As they say, “Cash rules everything around me.” These days, that saying certainly holds weight. With T-bills, money market funds, and even bread & butter savings accounts paying yields not seen in years, investors’ cash balances have grown to record levels. Trillions of dollars now sit earning 4% to 5%.

But perhaps cash is a bit too much on investors’ minds.

That’s the gist according to a new white paper from investment manager Capital Group. It turns out that those high cash balances may come to bite investors in the end. With that in mind, there are four ways investors can use their cash now to build out high income for today and tomorrow.

Too Much Cash

It’s been a good couple of quarters for savers. As the Fed tightened, interest paid on a variety of safe and liquid asset classes surged. T-bills are paying over 5%, money market funds are paying 4.5%, and CDs and savings accounts are paying north of 4%. These are yields not seen since before the Great Recession. And investors took advantage, particularly with all the excess stimulus cash and uncertainty about the global economy.

To that end, investors grew cash balances to over $5.5 trillion in money market funds. This compares to the $4.79 trillion cash peak during the pandemic and the $3.90 trillion peak during the Great Recession.

However, all that cash could be a problem going forward.

According to American Funds manager, Capital Group, investors may be setting themselves up for some heartache in the future if they don’t act soon. That’s because when the Fed cuts interest rates—and it already signaled that it will—short-term bonds and cash will feel those cuts first of all. These juicy yields will dial down. The problem comes with reinvestment risk.

Yields on longer-dated bonds will also drop and investors in cash will miss the boat to lock in higher yields for the long haul. To this end, Capital Group recommends four strategies for investors to look at today to move out of cash now and score better income later on.

Lock In Yields Now!

The easiest of Capital Group’s recommendations is to move out of cash and lock in attractive yields. After 2022’s bond rout and 2023’s steady pricing environment, bonds of all stripes are yielding some attractive amounts.

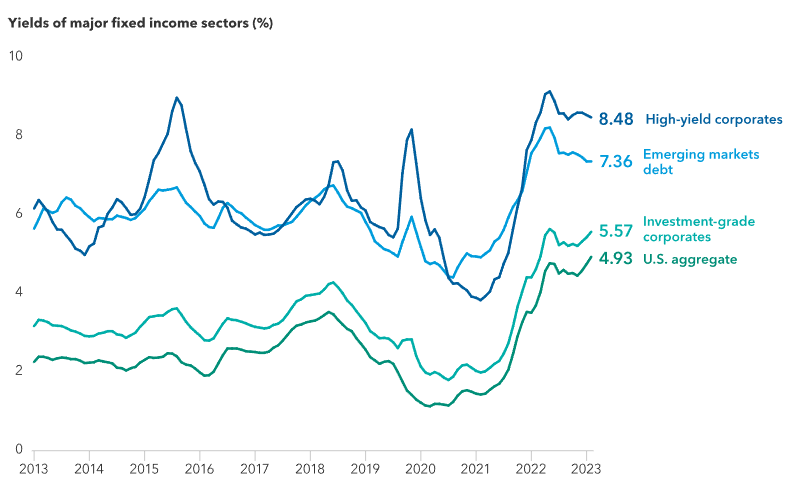

Take a look at the benchmark, the Bloomberg U.S. Aggregate Index. The index of investment-grade bonds—rated BBB/Baa and above—is currently yielding around 4.93%. This compares to just 1.7% at the end of 2021. And the Agg isn’t alone. Many other bond sectors are now yielding amounts not seen since 2009. This chart from Capital Group shows just some of the current yields on bond sectors and how much they’ve increased. 1

Source: Capital Group

These attractive yields won’t last long once the Fed begins actually cutting rates. With the central bank mentioning that two cuts could come this year, investors may not have much time to buy in. Already, the sheer mention of these cuts has already begun to drop yields across many fixed income asset classes. That means investors must lock in bond yields now for years of lower rates tomorrow.

Focus on Investment-Grade

One of the biggest issues facing investors continues to be uncertainty. Economic data is mixed all around. Consumers are still spending. But they appear to be spending less. The labor market is healthy, but layoffs and job activity have started to slow. Manufacturing, housing, and other sectors of the economy are also showing similar good, but not great, outlooks. Even inflation appears to be stuck in neutral: not very high anymore, but not dropping either.

All of these have kept recession in the window. It hasn’t gotten closer, but it’s still there in the distance. That has made some investors complacent. According to Capital Group, that’s not necessarily a good thing. When the tide turns, quality will quickly be snagged up by investors. With that, it’s important to grab that quality now before it turns bad.

That means focusing on investment-grade bonds while fundamentals in the economy are still good. Investment-grade corporates, Treasuries, and municipal bonds all offer high yields and strong quality. Here investors can ratchet up their portfolios’ quality today, get strong yields, and have plenty of protection later on. Moreover, these bonds should see price appreciation as the economy drifts lower as other investors flee to safety.

Don’t Ignore High Yield

While quality should be preferred, Capital Group suggests that investors shouldn’t forget about high yield opportunities either. With 8%+ starting yields, high yield and junk bonds offer plenty of buffer these days against volatility and the opportunity for stock-like returns. For example, the Bloomberg High Yield Very Liquid Index managed to return over 13% in 2023, with yield and price appreciation.

Moreover, Capital Group notes that junk is starting to look less risky overall. Many firms in the category are improving their credit ratings, holding larger reserves and being able to refinance with ease. That makes the sector an interesting opportunity for risk-seeking investors.

Be Diverse With Your Income

No matter what investors do with their cash, Capital Group recommends that they don’t put all their eggs in one basket. Diversification is always important, but given the differences in the fixed income world today, this diversification is paramount. The unevenness in the world’s economy lends itself to differences in returns across various bonds.

For example, after being a real leader and strong driver of returns into the pandemic, commercial-backed mortgage securities have been very volatile due to concerns about the health of office buildings and commercial real estate prices. Emerging market bonds have been on an opposite run with the potential for a weaker dollar boosting their prices.

All in all, having a mix of fixed income asset classes could be the key to winning for portfolios.

Playing Capital Group’s Recommendations

For investors looking to follow Capital Group’s advice, get out of cash, and start building a fixed income portfolio, there are plenty of choices out there. A variety of low-cost and passive vehicles make it easy to build a bond portfolio across the investment manager’s advice. For example, the iShares Core Total USD Bond Market ETF, iShares Broad USD High Yield Corporate Bond ETF, and the iShares Aaa – A Rated Corporate Bond ETF could be all you need.

Another choice? Let someone else do it for you. Capital Group has several active choices across fixed income sectors. This includes the Capital Group U.S. Multi-Sector Income ETF, which is actively managed and follows the manager’s framework outline here.

Fixed Income ETFs

These ETFs were selected based on their exposure to various fixed income sectors with an active tilt. They are sorted by their one-year total return, which range from 1.2% to 8.1%. Their dividend yields range from 3.8% to 7.7% and they have assets under management of $332M to $22B. Their expense ratio ranges from 0.07% to 0.39%.

| Ticker | Name | AUM | 1-year Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| USHY | iShares Broad USD High Yield Corporate Bond ETF | $8.99 | 8.1% | 6.7% | 0.08% | ETF | Yes |

| CGMS | Capital Group U.S. Multi-Sector Income ETF | $369.79M | 7.8% | 7.7% | 0.39% | ETF | Yes |

| CGSD | Capital Group Short Duration Income ETF | $332.4M | 4.7% | 6.1% | 0.25% | ETF | Yes |

| CGMU | Capital Group Municipal Income ETF | $516.82M | 4.4% | 4.3% | 0.27% | ETF | Yes |

| CGCP | Capital Group Core Plus Income ETF | $1.54B | 4.1% | 6.8% | 0.34% | ETF | Yes |

| QLTA | iShares Aaa - A Rated Corporate Bond ETF | $922M | 1.8% | 3.9% | 0.15% | ETF | Yes |

| IUSB | iShares Core Total USD Bond Market ETF | $21.6B | 1.2% | 3.8% | 0.07% | ETF | No |

The end all, be all is that investors need to start rethinking their high cash positions and start locking in income. Following Capital Group’s advice could be great for building a strong high-yielding portfolio that is ready to take on the economy’s challenges and the world of lower rates.

The Bottom Line

Investors are sitting on a huge amount of cash. That’s a problem when the tide turns. Luckily, Capital Group has some sound advice on what to do. By locking in yield, focusing on quality, being selective with high yield, and ultimately spreading their bets, investors can win and score high yields for the future.

1 Capital Group (September 2023). 4 high-income seeking investment strategies for a high-rate world