Investors don’t like uncertainty. This statement is perhaps true for investors in the fixed income market. By definition, bonds are boring and many investors in the space like it that way. They simply collect coupons and eventually get their principal back. So when anything upturns the apple cart, bond investors aren’t too happy.

And that’s what’s happened over the last year or so. Volatility, economic data, and interest rate changes have created a lot of uncertainty. Figuring out what’s next is key to getting bond investors back into the swing of things and calming down.

Analysts at J.P. Morgan (JPM) may have the answer to what is the ‘new normal’ for Treasury bonds. With their latest analysis, investors may have a framework for their bond holdings. And if they are right, the sector could provide plenty of strong total returns going forward.

Too Much Stimulus

How we got to today is very important according to JPM’s analysis. Much of that stems from the surging stimulus in the COVID-19 and post-pandemic world.

After the Great Recession, the Fed kept rates at near zero levels to help fight stagnating growth. And just as the Fed was starting to consider raising rates after a period of strong growth in 2018 to 2019, the pandemic happened. The Fed again cut rates back to zero and lawmakers unleashed plenty of fiscal stimulus. According to JPM, the amount of stimulus as a percentage of GDP was more than during WWII. That stimulus unlocked $5 trillion in excess growth and pulled forward five years’ worth of spending into the economy. 1

And while you can argue that the stimulus was too much or not needed, it happened. The effect of that stimulus was surging inflation. CPI hit levels not seen since the 1980s and the Fed stepped up and dramatically raised rates to the current 5.5% benchmark.

The end result is that bonds and other asset classes tanked. This pushed up yields on the 10-year Treasury bond.

What About Tomorrow?

That was the story for 2022. Last year was a mixed bag of volatility and uncertainty. That has raised questions about the 10-year Treasury and how bond investors will function as a whole in 2024 and beyond.

The Fed has already indicated it will cut rates by 75 basis points this year. The issue is the timing of the cuts and whether or not they’ll actually do that, and whether or not they’ll be able to cut further down the road. JPM offers a mixed outlook.

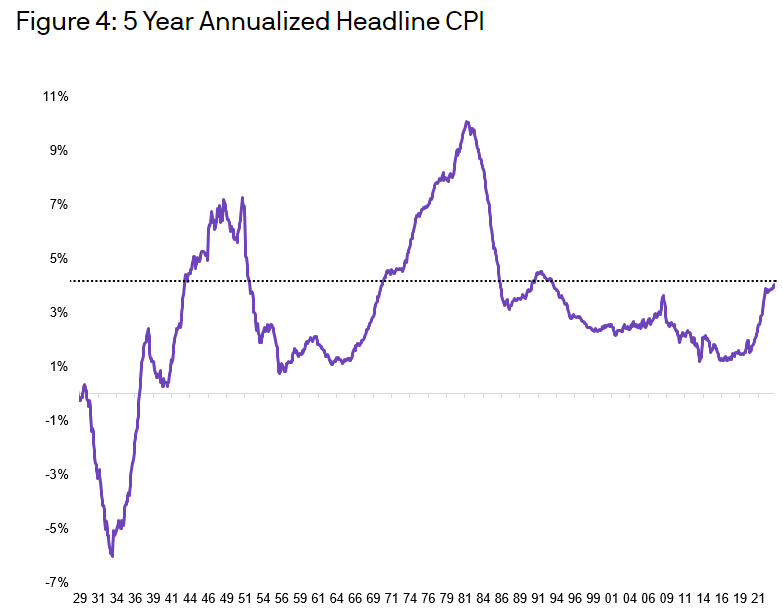

For one thing, inflation is very stubborn. After spiking, CPI did drop. However, consumers and enterprises have gotten used to higher rates. Manufacturing activity, consumer spending, business spending, labor data, etc. have all stayed moderately bullish. As such, inflation has begun to creep back up. This chart from the investment bank shows the sudden jump to CPI.

Source: J.P. Morgan Asset Management

This fact will potentially limit the Fed’s ability to cut rates in the short term.

Another factor weighing on this inflation and overall higher prices continues to be deglobalization and supply issues. After the pandemic unveiled the issues with the global supply chain, many manufacturers and end users began the process of onshoring and resuming localized production. This build-out and the required warehousing will only serve to create a floor for goods prices.

The final nail in the coffin remains the absence of price insensitive buyers. These include banks, foreign official entities, federal pensions, and the Fed itself. Many of these buyers have become net sellers of bonds with the private sector setting up their purchases. Private sector buyers—such as mutual funds, ETFs, private pension funds, insurance funds, and households—have increased their bond holdings by more than $12 trillion and now own more than half of the outstanding marketable debt. They’ve also parked about $5.6 trillion in money market funds. To get these sorts of buyers to purchase more, JPM estimates that rates need to be higher. The return of zero percent interest rates may never be in the cards again.

With all of this in mind, the investment bank now predicts that we expect 10-year Treasury yields to move lower in the next three to six months to a range of 3.5% to 4.0% before increasing to 5%.

Playing JPM’s Forecast

At its core, JPM estimates that yields will move lower in the short term, but stay higher for longer as several structural headwinds prevent the Fed from dropping rates too low. For income seekers, this is pretty good news. Ultimately, the bonds will once again be great sources of stability and income for portfolios.

The way to play is to start buying. In the short term, investors will be treated to some decent capital gains; over the longer term, income will drive most of the returns. JPM’s analysis focuses on the 10-year, which is the real benchmark bond that all others are judged on.

Given the liquidity of U.S. Treasury debt, investors can certainly start buying the 10-year Treasuries. Most brokerages offer the ability to purchase them, both at auction and on the secondary market. Moreover, through the official Treasury Direct website, investors can purchase 10-year notes for as little as $100 each.

At the same time, there are plenty of ETFs that cover Treasury debt and, more specifically, the 10-year and other intermediate-term debt (7- to 10-year bonds).

Intermediate Treasury Bond ETFs

These funds are selected based on exposure to intermediate Treasury bonds and the 10-year note. They are sorted by their one-year total return, which ranges from -1% to 2.4%. Their expense ratio ranges from 0.03% to 0.15%, while they have AUM between $58M and $28B. They are currently yielding between 3% and 4.4%.

| Ticker | Name | AUM | 1-Yr Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| IEI | iShares 3-7 Year Treasury Bond ETF | $13.4B | 2.4% | 3% | 0.15% | ETF | No |

| VGIT | Vanguard Intermediate-Term Treasury ETF | $23.2B | 1.9% | 3.4% | 0.04% | ETF | No |

| SPTI | SPDR Portfolio Intermediate Term Treasury ETF | $4.38B | 1.9% | 3.6% | 0.03% | ETF | No |

| SCHR | Schwab Intermediate-Term U.S. Treasury ETF | $7.4B | 1.5% | 3.2% | 0.03% | ETF | No |

| IEF | iShares 7-10 Year Treasury Bond ETF | $27.6B | -0.3% | 3.5% | 0.15% | ETF | No |

| UTEN | US Treasury 10 Year Note ETF | $58M | -1% | 4.4% | 0.15% | ETF | No |

In the end, the low yields that investors have been used to for the last decade are now officially a thing of the past. Several headwinds will continue to keep the ten-year yield high. For income seekers, this is wonderful news. Investors are likely to be treated to a great blend of capital appreciation and yield going forward. An added bonus is that bonds will once again provide ballast to a portfolio.

The Bottom Line

As the bond benchmark, the yield on the 10-year is important for income seekers. And according to J.P. Morgan’s latest missive, that yield could be higher for longer. For income seekers, this is great news. Bonds may finally begin being great sources of income again for the long haul.

1 J.P. Morgan (November 2023). What is normal for long term Treasury yields?