For most investors, the only currency they ever really think about is the U.S. dollar. Stocks and bonds are priced in greenbacks. We pay for our groceries and mortgages with cash. Our paychecks are written against dollars, while our savings and checking accounts are priced in Washingtons.

However, our hometown bias could be costing fixed income investors some yield and opportunity.

Investing in currencies and money market funds outside the U.S. dollar can expose fixed income seekers to a variety of different yields, central bank policies, and economic differences. This is how they could potentially beef up income and change the dynamics of a fixed income sleeve. The best part is that getting exposure is now pretty simple.

Outside the U.S. Vacuum

The idea of investing in foreign currency of FOREX drums up images of a 24-hour market, day trading, and quickly losing a portfolio’s value. Yes, that world exists. But even the most conservative investors experience currency trading and fluctuations in their portfolios. Owning international stocks and bonds already exposes portfolios to changes in the currencies versus the U.S. dollar, while multinational U.S.-based firms must translate their international earnings back into greenbacks to make their reports,

Truth be told, the vast bulk of investors are actually FOREX traders without even realizing it.

So, why consider direct investment in currency and FOREX for a portfolio? For fixed income investors, this can bring bigger yields and diversification benefits. When investing in currency, there are two major points: central bank policy and the value of the foreign currency when compared to dollars.

The Bank of Japan, Bank of England, Bank of Canada, and European Central Bank (ECB) function just like the U.S. Federal Reserve and have similar mandates of keeping the economy humming along while making sure inflation is low. To that end, they set their benchmark interest rates accordingly. However, inflation tends to be a localized phenomenon. Prices in Australia and Switzerland are different from each other as well as the U.S. That produces different yields on savings accounts, CDs, and bonds. For example, the Reserve Bank of Australia (RBA) cash rate is 4.1%, while it’s 1.5% in Switzerland. Investors looking abroad can potentially get higher yields than here at home.

The second piece of the equation is translating those Loonies, Yen, Euros, etc. back into U.S. dollars.

When the dollar is strong versus another currency, it takes more of that currency to make dollars. When the dollar is weak, the opposite is true. If the dollar is declining versus a currency, investors actually pick up more income and yield.

When combining both localized interest rates with the changes in currency pairs, investors can gain some interesting income diversification benefits and the potential for capital gains.

Currency Investing in Practice

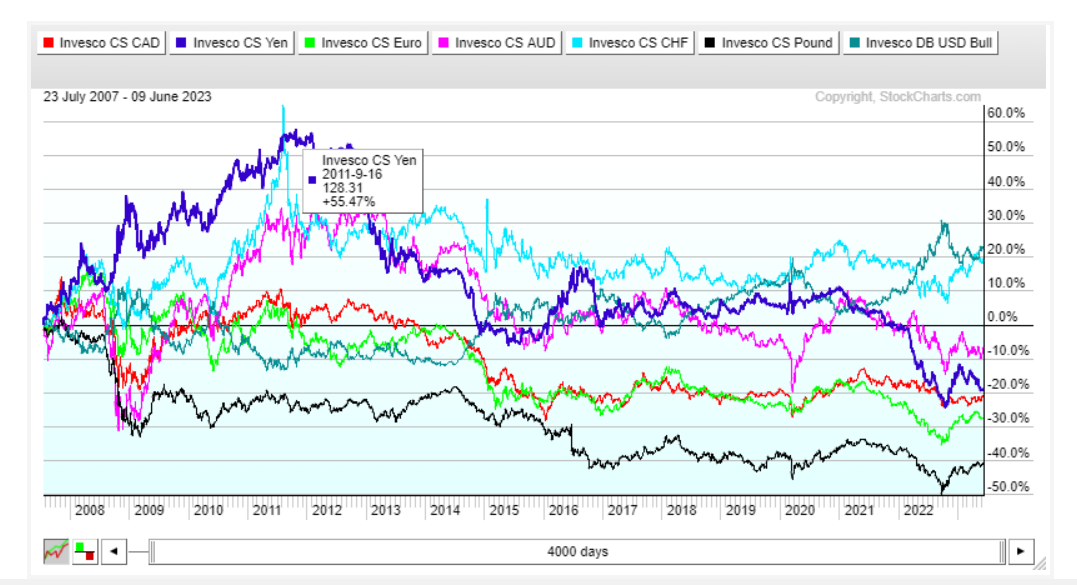

The proof is in the pudding. The U.S. dollar managed to appreciate over 12% in 2022, and hit a two-decade high in September 2022 1. However, it hasn’t always been that way. The chart below looks at various currencies—Yen, Euros, Canadian and Australian dollars, as well as Swiss Francs—versus the dollar since 2007. As you can see, there have been plenty of times when the dollar wasn’t the best performer and investors could have gained plenty of extra yield in these other currencies.

Source: Stockcharts.com

Second, fixed income investors looking to currencies for extra yield and income can have another benefit. That’s reducing volatility. By owning various currencies in a portfolio, investors can pick up important diversification benefits. According to research by DFA, looking at data on 12 developed market currencies from 1985 to 2019, currency hedging can add meaningful extra returns versus static and unhedged fixed income portfolios. 2

Making a Currency Play

For fixed income investors, looking at currency can be a major win, adding extra yield and powerful hedging/lower volatility benefits. Moreover, it has the potential to add rising income during periods of dollar decline.

Getting the exposure—outside of becoming a FOREX trader—is easier than you expect. For starters, brokerages and investment managers like Fidelity and TIAA will allow you to open money markets and CDs based in various foreign currencies. This allows investors to directly own cash in other currencies, get different yields, and discover exchange rate potential.

Second, Invesco offers a suite of physically-backed currency ETFs. Here, Euros, Francs, Yen, etc. are held on behalf of the ETF’s investors. Pricing of the ETFs fluctuates based on the value of the currency versus the dollar, while investors earn interest on the currency, all for low expenses of 0.4%.

Here's a summary of the Invesco Currency ETFs on the market

| Name | Ticker | Type | Active? | AUM | YTD Ret (%) | Expense |

|---|---|---|---|---|---|---|

| Invesco CurrencyShares® British Pound Sterling Trust | FXB | ETF | No | $98 million | 5.3% | 0.4% |

| Invesco CurrencyShares® Canadian Dollar Trust | FXC | ETF | No | $124 million | 2.3% | 0.4% |

| Invesco CurrencyShares® Swiss Franc Trust | FXF | ETF | No | $258 million | 2.1% | 0.4% |

| Invesco CurrencyShares® Australian Dollar Trus | FXA | ETF | No | $103 million | -0.6% | 0.4% |

| Invesco CurrencyShares® Euro Currency Trust | FXE | ETF | No | $253 million | -0.9% | 0.4% |

| Invesco CurrencyShares® Japanese Yen Trust | FXY | ETF | No | $173 million | -6.2% | 0.4% |

Sadly, both Merck and VanEck closed their currency-focused mutual funds over the last few years as the dollar surged and investor interest declined.

The Bottom Line

For fixed income investors, currency remains an interesting choice for diversification and yield benefits. By looking outside the U.S., income investors can pick up larger yields and gains potential. Adding direct currency investments isn’t as scary as it sounds. It can be as simple as buying an ETF or opening a savings account/CD.

1. Currency Volatility: Will a Strong US Dollar Return?