Cash has quickly become the asset class du jour for investors over the last year or so. With the Fed raising rates, liquid assets such as T-bills and money market funds are paying yields not seen in about a decade. But investors in cash may be doing themselves a real disservice. As the Fed cuts, investors in cash will be stuck between a rock and a hard place.

Cash really isn’t as safe as investors think.

But there may be a solution to have safety of principal while still getting high yields. Short-term bonds are now offering some compelling yields and opportunity for investors to lock in high yields while still maintaining liquidity, and at the same time remove dreaded reinvestment risk.

Cash & Reinvestment Risk

It’s easy to see why investors have stocked over $5.5 trillion in money market funds over the last year, boosting cash balances to record amounts. With the Federal Reserve tightening, cash can now be considered a real asset class. T-bills, money market funds, and even traditional passbook savings accounts are paying 4% to 5% on average.

The problem isn’t today, but what comes next. And having a huge amount of cash exposes investors to something called reinvestment risk.

Reinvestment risk is basically the idea that investors will not be able to reinvest cash flows, coupon payments, or principal at a comparable rate to their current rate of return. This is a huge problem during a falling rate environment.

The issue is that cash quickly adjusts to the Fed’s interest rate changes. At the same time, longer-dated bonds react by seeing their prices rise. For investors in very liquid securities like T-bills or cash, they’ll simply miss the yield opportunities in longer-dated bonds when the Fed cuts.

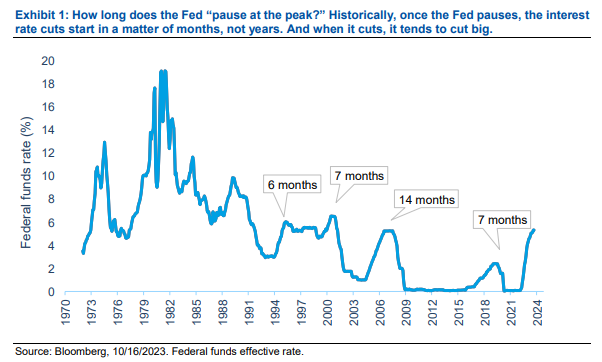

The problem is once the Fed starts pausing, like today, there historically isn’t much time before reinvestment risk becomes a reality. According to investment manager Amundi, in every rate tightening cycle since the 1970s, once the Fed pauses, it’s only a matter of months before it starts cutting. This chart shows the length of recent cycles and their cuts. 1

Source: Amundi

Already, the Fed has paused for several months now.

For investors in cash, this is a problem. The brick wall is fast approaching. And while the 5%+ is good today, investors risk getting a lower return in the medium term as they miss the boat and lock-in yield.

Short-Term Bonds Look Good

The answer may lie in going out just a bit farther out on the curve. Short-term bonds are those that mature within 1 to 3.5 years. These bonds feature a wide variety of credit quality and issuers. Because these bonds mature fast, credit risk and interest rate risk are usually low. Because of their short timelines, new short duration bonds are able to ‘roll over’ faster to reflect changes in interest rates, so they don’t drop as much as bonds with 30 years left to go.

Moreover, because of their short maturity profiles, they are fairly liquid and price stable when the Fed cuts rates. This allows them to function like cash or cash-like holdings.

The best part is that short-term bonds are paying nearly the same as or more than many cash-like equivalents. Yields on short-term bonds have risen from just 0.22% back at the start of 2021 to over 5.35% today. This is the highest yield for these bonds in nearly 17 years. That’s a huge yield advantage and in many cases beats CDs, and is near the yield on T-bills.

However, investors are able to lock in that yield for two years or so. That’s powerful protection when the Fed cuts and the yield on cash drops very quickly.

Get Out of Cash

For investors looking to score good yields with a dose of safety, reduced interest rate risk, as well as removing reinvestment risk from the table, short duration bonds make a ton of sense for their portfolios. It’s particularly advantageous for those investors with larger cash balances or those with conservative tilts such as retirees or those near retirement. Buying them is pretty easy too. There are numerous ETFs that track the segment and investors can find short duration bonds across many different credit qualities and sectors. For example, investment-grade, tax-free municipal debt, and even junk bonds.

Short-Term Bond ETFs

These ETFs are selected based on their ability to tap into short-term duration bonds at a low cost. They are sorted by their one-year total return, which ranges from 1.6% to 4.8%. Their expense ratio ranges from 0.03% to 0.56%, while they yield between 1.9% and 5.1%. They have AUM between $730M and $58B.

| Ticker | Name | AUM | 1-year Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| DFSD | Dimensional Short-Duration Fixed Income ETF | $1.55B | 4.8% | 3.9% | 0.18% | ETF | Yes |

| FSIG | First Trust Limited Duration Investment Grade Corporate ETF | $731M | 4.8% | 4.6% | 0.56% | ETF | Yes |

| LDUR | PIMCO Enhanced Low Duration Active ETF | $989M | 4.5% | 4.7% | 0.51% | ETF | Yes |

| SPSB | SPDR Portfolio Short Term Corporate Bond ETF | $7.3B | 4.6% | 5.1% | 0.04% | ETF | No |

| SCHO | Schwab Short-Term U.S. Treasury ETF | $12.4B | 3.5% | 3.9% | 0.03% | ETF | No |

| SHY | iShares 1-3 Year Treasury Bond ETF | $26B | 3.4% | 3.8% | 0.15% | ETF | No |

| BSV | Vanguard Short-Term Bond ETF | $58B | 3.3% | 3% | 0.04% | ETF | No |

| SUB | iShares Short-Term National Muni Bond ETF | $8.8B | 1.6% | 1.9% | 0.07% | ETF | No |

In the end, investors need to step out of cash to lock in good yields. Short-term bonds offer a great solution to scoring high yields and removing reinvestment risk for a fixed income portfolio.

The Bottom Line

Investors are sitting on a huge amount of cash. That’s a problem when it comes to reinvestment risk amid the Fed’s potential rate cuts. For investors, the solution may lie within going short. Short duration bonds offer all the benefits without many of the hassles.

1 Amundi (November 2023). The Reinvestment Risk of Cash