Wall Street doesn’t like uncertainty, particularly when it doesn’t match its expectations. And right now, everyone is expecting that the Federal Reserve will cut rates sooner than later. After ratcheting up benchmark rates to levels not seen in decades, the Fed has paused amid dwindling economic data. Naturally, the Fed will have to begin cutting rates, right?

Not so fast. Stubbornly high inflation is throwing a wrench into the machine.

But that doesn’t mean that fixed income investors need to fret – it may be just the opposite. A higher-for-longer message is possibly the best outcome for bondholders in a long time. With that, bonds are still a big-time buy.

The Path Higher & Its Pause

The post-pandemic world was one of pent-up demand and low supply. This fact plus all the excess stimulus cash filling consumers and businesses coffers caused inflation to surge. The CPI eventually hit levels not seen since the 1980s, peaking during the summer of 2022 at just over 9%.

To counteract the surge in inflation, the Federal Reserve reacted swiftly and raised rates. Between 2022 to 2023, the central bank increased interest rates eleven times, including four 0.75 basis-point hikes. This brought the benchmark rate from effectively zero to 5.5%.

With higher rates, borrowing costs skyrocketed, and the Fed has now begun to cool the economy. A variety of economic metrics have started to dip. Meanwhile, bond prices – with their inverse relationship to yield – also sank.

For Wall Street, the stagnating economy meant one thing: the Fed would have to begin cutting rates to slow economic growth. Even the Fed itself said it was planning on cutting rates. However, there has been a slight problem in this equation – inflation hasn’t continued to drop. Conversely, it started to rise and has continued to stay high.

To that end, the central bank hasn’t begun to cut rates and has, instead, indicated that it may keep rates at the 5.5% mark for much longer than many investors expect. This has sent a variety of investors to the exits.

Bond Investors Blossom

However, bond investors may want to run towards these higher rates. The higher-for-longer message may be setting up fixed income assets for some of their best returns in years, according to the latest from Hartford Funds.

The prolonged interest rate environment is wonderful for bonds and their investors. This is especially true for those looking at investment-grade bonds: Treasuries, corporate and municipal fixed income assets.

For starters, higher for longer equals more income for fixed income holders, including both existing bonds and new bonds coming to market. Yields have continued to rise in the wake of the Fed’s tightening and, now, income investors have some very juicy income opportunities.

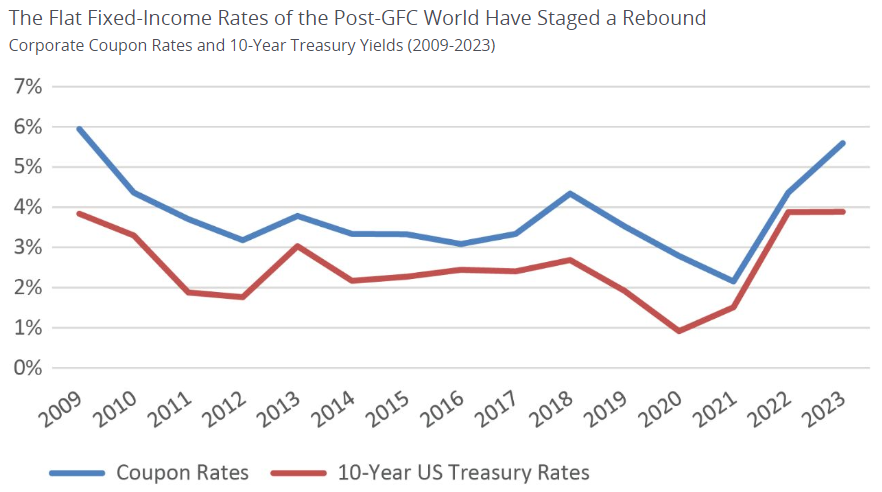

According to Hartford, the last decade has been pretty disappointing when it comes to yield. Investment-grade corporate bonds were yielding almost 6% in 2009, only to drop to just 2.15% in 2021. The 10-year Treasury bond featured a similar pattern, dropping from ~ 4.5% to ~ 2.25% in that time. This chart from the investment manager shows the decline.

Source: Hartford Funds

At the same time, Hartford suggests that there is a lot of older corporate debt that will need to be rolled over. With the higher-for-longer rate environment, firms will be forced to do so at the current high coupon rates. This will bring more income opportunities to bond investors.

Hartford further suggests that capital gains could finally be back in the bond world. Thanks to their inverse relationship, bonds already on the market are likely to fall in price to match the yield of new bonds being issued. In 2022, the Bloomberg US Aggregate Bond Index lost 13%. Digging into the Bloomberg US Corporate Index, Hartford shows that more than 5,300 bonds issued between 2010 and 2021 are now trading at an average price of 89 cents on the dollar, providing plenty of upside when the Fed finally starts cutting interest rates. Moreover, thanks to accretion, that process begins to take place as time goes by and the expectation of a cut grows, which is sort of what is going on today. 1

‘Higher for longer’ may also benefit bond investors in another way: lower volatility. This has to do with shorter durations. Duration – or the sensitivity of a bond price with regard to interest rates – includes coupon payments in its calculation. The higher a bond’s coupon, the shorter its duration. This is because investors receive more of the bond’s total return in the form of interest payments before final maturity.

With this, bonds with higher coupons have less interest rate risk and overall volatility as the Fed has moved and the prices have fallen. The new issues coming to market naturally have a lower duration due to their already-higher coupon rates.

While higher yields and coupons can signal increased credit risk, because borrowing costs are higher, there is a sweet spot where investment-grade bonds have a perfect blend of low volatility and high coupon rates. According to both Hartford and historic data, we’re in that sweet spot right now.

Playing Higher for Longer as a Bond Boon

The question for many investors is, “how long is too long?”. According to historical data, it’s a lot longer than many of us remember. Prior to the Great Recession and 2008, interest rates were consistently north of 4% and inflation was higher than 3%. In that time, the economy grew by an average of 3.01% per year.

So, ‘higher for longer’ may actually signal a return to normal. For fixed income seekers, we could be looking at some very good times ahead. The combination of high-income potential, low volatility and even some capital gains could be a huge win for portfolios. This means buying bonds is a key portfolio play.

According to Hartford Funds, this all works when focusing on investment-grade bonds.

Investment-Grade Bond ETFs

These funds were selected based on their exposure to investment-grade bonds at a low cost and are sorted by their one-year total return, which ranges from -1% to 6.9%. They have expenses of 0.03% to 0.25% and yields from 2.9% to 5.2%. They have assets under management between $880M and $59B.

| Ticker | Name | AUM | 1-year Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| NEAR | BlackRock Short Duration Bond ETF | $3.18B | 6.9% | 4.7% | 0.25% | ETF | Yes |

| SPBO | SPDR Portfolio Corporate Bond ETF | $886M | 3.5% | 5.2% | 0.03% | ETF | No |

| SPTS | SPDR Portfolio Short Term Treasury ETF | $5.82B | 3.0% | 4.1% | 0.03% | ETF | No |

| BSV | Vanguard Short-Term Bond ETF | $58.8B | 2.8% | 3.0% | 0.04% | ETF | No |

| LQD | iShares iBoxx $ Investment Grade Corporate Bond ETF | $27.9B | 2.2% | 4.4% | 0.14% | ETF | No |

| VTEB | Vanguard Tax-Exempt Bond ETF | $29.3B | 1.6% | 3.1% | 0.05% | ETF | No |

| VCLT | Vanguard Long-Term Corporate Bond ETF | $6.44B | 1.0% | 4.5% | 0.04% | ETF | No |

| GOVT | iShares U.S. Treasury Bond ETF | $23.2B | -1.0% | 2.9% | 0.05% | ETF | No |

All in all, many investors have been jeering the longer-for-higher rate environment, but bond investors should be cheering for it. The combination of benefits, including high yields, lower volatility and the potential for capital gain, should make bonds a top draw for portfolio assets. Focusing on investment-grade bonds are the key to making it all work.

The Bottom Line

The higher-for-longer rate environment has been met with scorn by many investors. However, fixed income investors may want to rejoice. It turns out that bonds are perfectly suited to profit in this environment. Buying bonds makes a ton of sense for portfolios.

1 Hartford Funds (January 2024). Three Reasons Why “Higher for Longer” May Benefit Bond Investors