Bonds and other fixed income investments have sat on the backburner over the last few years as investors used the low interest rate environment to focus on growth stocks and other income asset classes. However, thanks to the surge in inflation and the Fed’s tinkering with rates, bonds are now once again hot.

And according to one asset manager, they represent a “generational opportunity” for investors.

BlackRock surmises that bonds and their higher yields across the board are a once in a lifetime opportunity to reset allocations, grow portfolios, and get valuable income. To that end, adding bonds now makes a ton of sense.

A Mixed Couple of Years

We all know that 2022 was a terrible year for investors. Inflation finally got the best of the economy and the Federal Reserve was forced to act. This sent interest rates on a path to tighten, boosting benchmark rates to levels not seen in decades. Naturally, bonds—with their inverse relationship—tanked. The broad Bloomberg U.S. Aggregate Bond Index sank by more than 13%.

So far in 2023, the Agg hasn’t exactly been a stellar performer either. The continued rise in rates, along with economic pressures and other worries, such as the debt ceiling and congressional in-fighting, has continued to keep returns in the proverbial toilet

Year-to-date, the Bloomberg U.S. Aggregate Bond index has returned a negative 0.53%.

On a total return basis, we’re still looking at a slight positive gain for bond investors. That’s been driven by bonds with higher yields. It’s those yields that make many assets across the fixed income spectrum a worthy addition.

BlackRock’s Generational Opportunity

In fact, this may be a once in a lifetime opportunity for investors. That’s the gist according to asset manager BlackRock. Higher yields and other features have now made bonds a top draw for portfolios.

The key for bonds comes down to those higher yields. Looking at the so-called Bloomberg Global Aggregate Index—which includes investment-grade bonds from across the world—more than 82% of the index is now yielding over 4%. Strictly focusing on the 10-year Treasury, we’re looking at yields closer to 5%.

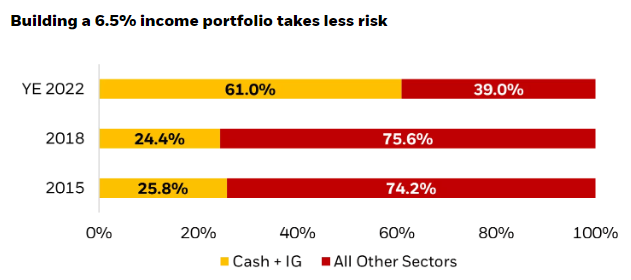

That yield is pretty compelling, particularly when looking at risk and income. According to BlackRock, highly-rated investment-grade corporate bonds, mortgage-backed securities, and Treasuries are now yielding what higher-risk and poorly rated bonds did a year ago. To that end, it takes much less risk to build an income portfolio.

For example, and as illustrated by the chart from the asset manager, for investors to score a 6.5% income portfolio, today they can get that from having mostly cash and investment-grade bonds. In the pre-pandemic days, you would have to stretch into very risky corners of the bond market to do so.

Source: BlackRock

Second, bonds may be offering true ballast for a portfolio once again. Despite the Fed hiking four times this year and signaling that more rate hikes are on the horizon, bonds have been pretty steady. Yes, as we noted, they’ve dipped this year. However, the carnage is not as bad as previous years and damage has been muted.

According to BlackRock, the key is that yield again. Right now, investors are being fairly compensated for any additional rate hikes, with the current yield providing protection. Part of that protection also comes from the pivot factor. Bonds right now are offering plenty of upside when looking at spreads and risk-free contributions of yields. This implies that bonds are in the sweet spot for investors, offering downside protection today and upside tomorrow.

This hasn’t occurred since before the Great Recession. For BlackRock, this means investors have a real opportunity to load up on fixed income assets.

Three Big Moves

Within this framework, BlackRock suggests investors make some strategic moves to play the current and future environment to take advantage of the opportunity in fixed income assets. For the asset manager, this means re-sizing fixed income to a prominent spot in portfolios to cure underweight allocations due to last year’s worth of growth stock focus. At the same time, investors need to rethink the composition of fixed income allocations. That means potentially taking on less risk than they had to before or increasing bonds outside investment-grade issues if they have too many holdings here.

The asset manager has three big moves for the portfolio to make.

- Optimize liquidity: Cash may not be the best place despite its high yields. If the Fed pivots, cash-heavy investors will suffer. To that end, BlackRock suggests using short duration bonds to keep liquidity good while still getting high yields.

- Rethink core allocations: With the troubles in Congress, Treasuries aren’t the slam dunk they once were. However, strongly rated corporate bonds could be a top choice. This means using a core plus strategy rather than just owning the Agg.

- Non-benchmark exposures: Finally, BlackRock suggests using other non-core bonds to boost yield, add diversification, and manage downside risk. High-yield corporates, floating rate loans, and mortgage-backed securities offer strong buys now that yields have downside protection built in.

Bonds Back on the Menu

With fixed income assets offering such a compelling buy, investors may want to follow BlackRock’s lead and load up on bonds. And it’s pretty easy to follow BlackRock’s framework for success.

Short-duration bonds, or those with durations of one to two years, can be had in a number of low cost vehicles, in both active and passive forms. The BlackRock Short Maturity Bond ETF, iShares Core 1-5 Year USD Bond ETF, and iShares 1-3 Year Treasury Bond ETF are just some examples.

Core-plus bond funds take the Agg and shift around its holdings, overweighting and underweighting different sectors of the index. The idea is to improve returns. ETFs have made core-plus bond funds perform better with their low costs. The JPMorgan Core Plus Bond ETF and Capital Group Core Plus Income ETF are two strong ETF choices for core-plus exposure.

Finally, the iShares iBoxx $ High Yield Corporate Bond ETF and iShares MBS ETF can be used to add some much-needed spice and diversification.

Passive & Active Bond ETFs

These funds were selected based on their YTD total return, which range from -5% to 4.4%. All of these funds provide low-cost exposure to various bond varieties and their high yields. They have expenses between 0.05% to 0.49% and have AUM between $1B and $26B. They are currently yielding between 3.10% and 6.40%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| NEAR | BlackRock Short Maturity Bond ETF | $3.18B | 4.4% | 4.8% | 0.25% | ETF | Yes |

| HYG | iShares iBoxx $ High Yield Corporate Bond ETF | $13.92B | 1.9% | 6.4% | 0.49% | ETF | No |

| SHY | iShares 1-3 Year Treasury Bond ETF | $26.26B | 1.7% | 3.1% | 0.15% | ETF | No |

| ISTB | iShares Core 1-5 Year USD Bond ETF | $4.1B | 1.2% | 3.2% | 0.06% | ETF | No |

| CGCP | Capital Group Core Plus Income ETF | $1.09B | -1.9% | 5.5% | 0.34% | ETF | Yes |

| JCPB | JPMorgan Core Plus Bond ETF | $1.44B | -2.2% | 5.1% | 0.40% | ETF | Yes |

| MBB | iShares MBS ETF | $25.89B | -5.1% | 4.1% | 0.05% | ETF | No |

Ultimately, bonds are now in a once-in-a-lifetime sweet spot for investors. Adding them makes a ton of sense. Thanks to their current yields, investors have the best potential upside and plenty of downside protection.

The Bottom Line

The last two years have left bonds in a wonderful place. In fact, according to BlackRock, it’s a “generational opportunity.” Thanks to their yields, there is protection and current income associated with the asset class and investors should take notice.

1 BlackRock (Sep 2023). A Generational Opportunity in Fixed Income