The Federal Reserve is creating an interesting and potentially difficult to navigate environment for investors. Thanks to its rate hikes, balancing both returns and risks in both equity and fixed income markets is becoming more difficult with every passing rate hike. For investors, deciding how to choose between stocks and bonds is a very tough nut to crack.

But the decision might not have to be a difficult one.

Convertible bonds could offer some of the best ways to play the current environment. The hybrid security offers the best blend of both worlds, with bond- and stock-like attributes. Given the murky waters that favor both equity and bond returns depending on the Fed’s moves, convertible bonds could be a big winner for portfolios.

The Thin Line

We all know the Fed has been raising rates over the last year to combat inflation and a red-hot economy. The rate hikes have had some interesting consequences for various asset classes. And today, stocks and bonds are playing this weird game of chicken with each other.

Risk for equities remains high given the recessionary concerns, slowdown in the economy, and declines in corporate earnings. The whole point of raising rates is that it makes saving rather spending a better option, while borrowing costs start to rise. As a result, equities tend to drop in price. The Fed’s pause helped boost stock prices in the medium term. But the Fed has continued to indicate it plans on raising rates to get inflation under its intended 2% target. This has increased recessionary risks and stalled some of the equity rally.

The flip side—the surge in rates—has crimped bond prices and raised yields. But that has now increased reinvestment risk. Additionally, the Fed hasn’t officially signaled it is done with raising rates. Although it is slipping, inflation remains high and above its 2% target, while other measures of economic health—such as the labor market—remain elevated. As the Fed keeps raising rates, prices for longer-dated bonds will drop and potentially increase losses.

The combination of equity and bond risks and potential for losses makes the current situation for portfolios a sticky one. Investors are positioning themselves for plenty of volatility, no matter what path they choose.

Why Not Both?

However, there may be an option that will allow investors to play both sides and straddle the line between equity and bonds. We’re talking about convertible bonds.

Convertibles are bonds. They are issued just like a normal bond with a coupon, par value, and place in the bankruptcy ladder. However, tucked inside that normal bond is basically a hidden stock option. Convertible bonds have a feature that allows the issuing firm to exchange the bonds for shares of its own stock under certain conditions. Typically, this condition is when the price of the firm’s underlying shares hit a certain point. This allows investors to get steady bond-like income and the ability to gain from a rising stock market.

Given they can function like both bonds and stocks makes investing in convertible bonds an interesting and ideal way to play the current environment.

If the Fed pauses and the market takes off, it makes sense for many issuers to ‘convert’ their bonds into stocks. With that, investors are able to get a great return and participate in the rally.

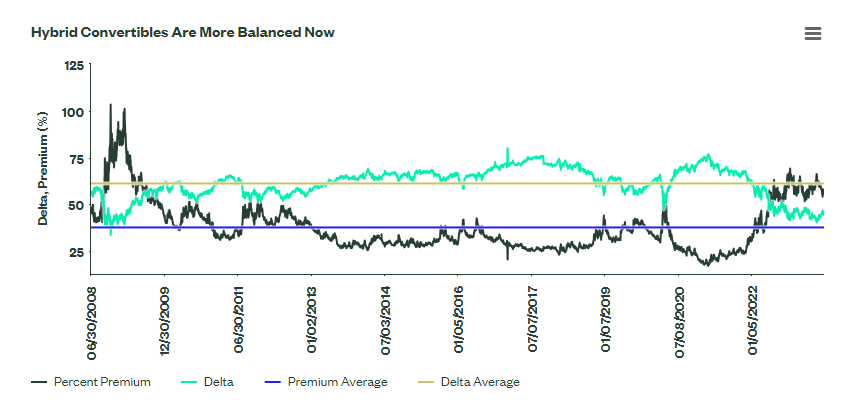

The bond side is also attractive for portfolios. Like many bonds, convertibles were hit hard over the last year as the Fed raised rates. But it appears they got most of their lumps out of the way early on. When looking at the sector’s delta, it’s currently at 45 and has been range bound in the low 40s for much of the year. That’s near post-global financial crisis lows and is about 26% below equities. Delta is the measure of sensitivity of a convertible bond relative to the underlying stock price. When convertible bonds have deltas ranging from 45 to 65, stock and bond prices are in sync, which is perfect for environments in flux. When delta is below 40, the bond side becomes more valuable, while a reading above 70 makes it more suitable for conversion.[1,2]

Right now it looks like convertible bonds seem to be in the sweet spot with regard to both bonds and equity. As you can see in this chart from State Street, converts’ delta is very close to bonds’ historic premium to par value. This indicates again the sector is trading at a good place for the current environment.

Source: State Street

Basically, based on current valuations, the equity and bond sides of a convertible bond are in perfect harmony and balance. This makes them a top play to purchase for the current environment, no matter what the Fed or economy does.

Adding a Dose of Convertible Bonds

Given the current environment, investors may want to snag some convertible bonds for their portfolios. There are plenty of chances to do that. Issuances of convertibles are up 198% this year as firms look for cheap funding. However, getting your hands on individual convertible bonds may prove to be difficult. They tend to be bought and held by institutional investors and don’t trade in the secondary market that often. Buying them means using an ETF or mutual fund.

The largest and easiest way to get exposure is the SPDR Bloomberg Convertible Securities ETF. The $4.6 billion ETF tracks nearly 300 different convertible bonds and yields about 1.83%. With an expense ratio of 0.40%, it’s a cheap option as well. The iShares Convertible Bond ETF is the other low-cost choice in terms of index ETFs.

Passive Convertible Bond ETFs

| Ticker | Name | AUM | YTD Price Ret (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|

| ICVT | iShares Convertible Bond ETF | $1.442B | 7.9% | 0.2% | ETF | No |

| CWB | SPDR Bloomberg Convertible Securities ETF | $4.761B | 7% | 0.4% | ETF | No |

Given the esoteric nature of the asset class, convertible bonds have long been a great place for active management. Investment manager Calamos made its living in the sector early on. The Calamos Convertible Fund is one of the largest and best performing in the sector. However, there are plenty of new and other choices that offer great performance. For example, the American Century Quality Convertible Securities ETF focuses on the top credit ratings in the sector.

Active Convertible Bond ETFs & Mutual Funds

| Ticker | Name | AUM | YTD Price Ret (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|

| FCVSX | Fidelity® Convertible Securities Fund | $1.55B | 6% | 0.72% | MF | Yes |

| CICVX | Calamos Convertible Fund Institutional Class | $662.1M | 5.2% | 0.85% | MF | Yes |

| QCON | American Century Quality Convertible Securities | $20.8M | 3.2% | 0.32% | ETF | Yes |

| CNSDX | Invesco Convertible Securities Fund Class Y | $333.7M | 1.2% | 0.68% | MF | Yes |

| LACFX | Lord Abbett Convertible Fund Class A | $176.9M | -0.9% | 1.07% | MF | Yes |

Either way—active or passive—convertibles allow investors to split the difference, reduce the risk of equities and bonds, and play the upside of either sector.

The Bottom Line

The Fed’s moves to raise rates has put portfolios in a pickle. Convertible bonds offer a way to play the potential outcomes for both stocks and bonds. With their ability to convert into shares and current discounts/high yields, investors have a perfect play for the current murky outlook.

1 Lord Abbett (June 2023). Convertible Bond Market Perspectives

2 State Street (July 2023). Bond ETF Ideas to Beat the Heat and the Fed