For fixed income investors, the last year or so has certainly been a challenge. With the sudden and fast pace of the Fed’s rate hikes, the entire landscape for bonds and other income assets has changed. That includes leverage and senior loans.

At first, the fixed income security type was seen as a way for investors to play the rise in rates. But then in time, investors pulled back as the fear of defaults and recession increased.

For investors today, the current yields, Fed pause potential, and strengthening economy could provide a wonderful chance to add leverage and senior loans to a portfolio. Ultimately, default risk has decreased and that makes the high-yielding securities advantageous.

Strong Performance, Then Declines

Senior and leveraged loans are a unique asset class in the world of fixed income. Thanks to the birth and growth of private credit, these assets have exploded in issuance since the Great Recession. The asset type is a bit weird, offering elements of junk bonds, Treasury inflation- protected securities (TIPS), and asset-backed securities in one bond type.

Typically, senior loans are made to those firms with credit ratings below investment-grade. This provides them with high initial starting yields. The kicker is they are typically tied to physical assets such as a pipeline, factory equipment, accounts receivable or even intellectual property. That provides a bit of safety to the bonds during bankruptcy proceedings. The ‘senior’ in senior loans means loan-holders are paid first if a company defaults.

How they act like TIPS is that their coupons float with regard to changes in interest rates, with most now tied to the SOFR (Secured Overnight Financing Rate). So, every 30 to 90 days, the interest rate a bank collects from the loan will change. For the current environment, this has been a godsend. As the Fed has raised rates, investors flooded into senior loans for the floating rate protection. Even with the bond route last year, senior loans only lost 2.33% on a total return basis.

However, this year, fund flows and returns tell a different story. This issue comes down to that floating rate and the credit rating of the firms that use senior loans. With the Fed pushing borrowing costs to levels not seen in decades, recession risk is in the cards. The issue is how can these junk debt borrowers afford to keep the payments on their loans going? This has sent investors out of senior loans and into ‘safer’ fixed income assets.

Time to Buy?

However, investors may want to rethink that stance when it comes to senior and leverage loans. While caution is warranted, they may want to consider buying the asset class. That’s the gist of a new Lord Abbett look at the sector. According to the fixed income specialist, their attractive yields, strong interest-coverage ratios, and healthy issuer fundamentals are supportive of the investors in the asset class.

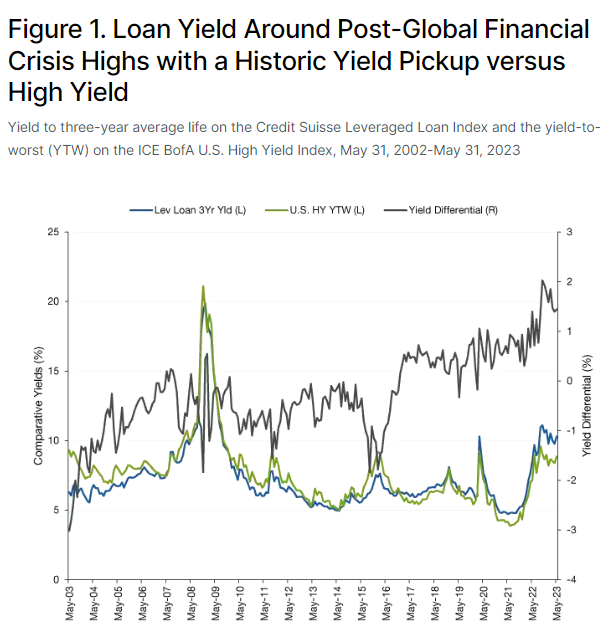

For starters, yields on senior loans are currently topping 10%. This is roughly double what they were paying just a year ago. Better still is that they are attractive versus other high-yield credit sectors, such as junk bonds, when looking at credit spreads. Here, they offer more value and are closer to recession averages compared to spreads on high-yield bonds. The following chart from the asset manager highlights this fact. Potential distress may already be factored in.

Source: Lord Abbett

Speaking of that distress, it may not ever come. The beauty is that levels of leverage remain low when compared to historical averages. Moreover, the average life of a loan continues to see maturities well into the future. According to Lord Abbett, less than 4% of loans are set to mature in 2024. This provides plenty of flexibility with refinancing.

Additionally, the Fed may be starting to pause or slow its path of tightening. Inflation seems to be moderating and the economy seems to be slowing, but not crashing. The Fed may actually achieve its soft landing, which is bullish for these high-yielding investments. 1

All in all, the outlook for senior loans isn’t as bad as the sector’s performance would have you believe.

Adding a Dose of Senior Loans

Ultimately, the senior and leveraged loan sector remains attractive for investors. However, Lord Abbett says caution is still warranted. Under this advice, the asset manager says to stick with higher rated senior loans, avoiding those in the CCC or lower category. With that, investors may want to avoid some of the passive funds in the sector—such as the Invesco Senior Loan ETF—and take an active approach.

Lord Abbett doesn’t offer a dedicated senior loan fund, with its senior loan team providing management of loans for other broad-based income funds under its banner. But there are plenty of choices to get active exposure in the sector, both in using ETF and mutual fund structures. Senior loans are one of the areas of fixed income that active management can make a real difference.

The $4.9 billion SPDR Blackstone Senior Loan ETF is the largest ETF and a top-rated active choice for easily adding exposure to the theme. While the PIMCO Senior Loan Active and BlackRock Floating Rate Loan ETF are active newcomers that have quickly added assets. Any of the three offer low-cost exposure and high yields.

Active management of senior loans can be found in other places, such as closed-end funds like the Nuveen Floating Rate Income Fund, which investors can currently add at a discount to its net asset value and a big yield.

Senior & Leveraged Loan ETFs

| Ticker | Name | AUM | YTD Price Ret (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|

| BRLN | BlackRock Floating Rate Loan ETF | $20.8M | 2.1% | 0.60% | ETF | Yes |

| LONZ | PIMCO Senior Loan Active Exchange-Traded Fund | $176.6M | 1.9% | 0.72% | ETF | Yes |

| BKLN | Invesco Senior Loan ETF | $4.054B | 1.6% | 0.65% | ETF | No |

| FTSL | First Trust Senior Loan Fund | $2.168B | 1.2% | 0.85% | ETF | Yes |

| SRLN | SPDR Blackstone Senior Loan ETF | $4.602B | 0.9% | 0.7% | ETF | Yes |

No matter how they add senior loans, investors should keep the allocations small and focus on managers that are holding quality. Ultimately, the asset type has plenty of potential, but is still risky. Focusing on the top credit ratings will help reduce that risk.

The Bottom Line

Senior loans saw major inflows as investors looked for inflation protection. But as the Fed has continued to raise rates, recession and default risks have grown. According to Lord Abbett, those risks may be overblown and the sector could be a bargain for income hunters, with a dose of caution. Investing in the sector now could lead to plenty of gains down the road.

1 Lord Abbett (June 2023). The Landscape for Leveraged Loans