It’s been an interesting decade for bond investors to say the least. After the global financial crisis, a variety of actors kept yields low, boosting bond prices and setting off a 10-year bull market in fixed income. And now inflation has reversed course, sending bonds lower and resulting in one of the worst annual declines for fixed income of all time.

But investors may want to take the current declines in stride.

According to asset manager Franklin Templeton’s Brandywine Global subsidiary, the backdrop for bonds has only gotten better. The recent declines along with several other factors have the potential to ignite strong returns for the fixed income sector. And in that, bonds are a big time buy heading into the new year.

A Reversal of Trends

A decade is a lifetime when it comes to the markets. So it’s hard to remember just how bad the Great Financial Crisis was for the economy, investors, and consumers. To help spur the economy forward and right the ship, the Federal Reserve did the unthinkable and cut rates to zero.

The issue was that the economy never really got cooking. It grew slow and steady. And as such, inflation wasn’t an issue. In fact, we had periods of deflation during the last decade. With no inflation, the Federal Reserve felt it necessary to keep rates at zero for the decade. For investors seeking income, that meant buying bonds at whatever yields they were paying. This set off a bull market in bonds driven by these falling yields.

Then the COVID-19 pandemic happened.

This unprecedented event saw plenty of stimulus, fiscal expansion, and moves to shore up supply chains, consumers, and the healthcare sector. The end result of all the stimulus was that inflation quickly surged to levels not seen since the 1980s.

This brings us to today, where the Federal Reserve has started to raise rates and bring inflation down. According to Brandywine Global, we may be at a convergence point where we shift once again. For investors, this points to a unique place to score high yields plus capital appreciation.

A New Equilibrium

According to Brandywine, the Fed may quickly approach (or has approached with its two recent pauses) a so-called equilibrium for interest rates. Dubbed R*, this represents the neutral rate at which the economy is growing, yet is near the tipping toward recession. Hitting R* isn’t necessarily tricky. But keeping at such a rate is a very difficult thing to do. In fact, it’s pretty much impossible and that’s why most recessions are Fed policy-induced. Often, we don’t see R* until after the recession has started.

But it may be possible to predict if we are either close or there by using some historical framework to consider. According to Brandywine, three factors may point to the fact the current Fed’s fund rate of 5.5% may be it. 1

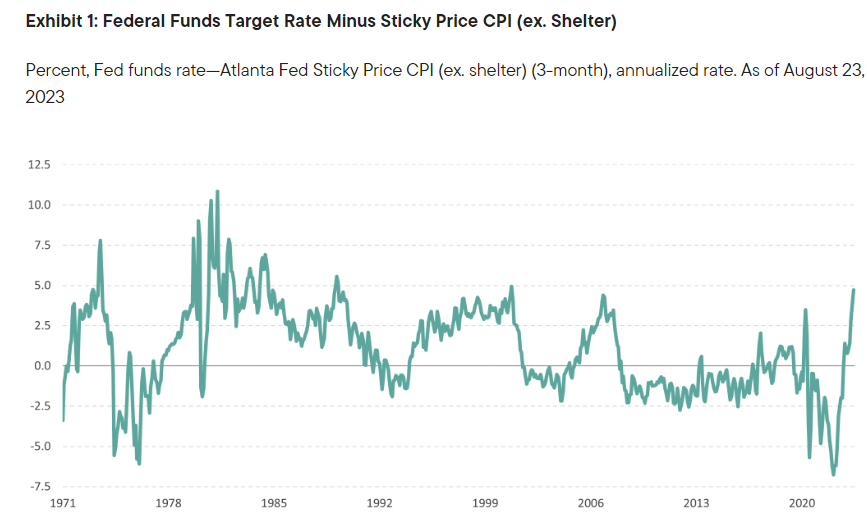

For starters, monetary policy is already very stringent and rates are high. Looking at the Fed funds target rate minus the Federal Reserve Bank of Atlanta’s calculation for the ‘stickiest’ part of the Consumer Price Index (CPI) basket, you get a picture that the Fed has already raised rates very high. Looking at this chart, you can see that short-term real interest rates are at levels near previous tops over the past 50 years. You have to go back to the 1980s to find similar highs. Moreover, the highs on the chart line up with previous recessions.

Source: Brandywine

Second, Brandywine surmises that U.S. fiscal policy is why the economy is going so well. Thanks to all the stimulus, major government spending such as the CHIPS Act and Inflation Reduction Act, and high cash balances created during the pandemic, the economy has continued to float. However, government spending is starting to drop while consumers appear to be finally tapped out and have spent much of their stimulus cash. This points to recessionary risks in the new year.

Finally, a historic lag time of both fiscal and monetary policy puts us right about the start of hitting R*. According to the asset manager, the “effects of tight monetary policy kick in just as the effects of fiscal stimulus start to fade.” Historically that’s about 18 to 30 months after the start of stringent monetary policy, which is right where we are today.

We have two major shifts now hitting at the same time.

A Great Backdrop for Fixed Income Investors

This is wonderful news for those looking toward bonds. Right now, yields are still high. This allows investors to lock in income. Even if the Fed keeps rates steady for a while, as evident by its pauses, portfolios can coupon clip a high yield. Meanwhile, it looks like the potential for rising bond prices is growing. The Fed may have to switch gears soon enough. That will drive bond prices higher and yields lower as investors rush into higher-yielding bonds. This could set off the next bull market in bonds. According to Brandywine, the time to buy bonds is now.

To make the relationship and potential work, investors need to move out on the duration ladder. But that doesn’t necessarily mean buying the Bloomberg US Aggregate Bond Index (Agg). The Treasury-heavy Agg eliminates many of the bond opportunities out there. To that end, investors may want to use so-called Core-plus strategies. These funds tweak the Agg’s allocation.

Core-Plus ETFs & Mutual Funds

These funds were selected based on their low costs and year-to-date total return, which range from 0.2% and 1.6%. They have expenses between 0.19% to 0.74%, and have AUM between $42M and $31B. They are currently yielding between 3.9% and 5.1%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| CGCP | Capital Group Core Plus Income ETF | $1.12B | 1.6% | 5.1% | 0.34% | ETF | Yes |

| JCPB | JPMorgan Core Plus Bond ETF | $1.86B | 0.8% | 4.38% | 0.40% | ETF | Yes |

| PAB | PGIM Active Aggregate Bond ETF | $42.3M | 0.7% | 3.9% | 0.19% | ETF | Yes |

| BOND | PIMCO Active Bond ETF | $3.55B | 0.50% | 4.23% | 0.58% | ETF | Yes |

| JFLEX | Janus Henderson Flexible Bond Fund - I | $2.6B | 0.50% | 4.34% | 0.53% | MF | Yes |

| DLTNX | DoubleLine Total Return Bond Fund - N | $30.9B | 0.2% | 4.25% | 0.74% | MF | Yes |

Investors may want to look at other opportunities outside the Agg individually as well. Mortgage-backed securities offer high yields and comparable credit quality to Treasuries, while municipal bonds feature higher after-tax yields. Likewise, quality corporate bonds are currently offering strong yields and strong credit quality. The key is to make sure investors limit their exposure to shorter durations and move out on the curve to play the better backdrop.

Ultimately, bonds haven’t been this good in decades. According to Brandywine, the current convergence of trends provides the opportunity to pick up the current yield today while preparing for the bond bull market tomorrow. And in that, investors should consider adding more bond exposure to their portfolios.

The Bottom Line

The backdrop for bonds has never been better. That’s the gist according to Brandywine Global’s latest missive. The Fed may finally be at the critical neutral rate and historically that’s a wonderful spot for bond investors to buy, collect a high yield, and potential capital appreciation.

1 Brandywine Global (August 2023). Assessing bond value in the new era