Rising rates have been great for investors seeking yield and income in the current market. However, for firms looking to raise funds, higher rates have been a real pill. To fight that interest expense, many have turned to alternative funding methods, including a hefty dose of hybrid securities.

Convertible bond issuance is on the rise.

The question for investors is whether or not the surge in convertible bonds is a sign of trouble or an opportunity for portfolios. Goldman Sachs has the answer – and it may be better than expected.

Convertibles & Rising Rates

If we remember, bonds are technically IOUs or an enity borrowing money. While higher rates are great for lenders, they are terrible for those looking to borrow money. But with the need for capital ever-growing, many firms need to get creative when it comes to issuing and rolling over debt in rising rate environments.

With the Fed raising benchmark rates to 5.5% in just over a year, firms are certainly facing that issue.

There are a variety of ways firms can raise capital creatively – from private equity and different styles of loans. One of those happens to be convertible bonds.

Convertibles are just like normal bonds. They are issued with a coupon, par value and have a high place on the bankruptcy ladder. However, tucked inside that normal bond is basically a hidden stock option. Convertible bonds have a feature that allows the issuing firm to exchange the bonds for shares of its own stock under certain conditions. Because investors have the chance for equity exposure, they often come to the market with lower coupon rates than regular bonds.

This makes them a top funding choice for rising rate environments.

Issuance Surges

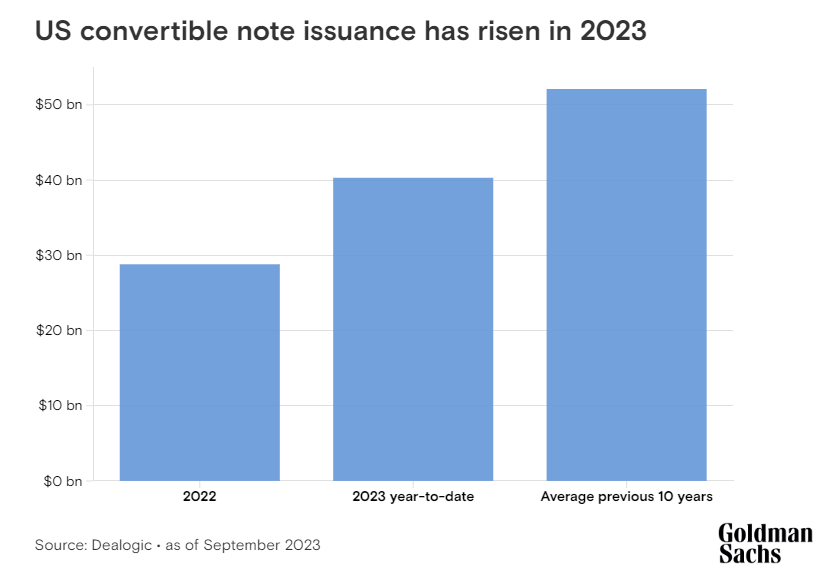

And it seems like firms have gotten the hint that converts are a good deal these days. According to data from Dealogic, U.S. firms have issued more than $40 billion in convertibles across 60+ deals by the end of the third quarter. To put that into context, 2022 saw 54 transactions and only $29 billion worth of bonds issued. This chart from Goldman Sachs shows the issuance and how close we are to getting to the ten-year average.

Source: Goldman Sachs

The kicker, Goldman says, is just who is issuing such convertible debt.

Historically, convertible bonds were issued by smaller firms or those with already heavy debt loads. These sorts of firms weren’t able to get favorable terms in the normal bond market and with lower credit ratings, junk or floating rate debt would be way too expensive.

These days, however, issuance has started to drift higher up the credit rating ladder. In recent months, firms such as mega-utility CenterPoint Energy and large office building owner Corporate Office Properties have issued convertible bonds. The common thread is these are investment-grade-rated companies.

So far this year, investment-grade borrowers have issued $12 billion in convertible bonds. This represents a third of all the issuance, the highest proportion in over a decade and is more than triple the average rate of the last ten years. Back in 2022, investment-grade firms issued just $2 billion convert debt or about 7% of the total pie.

Goldman predicts that issuance by investment-grade borrowers will continue to grow in the new year. A lot of corporate debt will need to be rolled over in 2024/2025 to the tune of $4 trillion. By using convertible bonds, many investment-grade issuers were able to save between 2 to 3 percentage points on their interest expenses versus regular corporate bonds. These days, corporate bonds are yielding close to 6%. The savings are very attractive for borrowers.

Good for Total Returns

For investors, the surge of convertible issuance has traditionally been a troubling sign. Thanks to previous historical data, upswings in convert issuance have usually precluded recession or higher defaults. After all, the nature of converts was lower quality firms being shut out of traditional debt markets – they had to use convertibles to get financing.

But the issuance today is an interesting conundrum. Today, REITs, utilities and growing tech firms – all with investment-grade ratings – are now entering the market. And they are doing so for cost savings purposes.

That’s good for investors in a variety of ways. For one, lower costs strengthen balance sheets and improve cash flows. This allows more cash to be used for other purposes while improving the firm’s debt-coverage ratios. It also improves the overall credit quality of the convertible sector. With more investment-grade issuers entering the market, newer investors could be drawn to the sector, boosting prices and creating a great total return for investors. This is even before any appreciation from the stock portion.

Perhaps the only issue will be for those seeking income. Less issuance going into corporate bonds – with higher yields – means less high income opportunities for investors.

Convertible Bond ETFs

These funds were selected based on their assets under management and represent the largest convertible bond ETFs. They are sorted by their YTD total returns, which range from 7% to 14%. They have expenses between 0.20% and 0.95% and assets under management between $5M and $3.5B. They are currently yielding between 1.75% and 2.85%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| ICVT | iShares Convertible Bond ETF | $1.5B | 14% | 1.85% | 0.20% | ETF | No |

| CWB | SPDR Bloomberg Convertible Securities ETF | $3.44B | 13.3% | 2.3% | 0.40% | ETF | No |

| QCON | American Century Quality Convertible Securities ETF | $24.09M | 9.5% | 2.85% | 0.32% | ETF | Yes |

| FCVT | First Trust SSI Strategic Convertible Securities | Yes ETF | $93.17M | 7.2% | 1.76% | 0.95% | ETF |

For investors looking for convertible bonds, now could be the halcyon days. With more top-rated firms exploring the bond types to save money, the overall picture gets better for the sector. That could be wonderful news for total returns.

The Bottom Line

Convertible bond issuance is surging amid rising rates, but it’s not due to traditional issuers. More investment-grade firms are taking the plunge – and that could be a good sign indeed and provide better returns for investors.