municipal, and Treasury bonds are the preferred fixed income vehicle for many investors and these bonds make up the so-called core category of bond funds.

By definition, high-yield bonds are issued by firms with less than investment-grade credit ratings. Typically, junk bonds are rated BB or lower by Standard & Poor’s and Ba or lower by Moody’s. While the ratings feature some gray areas, the gist is there is some risk of default or issues could prevent payback of the bonds. Because of this default risk, investors demand more compensation for lending money to these firms. That compensation comes in the form of yields in excess of investment-grade corporates and Treasury securities. These days, junk is paying close to 8.5% on average.

Overall, bond investors tend to be more conservative than those who dabble in the equity markets. The added risk and perceived volatility makes high-yield a no go for many portfolios.

Rethinking That Stance Today

However, investors may want to rethink that stance. That’s the gist of a new white paper from insurance giant New York Life. It turns out the current environment makes junk bonds a top allocation tool to lower volatility and increase returns over the long haul.

We all know the Fed has been on its path to increase rates, reduce inflation, and cool the economy. Like much of the bond sector, junk performed poorly last year, with the benchmark ICE BofA U.S. High Yield Index tanking about 12%. However, that has pushed junk yields up from about 4.5% to well over 8%. That’s about 1.5% higher than their 20-year average.

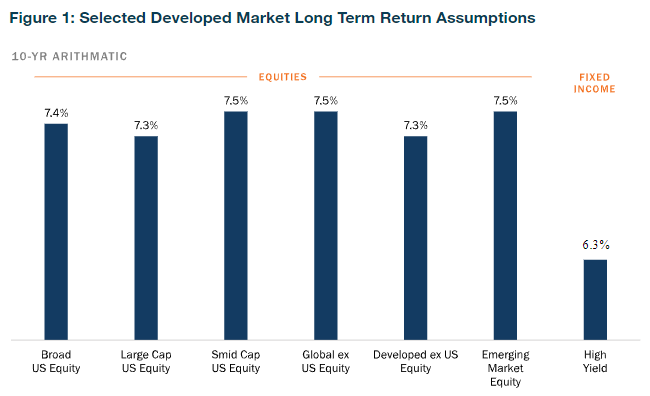

According to New York Life, the higher yields on junk bonds has pushed up long-term return expectations to historic 10-year norms. The low rates and lust for yield in the post-Great Recession period was an anomaly in which junk investors weren’t necessarily compensated for their risk. Today, high-yield bonds offer a 10-year expected annualized return of over 6%. 1

This chart from New York Life illustrates the competitive return of junk versus various equity groups.

Source: SNew York Life

The kicker is junk bonds may offer much less risk and volatility than equities.

The higher yields now provide enough of a cushion, with much bad news baked in. The real win for junk comes down to its make-up. These days, junk is overall less junky. At the end of 2022, the previously mentioned ICE BofA U.S. High Yield Index consisted of 50% BB-rated bonds. The top group of junk only made up 43% of the index in 2011. Moreover, CCC-rated bonds—which are the lowest rating—have decreased to just 12% of the index in 2022. Overall, the better credit make-up of the bonds should help lower the overall volatility of junk as well.

Adding further fuel to the lower volatility fire is that New York Life suggests that around 69% of the U.S. high-yield market has a publicly traded equity component. This helps reduce volatility as public stocks must provide financial information, allowing for fewer ‘surprises.’

Getting Strategic With Junk Bonds

With the yield reset, high-yield debt is once again allowed to function as a pre-Great Recession stock-like/bond-like allocation tool. Investors of all stripes can now benefit from higher total returns with low volatility than many other asset classes. According to New York Life, investors should make it a point to strategically add junk to their portfolios as more than just a satellite allocation, including those who tend to lean on the conservative side.

The best part is that junk is pretty easy to add to a portfolio. The $15 billion iShares iBoxx $ High Yield Corporate Bond ETF and $8.1 billion SPDR Bloomberg High Yield Bond ETF are two of the largest ETFs in the sector and provide quick and easy exposure to the theme at a low cost. However, there are plenty of other passive/index vehicles in the space.

High-Yield Index Bond ETFs

| Ticker | Name | AUM | YTD Total Ret (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|

| FALN | iShares Fallen Angels USD Bond ETF | $1.395B | 4.4% | 0.25% | ETF | No |

| JNK | SPDR Bloomberg High Yield Bond ETF | $8.508B | 4.3% | 0.40% | ETF | No |

| HYG | iShares iBoxx $ High Yield Corporate Bond ETF | $15.176B | 3.7% | 0.49% | ETF | No |

| XBB | BondBloxx BB Rated USD High Yield Corp Bd ETF | $51M | 2.9% | 0.2% | ETF | No |

| HYBB | iShares BB Rated Corporate Bond ETF | $251.4M | 2.7% | 0.25% | ETF | No |

New York Life suggests investors may want to turn their attention toward active management in the space. Junk is a great area where active managers can potentially add additional alpha, reduce risks further, and lower volatility. Credit research can give them an edge. New York Life runs the top-ranked MainStay MacKay High Yield Corporate Bond Fund.

Active High-Yield Bond ETFs & Funds

| Ticker | Name | AUM | YTD Total Ret (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|

| FLHY | Franklin High Yield Corporate ETF | $222.1M | 5.6% | 0.4% | ETF | Yes |

| YLD | Principal Active High Yield ETF | $107.7M | 5.2% | 0.41% | ETF | Yes |

| MHYIX | MainStay MacKay High Yield Corporate Bond Fund Class I | $3.154B | 4.3% | 0.7% | MF | Yes |

| PHYL | PGIM Active High Yield Bond ETF | $93.3M | 4.3% | 0.53% | ETF | Yes |

| VWEHX | Vanguard High-Yield Corporate Fund Investor Shares | $2.93B | 3.3% | 0.23% | MF | Yes |

An interesting strategy could be to pair a broad index ETF alongside an active fund or two. This way, investors can derive potential outperformance and still get the benefits of high-yield bonds at a low cost. No matter what, junk should be a strategic decision for your portfolio.

The Bottom Line

Investors have often ignored junk bonds in favor of ‘less risky’ Treasuries and corporates. However, the great bond reset has once again made high-yield a great total return play. According to New York Life, investors should consider junk as a strategic play in allocation decisions. Overall, lower volatility and stronger returns await.

1 New York Life (June 2023). The Case For a Strategic Allocation to High Yield