Balancing risk and return has long been the goal of any investor, especially on the fixed income side of the equation. Computing the answer may be a bit more difficult these days. With the Fed continuing to raise rates, recessionary woes growing, and uncertainty rising, choosing the right fixed income assets is becoming more difficult.

However, one bond type may be priced for perfection.

Short-term high-yield (or junk) bonds could be the answer. Offering high yield, duration protection, and the ability to perform well if the economy stays mixed, short-term junk may be the best bond asset class to get through the rest of the year and into the next.

An Uncertain Environment

There are a lot of questions on investors’ minds these days and uncertainty abounds. The Fed’s rate hikes have thrown plenty of shade onto the markets. Data remains mixed overall. For example, consumers are starting to spend slightly less. However, the labor markets remain very robust. Manufacturing has started to decline, but still shows signs of expansion in many areas. Mortgage rates have surged, but building permits and housing starts have begun to increase.

All of this has caused many investors to question the Fed. A quarter or two ago, it was easy to see the path of interest rates was higher. These days, it’s more difficult. Will the Fed pause or pivot given the mixed data or will it raise rates considering inflation is still above its targets?

All of this is making it very hard to be a fixed income investor.

Recessionary potential makes buying non-investment-grade bonds a risky proposition. Moving out on the duration ladder to get more yield could cause intermediate and long-term bonds to lose value as the Fed raises rates. Short-term bonds and cash feature reinvestment risk. Even safe Treasury bonds aren’t as great with the recent debt downgrade of the U.S.

All in all, fixed income investors are facing a quandary.

Short-Term Junk to the Rescue

But there may be one way investors can have their cake and eat it too. According to investment manager and fixed income specialist, Lord Abbett, buying short-term high-yield bonds could be the answer.

As the name implies, short-term high-yield (or junk) bonds are bonds that feature less than investment-grade credit ratings, rated BB or lower by Standard & Poor’s and Ba or lower by Moody’s. Like regular junk bonds, short-term bonds pay higher coupons given the potential default risks of the issuing firms.

The short-term nature refers to how these bonds feature close maturity dates, usually less than two years away. They can either be bonds issued with short lengths or be longer-term bonds with only a few years or months left before they mature.

It turns out the combination of high yields and short durations makes these bonds a powerful tool for the current market.

For starters, these bonds feature less risk than longer-dated high-yield bonds. After all, the odds of a firm defaulting over the next year or so is much less than one defaulting over the next five or ten years. Data from Lord Abbett shows that default rates for BB- and B-rated junk is just 0.29% and 1.14%, respectively, over a one-year period. This is versus 3.71% and 13.47% over five years. At the same time, current leverage and coverage ratios for all junk debt are at some of the healthiest points in history. The last decade of strong economic returns have helped keep corporate balance sheets flush with cash. 1

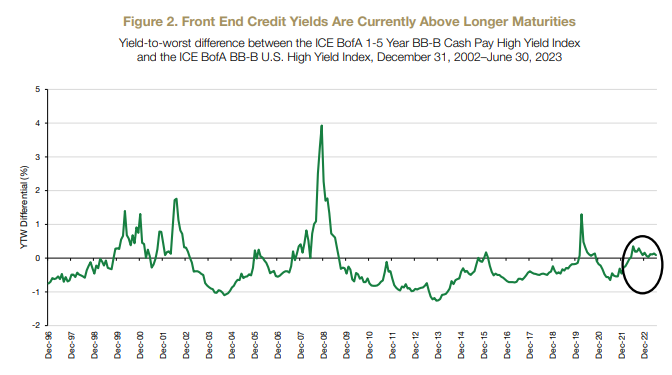

Second, short-term high-yield junk is currently yielding more than the average of the junk bond market when it comes to yield-to-worst. This chart shows that the spread between the front/short end of the curve and overall yield-to-worst is positive (i.e., paying more). This usually doesn’t happen and represents a unique opportunity.

Source: Lord Abbett

Right now, investors are getting a lot of yield with less risk. This helps cover some of the uncertainty of recessionary risk.

Short-term junk works for other scenarios as well. If the Fed pivots or pauses, this tends to boost junk bond prices as a strong economy and lower rates boost the earnings/cash flow potential of the firms issuing bonds. Meanwhile, firms that have issued short-term junk will be able to roll-over that debt at lower coupon rates, boosting cash flows further.

All in all, the shorter end of the junk bond market could be the sweet spot for investors looking to play the next few quarters as the continued mixed environment takes hold. Portfolios are able to get a high yield, limited duration risk, and still benefit from any positives.

Going Short With Your High-Yield Allocation

Given the potential for short-term high-yield bonds to win no matter what the near-term future may hold, investors may want to consider adding them to a portfolio. The best part is there are numerous ways to do just that.

The two biggest passive ways include the SPDR Bloomberg Short Term High Yield Bond ETF and iShares 0-5 Year High Yield Corporate Bond ETF. Both focus on the shorter end of the curve, with both ETFs holding bonds up to five years till maturity. However, both have durations closer to 2.3 years. They could be quickly added to boost exposure to the asset class.

Another compelling choice is to go active. The junk sector is one area where active management can make a difference when it comes to returns. This is true on the shorter end of the curve as well and there are numerous top funds catering to this area. Lord Abbett’s own Short Duration High Yield Fund is a prime four-star rated example that’s yielding nearly 8%. Another top high-yielding choice could be the PGIM Short Duration High Yield Income Fund.

Short-Term High-Yield Bond ETFs & Mutual Funds

| Ticker | Name | AUM | YTD Total Ret (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|

| HYS | PIMCO 0-5 Year High Yield Corporate Bond Index ETF | $1.12B | 7.31% | 0.55% | ETF | No |

| LSYAX | Lord Abbett Short Duration High Yield Fund Class A | $1.19B | 6.69% | 2% | MF | Yes |

| SJNK | SPDR Bloomberg Short Term High Yield Bond ETF | $3.91B | 6.52% | 0.40% | ETF | No |

| HYSAX | PGIM Short Duration High Yield Income Fund- Class A | $4.65B | 6.16% | 1.04% | MF | Yes |

| MDHAX | MainStay MacKay Short Duration High Yield Fund Class A | $1.8B | 5.62% | 1.01% | MF | Yes |

| SHYG | iShares 0-5 Year High Yield Corporate Bond ETF | $5.52B | 5.55% | 0.3% | ETF | No |

One key thing to remember is short-term high-yield corporate bonds are not the same as senior loan funds—which are also short-term non-investment-grade debt—nor are they the same as short-term high-yield municipal bonds. While there are pros to both of these asset classes, they don’t function the same as what we are looking at and can’t be a one-for-one swap.

The Bottom Line

Right now, fixed income investing is a difficult proposition. Uncertainty abounds and a lot of different scenarios could happen, rendering many fixed income asset classes moot. However, short-term high-yield debt could be the answer to investors’ woes. Featuring high yields, low duration risk, and the potential to outperform if either recession or expansion happens, investors should consider the bond asset class.

1 Lord Abbett (July 2023). An Update on Short-Term High Yield Bonds