If there has been one prevailing theme covering the entire investment community over the last year or so, it has to be the Federal Reserve and its pace of rate hikes. With surging pandemic-induced inflation, the Fed has raised rates at a quick pace, sending borrowing costs to levels not seen since before the Great Recession.

With recessionary forces starting to grow and inflation beginning to crack, the question is what comes next?

According to fixed income superstars at PIMCO, the time to plan for a Fed pause and pivot could be now. That means moving out of cash and into longer duration bonds and fixed income assets. Here, investors have a chance to lock in high income and potential gains.

The Fed Takes a Pause

Thanks to a myriad of factors, the post-pandemic world was hit hard by surging inflation. In June of last year, the consumer price index (CPI) hit a peak of 9.1%. We’d have to travel all the way back roughly 40 years to the 1980s to see inflation at similar levels.

In order to combat this high inflation, the Federal Reserve began raising benchmark interest rates. This included four consecutive 0.75% hikes as well as several 0.25% and 0.50% hikes. In roughly a year, the Fed raised benchmark interest rates from zero to 5.25%. That’s the highest level of borrowing costs since the Great Recession.

The surge in interest rates seems to be working and the economy has begun to cool. Housing demand and prices have taken a dip, consumers are rolling back their spending, unemployment has ticked up and, most importantly, inflation has gone down significantly. The latest CPI reading has inflation clocking in at just 4.1%. At the same time, recessionary risks have begun to grow.

And with that, the Fed recently took a pause on its path to interest rate hikes, but it still left the window open for at least two more hikes this year.

When the Fed Switches Gears

According to PIMCO, this is exactly what bond investors could be waiting for.

Many advisors and individual investors have moved into cash and short-term bonds to take advantage of the Fed’s interest rate policies. Shorter-term bonds, like T-bills and money market funds, are able to take advantage quickly of changes to rate policy. In terms of rising rates, this is good news and it is the reason why T-bills are yielding close to 5%.

However, when the Fed pivots and begins cutting rates, these shorter-term bonds come to market quickly with

And it turns out, now is the time for investors to act on this fact.

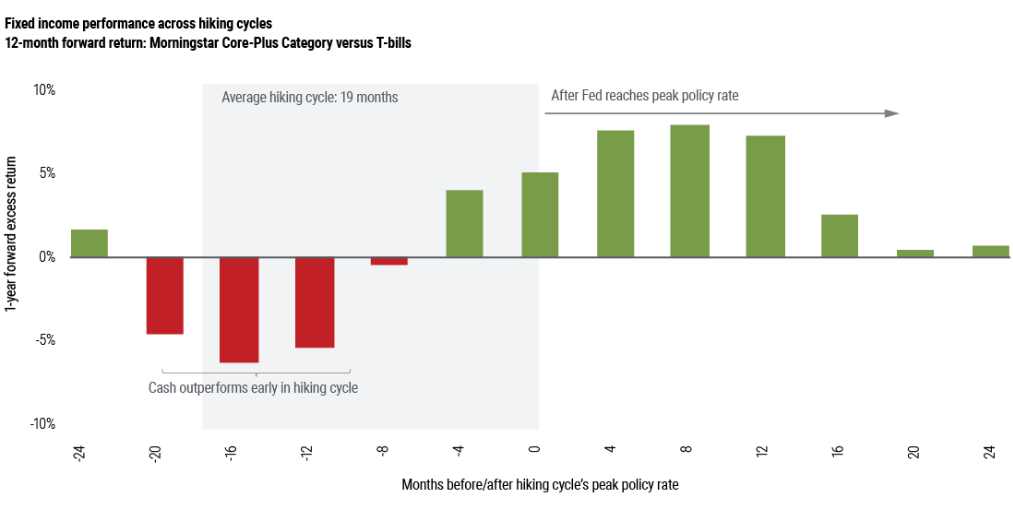

PIMCO dove into data since the 1980s and found that during the 7 tightening cycles, a pattern exists over the average 19-month tightening cycle. In the beginning, when the Fed starts raising rates, core fixed income underperforms cash and T-bills. This is what happened in 2022 when the broader bond market lost 13%. But around 4 months or so, before the peak and pivot, bonds began to outperform cash. This chart from PIMCO highlights the performance of cash vs core bonds throughout the cycle. 1

Source: PIMCO

The Pivot Could Be Coming

PIMCO believes that the so-called pause and pivot could be at hand. With the various negatives now affecting the economy and inflation already beginning to crack and decline, the Fed will most likely pause for a bit before starting to cut rates.

There’s actual evidence to suggest this.

According to the asset manager, before the Fed reaches its peak policy rate, yields on intermediate and core bonds begin to fall on average. After peaking in March of this year at 4.07%, yields on the 10-year Treasury have drifted lower to around 3.70%. At one point, they were as low as 3.28%, but the debt ceiling debacle caused a short-term spike higher. All in all, yields on the 10-year have fallen about 3.86% year-to-date.

The best part is that data from PIMCO suggested that even if the Fed pauses for a while, core bonds will do just fine and outperform cash and short-term fixed income. We’ve already moved beyond the “cash is king” portion of the cycle.

Preparing for the Pivot

Given that data suggests that now could be a great time to look towards intermediate and core bonds, investors may want to follow PIMCO’s lead and move back out along the duration ladder. Luckily, adding exposure to this corner of the bond world is very easy. For example, uber-popular core portfolio choice the iShares Core U.S. Aggregate Bond ETF is an intermediate bond fund. Simply buying it or the SPDR Portfolio Intermediate Term Treasury ETF, which focuses strictly on intermediate government debt, could be all you need to prepare for the pivot.

Fixed income remains a great place for active management and given PIMCO’s predictions, many of its funds have positioned themselves accordingly. Particularly, its core, plus funds like the PIMCO Total Return Fund, which fund manager Daniel Ivascyn cited “tactical U.S. duration positioning” for its market-beating performance during the first quarter. As did the PIMCO Income Fund, which Ivascyn also manages.

PIMCO suggests that investors who are still nervous or need cash-like security may want to move into short duration bonds via a fund like PIMCO Enhanced Low Duration Active ETF to get some duration exposure and lock in higher interest rates.

Here's a summary of how to prepare for the pivot.

| Name | Ticker | Type | Actively Managed? | AUM | YTD Ret (%) | Expense |

|---|---|---|---|---|---|---|

| JPMorgan Core Plus Bond ETF | JCPB | ETF | Yes | $303 million | 3% | 0.4% |

| PIMCO Active Bond Exchange-Traded Fund | BOND | ETF | Yes | $3.38 billion | 2.5% | 0.55% |

| iShares Core U.S. Aggregate Bond ETF | AGG | ETF | No | $90.3 billion | 2% | 0.03% |

| PIMCO Enhanced Low Duration Active | #N/A | ETF | Yes | $1.2 billion | 1.1% | 0.49% |

| SPDR® Portfolio Intermediate Term Treasury ETF | SPTI | ETF | No | $3.73 billion | 1.5% | 0.06% |

| PIMCO Income Fund | PIMIX | Mutual Fund | Yes | $124 billion | 0.8% | 0.62% |

| PIMCO Total Return Fund | PTTRX | Mutual Fund | Yes | $62.2 billion | 0.8% | 0.47% |

The Bottom Line

With the Fed pausing, the pivot could be close at hand. And according to PIMCO, now is the time to load up on intermediate bonds. Here, investors have the ability to lock in yields and, potentially, capital gains as the Fed pauses and reverses course. Going forward, they offer the best chance at strong returns.

1. PIMCO (April 26, 2023). Preparing for the Pivot: Key Takeaways From Our 2022 Advisor Fixed Income Portfolio Review