It’s easy to be bullish on bonds and fixed income assets these days. Thanks to the Fed’s rate hikes, bonds of all stripes are yielding the most they have in decades. Income choices are plentiful and they offer the chance for good returns versus stocks in the quarters ahead. With that, it’s easy to forget about some of the risks that come with fixed income investments.

And investment manager Putnam’s latest report unveiled a big one: contracting money supply or M2.

For investors, it’s a big risk waiting in the shadows that potentially could hinder a variety of bond asset classes and portfolios. For investors going gaga over bonds, it’s something to consider and, perhaps, profit from.

The Money Supply In a Nutshell

It’s probably been a long time since you heard the term money supply. And unless you’re an economist, it’s not something that comes up in conversation on a daily basis. The easy definition of money supply is the total of all of the currency and other liquid assets in a country’s economy on a certain date. This includes all the cash in circulation and all bank deposits that can easily convert to cash. Money supply is created when the Fed issues paper currency, coins and Treasuries.

There are a couple of different ways to calculate and report money supply, with the Federal Reserve preferring to use two distinct calculations. The “narrow money” or M1 is the classic definition above and is the count of the notes and coins that are in circulation. The dollar bill in your wallet or spare change under your car’s mat? That’s part of M1.

M2 includes everything in M1 as well as short-term deposits like CDs and repos as well as money market funds.

The Fed looks at money supply over time to track how much money is flowing, which can create inflation. The Fed can enact monetary policies to shrink the money and effectively “cool” the economy.

M2 Is Shrinking, Hitting Bonds

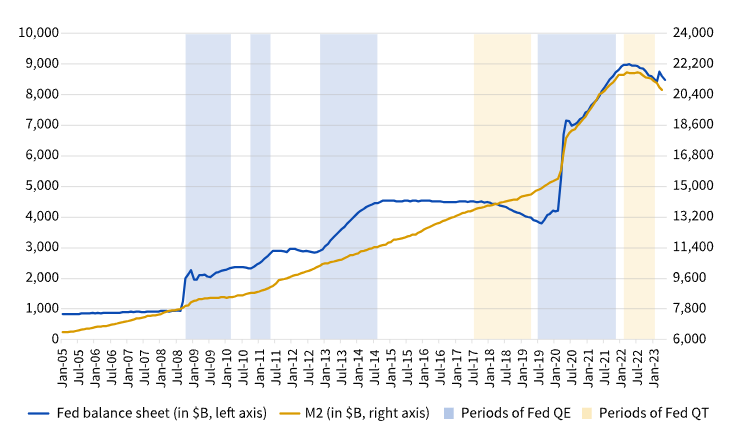

It’s no secret that the Fed has started to raise rates to cool inflation. The central bank has also taken steps through quantitative tightening to reduce the money supply – more specifically M2. This has reduced household wealth. You can see on this chart from Putnam, the recent downtrend to M2.

Source: Putnam

This shift lower has several implications across the banking sector. Money has continued to flow out of consumer and business accounts, while loan growth has started to decline due to the higher interest rates. Restarting of student loan payments has also helped reduce M2.

For the banks, this has been terrible. The aggregate commercial bank balance sheet has started to decline. That means they are making less, reducing profits and using their lessened cash in other ways.

This is where Putnam says the risk for bonds is located. Thanks to regulations and the need for safety assets, banks have long been one of the biggest buyers of Treasury bonds and agency mortgage-backed securities (MBS). The declining money supply means they will buy less of them. And it looks like they already are.

According to Putnam, the banks held at peak 7.5% of all marketable Treasury securities in May of last year. That number is down to just 6.4% today. Right now, they hold about 25% of all the MBS bonds. Again, much lower than peaks realized in January of 2022. In fact, banks have been net sellers of these assets. Remember, it was long-dated MBS that brought down the Silicon Valley Bank and started the crisis during the spring. The only thing keeping MBS prices stable has been low originations and reduction of supplies. 1

With Putnam’s analysis, we have less money available due to contracting money supply, which, in turn, is causing deteriorating balance sheets for the banks, lower profitability and less bond buying. That’s a recipe for a big potential bond hiccup down the road.

Ultimately, there may be too many bonds on the market and not enough willing investors to swoop up that supply. Investors continue to buy short-term securities to take advantage of large yields and sell/ignore longer-dated bonds, which could potentially cause lower prices for longer-termed bonds.

A Tough Play

For investors, the decline in money supply and the lack of banks buying up bonds is an interesting risk to consider for their bond portfolios. Given the high yields and return to normalcy for many bond types, it’s easy to get caught up in the positives when it comes to fixed income right now. But the risk is there.

So, how to play it and potentially mitigate that risk? Longer-term investors may want to sit on cash or short-term bond funds like the JPMorgan Ultra-Short Income ETF and wait for the eventual bargains that may appear. If Putnam is right, we should get plenty of opportunities to buy good intermediate- and long-term bonds at lower prices as M2 continues to shrink.

Another choice?

Go short. For risk-seeking investors or those who have significant holdings in longer-dated bonds or MBS, buying an inverse bond ETF could provide a hedge. A fund like the ProShares UltraShort 20+ Year Treasury ETF or the Direxion Daily 7-10 Year Treasury Bear 3x Shares effectively shorts their respective bond indexes using swaps and options – sometimes with leverage. Inverse and leveraged ETFs aren’t for the faint of heart or designed to be held long term. They have plenty of risks themselves. But tactically, they can provide hedges and loss reduction. For some investors, these ETFs could be a real win. Investors should, however, think twice before making the leap into these products.

Inverse Bond ETFs

| Ticker | Name | AUM | YTD Total Ret (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|

| PST | ProShares UltraShort 7-10 Year Treasury | $0.03B | 6.01% | 0.99% | ETF | No |

| TYO | Direxion Daily 7-10 Year Treasury Bear 3X Shares ETF | $0.02B | 5.93% | 1.08% | ETF | No |

| TBT | ProShares UltraShort 20+ Year Treasury | $0.47B | 5.87% | 0.89% | ETF | No |

| TMV | Direxion Daily 20+ Year Treasury Bear 3X Shares ETF | $0.3B | 4.92% | 1.01% | ETF | No |

| TBF | ProShares Short 20+ Yr Treasury | $0.17B | 5.24% | 0.90% | ETF | No |

| TBX | ProShares Short 7-10 Year Treasury | $0.03B | 4.22% | 0.96% | ETF | No |

| TTT | ProShares UltraPro Short 20+ Year Treasury | $0.22B | 3.89% | 0.95% | ETF | No |

Perhaps the easiest choice may be to keep buying bonds and other fixed income assets, M2 be damned. Even Putnam acknowledges the assumption that the Fed could kick on easing at a moment’s notice if things get too bad.

Either way, the shrinking of M2 is concerning when it comes to a bank buying Treasury and MBS bonds. Ultimately, there will be less liquidity and buying of these assets from some of the biggest buyers in the world, potentially creating headaches for bond holders in the near term.

The Bottom Line

It’s easy to forget about some of the risk with fixed income, now that yields are high once again. But Putnam’s analysis of a shrinking money supply, especially M2, throws plenty of cold water on bonds these days. For investors, this creates losses as the major buyers of these bonds have less liquidity to do so. For investors, making a plan to combat this issue is paramount.

1 Putnam (June 2023). Contracting money supply poses risk to bonds