Preferred stock is an interesting option for income investors. On one hand, you can earn attractive yields at lower tax rates than conventional bonds. But, on the other hand, some preferred stock is callable and you rarely see any equity growth. That said, it could be an attractive option depending on market conditions and your requirements.

In this article, we’ll look at the case for preferred stock, how they’ve performed in recent years, and whether you should consider the asset class for your portfolio in 2024 and beyond.

Why Invest in Preferred Stock?

Most income investors turn toward dividend stocks or bonds when seeking a steady source of income for retirement. But preferred stock often flies under the radar. That’s unfortunate because they offer attractive yields, good credit quality, and liquidity that you can’t find in many comparable bonds.

Preferred stock also typically comes with a very modest face value (e.g., $25), making it more accessible to retail investors than individual bonds. So, while you can purchase preferred stock ETFs or mutual funds, you have the option to purchase individual securities at a reasonable price.

And finally, the stable face value of preferred stock creates a bond-like fixed payment rather than a variable dividend. But, unlike conventional bond payments, preferred stocks usually pay qualified dividends that fall under a lower tax rate than ordinary income.

Preferred Stock's Track Record

Most preferred stock issuers are banks and credit unions. So, not surprisingly, the regional banking crisis—spurred by Silicon Valley Bank—created some turmoil in 2022 and 2023. In fact, the declines in mid-2023 were some of the sharpest since the 2008 financial crisis.

But these low prices created a unique dynamic during the bond market’s selloff earlier this year. Namely, the iShares Preferred & Income Securities ETF (PFF) is up 0.66% since January compared to a 9.45% drop in the iShares 20+ Year Treasury Bond ETF (TLT)—quite a strong outperformance!

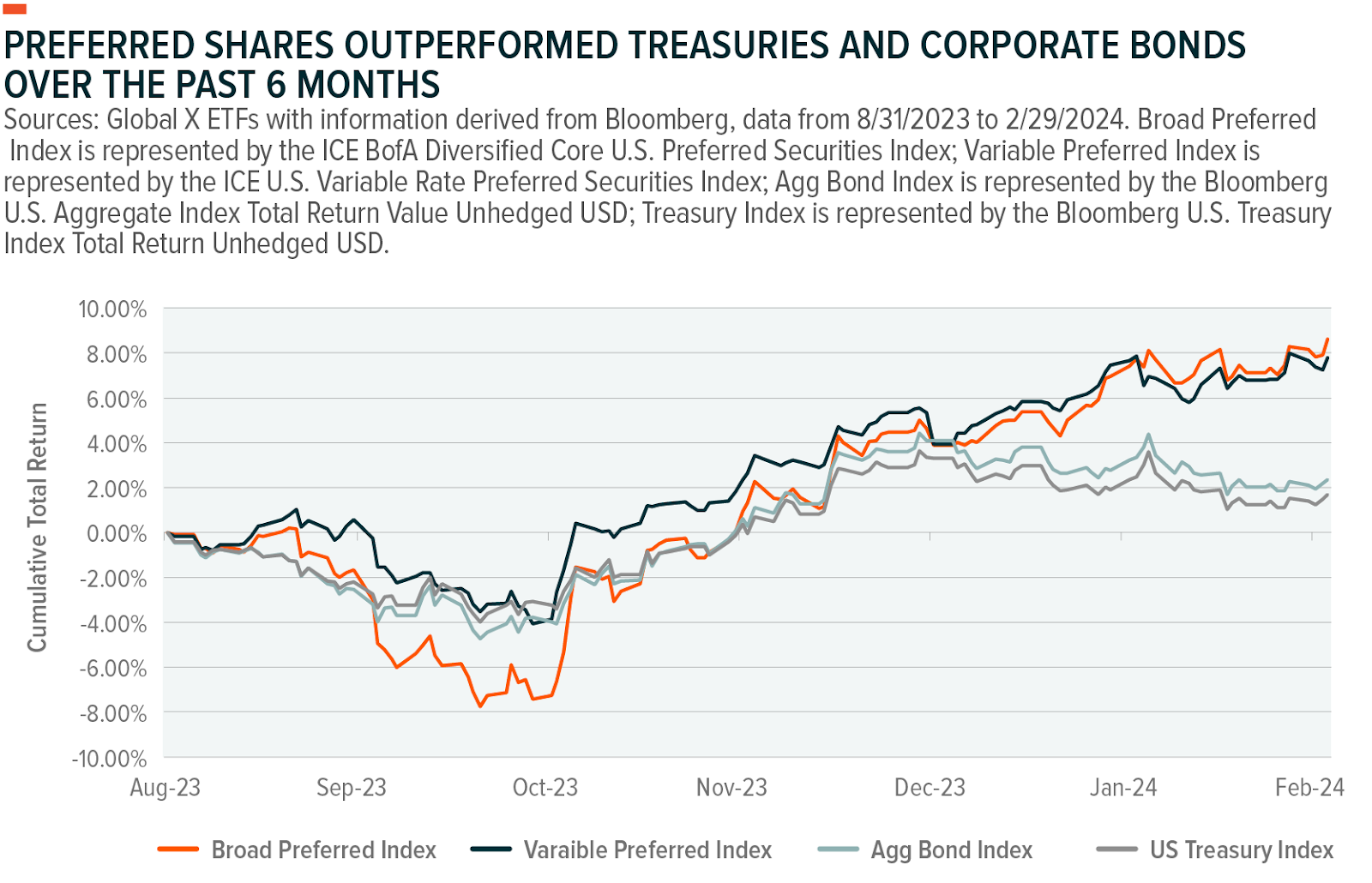

Preferred stocks outperform Treasuries and corporate bonds in 2024. Source: GlobalX

While higher interest rates led to a predictable drop in bond prices, already-depressed preferred stock prices helped buffer the impact. Meanwhile, a surge of redemptions put upward pressure on prices, as issuers redeemed $11 billion in preferred stock with only $9.5 billion in new issues.

What’s the Outlook for 2024 and Beyond?

The recent preferred stock rally makes them less attractive than they were earlier this year, which means you might have to shop around for a good deal. For example, JPMorgan’s Series MM (JPM.RPM) trades at $19.32 with a 5.44% yield—just 0.71% above 30-year Treasury yields. That compares to a historical one to two percent premium, suggesting the stock is trading at a premium.

That said, there’s still a lot to like about preferred stock. As with bonds, the strong economy is conducive to credit and high yields create an opportunity for price appreciation. But unlike bonds, the ICE BofA Fixed Diversified Core U.S. Preferred Securities Index is still yielding more than six percent—yields comparable to high-yield bonds without as much credit risk.

Preferred Stock ETFs

These ETFs are sorted by their total return, which ranges from 0.7% to 2.7%. They have AUM between $1.5B and $14.5B and expenses between 0.23% and 0.84%. They are currently yielding between 5.77% and 6.5%.

| Name | Ticker | Type | Actively Managed? | AUM | YTD Total Ret (%) | Yield | Expense |

|---|---|---|---|---|---|---|---|

| First Trust Preferred Securities and Income ETF | FPE | ETF | Yes | $5.31B | 2.7% | 5.77% | 0.84% |

| iShares Preferred and Income Securities ETF | PFF | ETF | No | $14.5B | 2.1% | 6.5% | 0.46% |

| Global X U.S. Preferred ETF | PFFD | ETF | No | $2.4B | 1.5% | 6.5% | 0.23% |

| Invesco Preferred ETF | PGX | ETF | No | $4.51B | 1.1% | 6.13% | 0.50% |

| VanEck Preferred Securities ex Financials ETF | PFXF | ETF | No | $1.52B | 0.7% | 6% | 0.41% |

If you’re not comfortable buying individual preferred stocks, several ETFs provide exposure. These funds offer a choice between fixed and floating rate preferred stock, providing flexibility when predicting future interest rate cuts. When choosing between these options, you should also consider the portfolio diversification (e.g., PFXF’s exclusion of financial stocks), yield, and expense ratio.

The Bottom Line

Preferred stock had a breakout year in 2024 following a rough 2022 and 2023. While many preferred stocks trade at a premium, investors may still want to consider the asset class for its high yields and tax-advantaged dividend distributions. But ultimately, they may work best as part of a diversified income-focused portfolio, helping boost yields and diversify interest rate exposure.