These could be the halcyon days for fixed income investors. Income hasn’t been so plentiful in over a decade, with yields on a variety of bonds hitting highs not seen since before the Great Recession. And those yields continue to get higher.

The question is, what is actually driving yields to new highs?

J.P. Morgan’s private bank and wealth management arm has some ideas. Analysts at the bank have pinpointed three big reasons for the surge in yields and the main culprit isn’t what many investors think it is. In that, it may cause a change in fixed income portfolio strategy.

10-Year Treasury Yields Hit 16-Year Highs

Income seekers are having a field day in the bond market these days. Everything from cash to long bonds are now paying yields not seen in over a decade. The path to tightening from the Federal Reserve has sent benchmark rates up from zero to 5.5% in just over a year. With that, bonds of all stripes have reflected that change. T-bills are yielding over 5%, junk bonds over 8%, and global sovereigns/treasuries around 3.5%.

According to investment bank J.P. Morgan, you’d have to travel all the way back to before the Great Recession and Credit Crisis to find yields this juicy.

And yields keep on growing.

While the Federal Reserve did pause the rate hike cycle during its last FOMC meeting, the benchmark 10-year Treasury saw its yield hit a 16-year high at the end of September, rising to 4.49%. Interest-rate-sensitive two-year bonds saw yields hitting 5.202%, the highest since July 2006.

The question is, why exactly have bond yields been rising? J.P. Morgan’s private bank may have the answer nailed down.

Three Potential Culprits

According to a new missive from the firm’s private bank, there are three potential culprits.

1. COVID-Inflicted Inflation

The obvious one is inflation and the Fed’s path of tightening.

As the pandemic ended, the economy went from being stuck in neutral to sixth gear very fast. That snap-back coupled with supply chain bottlenecks caused by the pandemic sent prices for commodities, goods, and services skyrocketing. The consumer price index (CPI) in the U.S. hit 9.1% in June of last year, a number not seen since the 1980s. To combat this, the Fed raised rates.

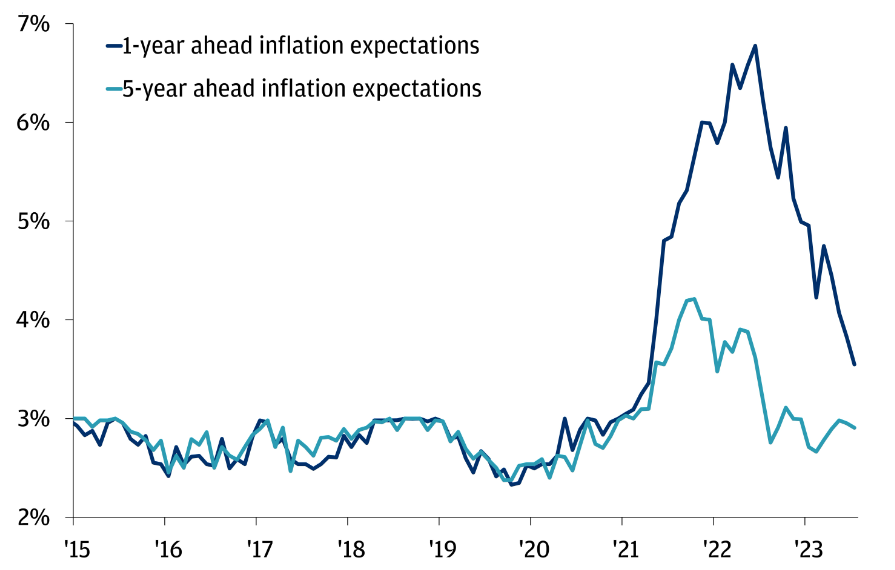

But while inflation was the initial reason for higher yields, it isn’t so today. Inflation has been cooling and consumers don’t seem worried about rising prices anymore. Both one- and five-year inflation expectations have begun to significantly drop. This chart sums up the massive drop in expectations for higher prices.

Source: J.P. Morgan Private Bank

According to J.P. Morgan, this rules out inflation for higher yields.

2. Delayed Prospects of Recession

The next culprit according to the investment bank could be higher growth. We’ve been talking about recession for the better part of a year now. And so far, that recession hasn’t come. Data has slowed but still remains good. The labor market is robust, industrial activity is steady, and even housing metrics haven’t fallen by too much.

With that, investors may be betting that high rates will be here to stay as the Fed pulls off a soft landing or no landing at all with the economy plodding along for the long haul. This feels likely given some of the recent data and market returns.

3. Overall Uncertainty

The third reason for the higher yields is the most likely scenario, according to J.P. Morgan, and is perhaps the scariest. That would be overall uncertainty.

Right now, we don’t have a clear picture of what is going to happen with regard to economic growth or the geopolitical situation. As we said, data is mixed. But it hasn’t been trending higher. Consumers are starting to pull back on discretionary spending despite lower inflationary pressures. The U.S. recently saw its credit rating downgraded and we could be headed for another debt ceiling/government shutdown.

All of this puts pressure on long-term bond yields. J.P. Morgan highlights the fact that investors demand “more compensation for locking up their money in a bond for a longer time versus a shorter time.” When things are uncertain like they are now, many investors will demand even more for long-dated bonds than normal. This is particularly true when short-term yields are as high as they are today. 1

To that end, investors have been shunning longer-dated bonds, pushing up yields. And when coupled with future growth expectations and the potential for the Fed to keep raising rates, we get the increasing high yield environment of today.

What To Do?

With inflation sort of out of the picture and uncertainty being the main reason why bond yields are rising, investors are facing an interesting conundrum for their portfolios. How should we play this uncertainty and the path to higher yields even if rates stay where they are? According to J.P. Morgan, bonds look even better now than they did before.

Uncertainty is where fixed income thrives. The key is the ‘fixed’ in fixed income. Those steady payments will be more valuable during the rocky period. Right now, investors have a chance to lock in some strong income for the uncertainty. The place to be could be the safest of them all: Treasury bonds. The $28 billion iShares U.S. Treasury Bond ETF is an ideal broad-based Treasury-only ETF with bonds that mature in five to ten years. The Vanguard Intermediate-Term Treasury Index Fund also makes for an ideal selection. Both funds yield over 4.5%.

Even when it comes to Treasuries, there is a sweet spot. Going out slightly more than cash, but not too far, will protect investors if yields continue to rise or the Fed raises rates. So, we’re looking at one- to two-year Treasury notes. Low-cost choices abound in this area. The SPDR Portfolio Short-Term Treasury ETF, Schwab Short-Term U.S. Treasury ETF, and U.S. Treasury 2 Year Note ETF are some prime examples.

U.S. Treasury Bond Mutual Funds & ETFs

These funds were selected based on YTD total return. Focus has been paid to include mutual funds and ETFs with low-cost exposure to U.S. Treasury debt, with expenses between 0.03% to 0.16%. They have AUM between $300 million to $27 billion and their yields range from 2.6% to 4.6%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| DFFGX | DFA Short Term Govt Portfolio | $1.52B | 2.5% | 2.6% | 0.16% | MF | Yes |

| SCHO | Schwab Short Term US Treasury ETF | $12.4B | 1.7% | 3.8% | 0.03% | ETF | No |

| SHY | iShares 1-3 Year Treasury Bond ETF | $25.8B | 1.6% | 3.1% | 0.15% | ETF | No |

| VGSH | Vanguard Short-Term Treasury Index Fund ETF | $26.9B | 1.5% | 3.6% | 0.04% | ETF | No |

| SPTS | SPDR Portfolio Short Term Treasury ETF | $5.33B | 1.5% | 3.8% | 0.03% | ETF | No |

| UTWO | US Treasury 2 Year Note ETF | $305.3M | 1% | 4.6% | 0.15% | ETF | No |

| VGIT | Vanguard Intermediate-Term Treasury Index Fd ETF | $22.31B | -1% | 2.8% | 0.04% | ETF | No |

Ultimately, the surge in bond yields can be traced back to uncertainty. And in that, bonds look better than before. Playing the uncertainty means investors need to focus on the safety of Treasury bonds.

The Bottom Line

While inflation was the main reason for rising bond yields before, these days it’s all about uncertainty. According to J.P. Morgan, that means bonds are even better than before. Making sure investors focus on the quality of U.S. Treasury debt is that much more important to lock in strong yields and safety.

1 J.P. Morgan (Aug 2023). What’s the deal with surging bond yields? We question 3 prime suspects.