It’s no secret that bonds of all stripes have garnered plenty of investor attention in recent quarters. One of the biggest winners of that interest has been corporate bonds. And it’s no wonder why. With strong credit quality and yields approaching 6%, investment-grade corporate bonds offer a chance to score safe, high income in today’s market.

But just how safe are they?

According to Goldman Sachs, they are perhaps not as safe as we think. That’s because a lot of corporate bonds are facing a wall of refinancing in the next two years. With rates potentially higher for longer, that leaves a lot of firms struggling to pay that debt. Investors looking at corporate bonds for their safety may want to readjust their idea of risk.

A Big Winner From Rising Rates

We all know the Fed has raised rates over the last year or so. For income seekers, this has opened up a wide range of opportunities to score some extra yield. For many, that means buying investment-grade corporate bonds.

At its peak, the Intercontinental Exchange’s U.S. Investment Grade Corporate Bond Index was yielding 5.7%. Today, that yield is still high at 5.49%. That’s been seen as a pretty good deal considering the index is full of bonds issued by strong firms like Coca-Cola and Microsoft. This is particularly true when you look at what the index represents. Because Coca-Cola doesn’t have the ability to print money or raise taxes to pay its debts like the U.S. government, there is some enhanced risk with corporate bonds. That is why they have higher than Treasury yields. But the reality is Coca-Cola features vast cash flows, big brands, and could be seen as ‘good as gold’, equally as strong as the U.S. government.

To that end, the bonds have taken in plenty of investor money this year to take advantage of the high yields and good credit quality.

Clouds on the Horizon

However, the surface isn’t very choppy. It’s below the waves that might give investors pause when it comes to corporate bonds and their perceived safeness. That’s according to a new Goldman Sachs research paper. It turns out corporate bonds may deserve their high yields if not higher ones.

That’s because higher interest rates are setting up the sector for some big failures.

During the years of low to zero percent interest rates, firms feasted on cheap debt. This allowed them to expand, conduct M&A, and even pay juicier dividends. Companies like Apple and Microsoft famously used their strong credit profiles and low rates to issue debt and then turn around and use that cash for buybacks and increasing dividends. However, that feasting is causing some indigestion.

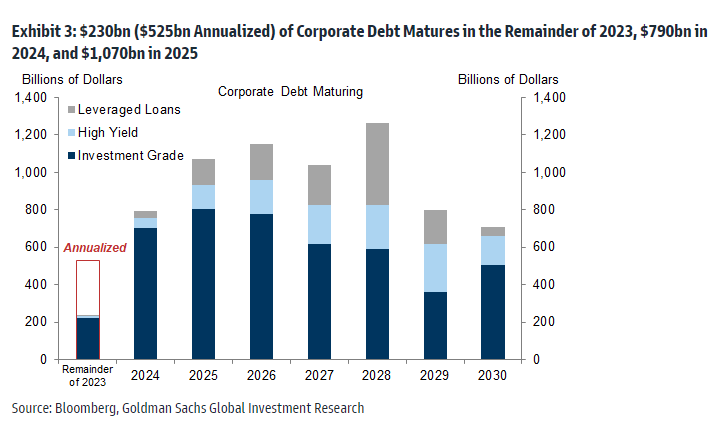

According to Goldman Sachs, more than 16% of all corporate debt outstanding will need to be refinanced over the next two years. This is on top of the $525 billion that came due in 2023. You can see by this chart from the investment bank the debt that needs to roll over. 1

Source: Goldman Sachs

That’s a major issue for a number of reasons.

For starters, interest rates are very high compared to even a year ago. Companies looking to roll-over their debt will be forced to pay interest expenses on this new debt. While the Fed has paused on rates, high inflation has many analysts (including Goldman) expecting that rates will be high for the long haul and that cuts won’t come until the end of 2024/beginning of 2025. Goldman estimates that the average interest rate on the current stock of corporate debt will rise from 4.20% in 2023 to 4.30% in 2024 and 4.50% in 2025.

That higher interest expense has some serious ramifications. The obvious one is that firms will have less money to spend on shareholder rewards like dividends and buybacks because more cash flow will need to go toward servicing higher debts. That is, if they are able to roll-over all the debt in the first place. Banks and lenders may balk, causing firms to spend down cash balances to pay off debt. Again, this means having less cash to do other activities.

That includes a hefty dose of growth activities as well. Goldman estimates that for every dollar of higher interest rate expense, firms reduce spending on CAPEX by 10 cents and labor costs by 20 cents. This reduces the potential to grow business and reduces the amount of cash consumers have to spend. Again, this hits revenues and growth potential.

For Goldman Sachs, this all spells trouble in the world of corporate bonds. The pristine aspect of the bonds may be put to the test. And given the interest in corporate bonds over the last year or so, many investors may be putting themselves at more risk than they realize.

Some Portfolio Considerations

Given the refinance risk, dwindling cash flow potential, and rising economic risks, investors with high exposure to corporate bonds may want to adjust those exposures and weightings. This could be essential for investors who have shifted to core-plus strategies in recent months. Core-plus takes the broad-based Agg Index and tweaks it, often overweighting investment-grade corporate bonds.

So, what to do?

The answer may be finding those bonds that offer strong yields, but have less credit risk than corporate bonds. This includes mortgage-backed securities (MBS) and municipal bonds. Both Munis and MBS bonds are yielding some of their highest amounts in years, albeit less than corporate bonds. But they feature strong, if not stronger, credit quality. MBS bonds are issued by government agencies and feature implicit Federal guarantees, while Munis are backed by states’ ability to tax residents.

For those looking to hold corporate bonds, focus on the top tier of bonds, which includes those rated AAA or AA+. These bonds should be able to lower refinance risk and keep cash flows humming along if Goldman’s prediction comes true.

Municipal Bond and Mortgage-Backed Security ETFs

These ETFs are sorted by their YTD total return, which ranges from 1.6% to 3.8%. Their expense ratio ranges from 0.04% to 0.35%, while they yield between 2.8% and 5.1%. They have AUM between $900M and $35B.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| VTEB | Vanguard Tax-Exempt Bond ETF | $29B | 3.8% | 3% | 0.05% | ETF | No |

| QLTA | iShares AAA-A Rated Corporate Bond ETF | $920M | 3.8% | 3.8% | 0.15% | ETF | No |

| MUNI | PIMCO Intermediate Municipal Bond Active ETF | $1B | 3.7% | 3.1% | 0.35% | ETF | Yes |

| MUB | iShares National Muni Bond ETF | $34.2 | 3.5% | 2.8% | 0.07% | ETF | No |

| JMBS | Janus Henderson Mortgage-Backed Securities ETF | $1.9B | 2.8% | 5.1% | 0.28% | ETF | Yes |

| MBB | iShares MBS ETF | $25.9 | 2% | 3.45% | 0.05% | ETF | No |

| VMBS | Vanguard Mortgage-Backed Securities ETF | $17B | 1.6% | 3.34% | 0.04% | ETF | No |

Ultimately, investment-grade corporate bonds may not be as safe as investors think. Refinancing risks and higher rates could hit the sector hard over the next few years. For investors, that could mean focusing their efforts elsewhere for a high yield and safety of credit.

The Bottom Line

Investors have flocked to investment-grade corporate bonds over the last year to lock in high yields at minimum credit risk. But according to Goldman Sachs, that credit risk is rising. Refinancing at higher rates will have a domino effect on firms’ cash flows, ability to grow, and repaying their debts. Investors should be prudent going forward.

1 Goldman Sachs (August 2023). The Corporate Debt Maturity Wall: Implications for Capex and Employment (Walker/Mori)