Striking a balance in the economy between strong growth but not too much growth is a tough job. While fiscal policy in that regard comes from government policies, the Federal Reserve has the hard work of balancing the monetary side of the equation. With its dual mandates of inflation fighting and employment, the Fed sets interest rate policies. And in the current environment, that means trying to execute a so-called “soft-landing,” guiding inflation lower without tipping the economy into recession.

But the Fed seems to have its hands full.

While inflation has dipped, it’s still running strong. Meanwhile, economic data has started to crumble, resulting in the central bank pausing. Here, we may be looking at a ‘no landing’ scenario. One in which bonds and their high yields rule the roost.

The Fed Raises Rates

The pandemic snap-back set the stage for one of the most interesting economic environments in a long time. On one hand, supply chain woes, shutdowns and other pandemic-era restrictions hit the world’s supply of goods and services. On the other hand, was full of stimulus measures for both consumers and businesses. When the pandemic was over, the two factors collided. End-users flushed with cash-boosted demand, while supplies remained tight.

That sent up inflation to levels not seen since the 1980s.

And seen then, the Federal Reserve has raised rates to combat the issue. Starting March of 2022, the central bank has raised rates by a total of 525 basis points, with a target Fed’s fund rate of 5.25–5.50%

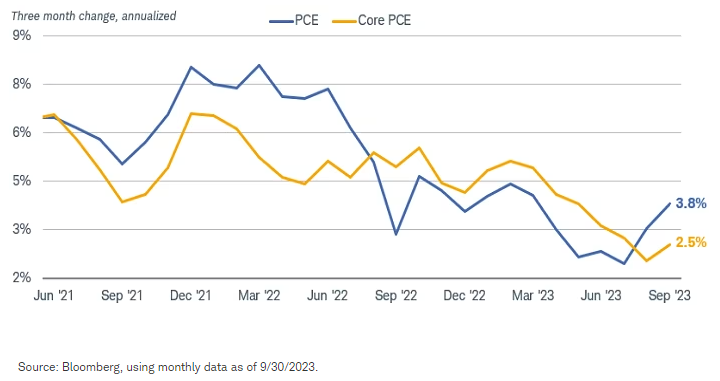

The Fed’s work on rates seems to be working. This chart from Charles Schwab shows the decline in inflation for the Fed’s preferred metric – the personal consumption expenditures less food and energy Index or Core PCE.

_Source: Charles Schwab

However, while inflation has dropped, higher interest rates have pushed down various economic data points. The economy is clearly slowing and drifting towards recession. Consumers are starting to stop spending, credit is tight and businesses have started to lay off employees/clamp down on investment.

With that, media pundits have gravitated to the idea that the Fed won’t be able to produce a so-called soft-landing, but instead a hard landing into recession.

The Call for No Landing Grows

The problem is with the end piece of the previously mentioned chart coupled with some economic data. As you can see, inflation has started to spike once again. By the same token, economic data has been flat. We’ve had deterioration in many data points, but for the most part, they’ve stayed flat. This helps support the Fed’s recent decisions to pause its rate hikes for the time being.

It also gave rise to the idea of a no-landing scenario: One where the recession continues to get kicked further down the road, but inflation remains high and economic growth slows, but does not stop. This is akin to the stagflation realized in the 1970s.

To that end, the Fed’s dot plot of rate potential has increased. Right now, rates are expected to drop in 2024 and 2025. However, the current plot shows that expectations for these years have increased – 5.1% for 2024 and 3.9% in 2025. The current plot also has rates staying at 2.9% in 2026, above the so-called neutral rate of 2.5%. 1

All in all, rates are now predicted to be higher for longer as the recession is in the distance but never comes while the economy grows miserly. The Fed won’t be able to really cut to grow it, because of stubbornly high inflation.

Bonds to Rule

With the potential for no landing, investors are being thrown for a loop when it comes to portfolios. Low growth and high rates tend to be bad for equities. Profits remain constricted, while high rates limit the appeal of risk assets. Low-term return expectations for stocks have continued to dwindle as the no-landing potential has grown.

Bonds on the other hand could be the asset class du jour.

Fixed income assets have an inverse relationship with rates. Prices fall when the Fed raises and vice versa. But when things are steady, bonds become very attractive. Investors know that they’ve been able to coupon clip for a while and collect a guaranteed return. After the Fed’s period of tightening, bonds are now yielding some very high amounts. A variety of bread-and-butter bonds – Treasuries, investment-grade corporate debt, and municipal bonds – are all yielding north of 4%. That’s very attractive considering the low return environment for equities and the fact the Fed may be in a spot where it’s forced to keep rates high for a while.

Data suggests just that. After the Fed pauses and keeps rates steady, bonds produce an average of an 8% or 13% total return, in the six-month and one-year periods, respectively. Better still, bonds produce a positive return 100% of the time after a pause.

Say Yes to Bonds

With the potential for no landing and higher rates for longer, investors should consider bonds for their portfolios. And given the sheer amount of yield available, the choices are vast. The key is to balance short-term and intermediate-term bonds in a portfolio. This provides exposure beyond cash if the Fed does cut. Investors can “lock in” income.

As we said before, Treasuries, munis and even corporate bonds offer plenty of exposure to higher yields. The best part is there are plenty of low-cost choices in these areas. For example, Vanguard Short-Term Bond ETF, Vanguard Long-Term Corporate Bond ETF and Vanguard Tax-Exempt Bond ETF could be a quick three fund choice to create the desired effect. By pairing these funds together, investors can make the most out of coupon clipping and the potential for deflation.

Investment-Grade Bond ETFs

These funds were selected based on their exposure to investment-grade bonds at a low cost and are sorted by YTD total return, which ranges from 0.1% to 5%. They have expenses of 0.03% to 0.25% and yields from 2.31% to 5.01%. They have assets under management between $880M and $59B.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| NEAR | BlackRock Short Duration Bond ETF | $3.18B | 5% | 4.08% | 0.25% | ETF | Yes |

| SPBO | SPDR Portfolio Corporate Bond ETF | $886M | 3.1% | 4.79% | 0.03% | ETF | No |

| LQD | iShares iBoxx $ Investment Grade Corporate Bond ETF | $27.9B | 2.9% | 4.11% | 0.14% | ETF | No |

| VTEB | Vanguard Tax-Exempt Bond ETF | $29.3B | 2.1% | 2.81% | 0.05% | ETF | No |

| BSV | Vanguard Short-Term Bond ETF | $58.8B | 2.4% | 2.31% | 0.04% | ETF | No |

| SPTS | SPDR Portfolio Short Term Treasury ETF | $5.82B | 2.3% | 3.36% | 0.03% | ETF | No |

| VCLT | Vanguard Long-Term Corporate Bond ETF | $6.44B | 2% | 5.01% | 0.04% | ETF | No |

| GOVT | iShares U.S. Treasury Bond ETF | $23.2B | 0.1% | 2.61% | 0.05% | ETF | No |

The Bottom Line

The Fed continues to balance inflation as well as dwindling growth in the economy. With data pointing to a mixed environment, it could mean that rates stay high for longer and we could be in a no-landing scenario. With that, bonds are on the menu for better returns.

1 Lord Abbett (September 2023). A “Higher for Longer”