The real meat & potatoes of modern portfolio theory comes down to diversification of asset classes. Putting together a variety of asset classes and securities allows portfolios to smooth out their returns. You have a variety of different assets moving independently of each other; when one is up, the other could be down. The net effect is steady positive returns over the long haul.

Typically, investors use stocks and bonds for the balance.

And right now could be a great time for that relationship to work. According to a new whitepaper from State Street, bonds currently offer a wonderful buoy for a portfolio and investors should position themselves according.

A Balancing Act

When it comes to portfolios, it’s all about balancing risk. In this case, volatility is used as a main measure of risk by Wall Street pros. Equities tend to have higher risk profiles on the whole. As such, getting proper diversification and balancing those risks has traditionally fallen to bonds and fixed income.

Fixed income investments work as ballast and offer lower volatility for two real reasons. One is that they offer steady coupon payments twice a year. All things being equal, investors can count on receiving these infusions of cash into their portfolios. And two, when bonds mature, investors get their principal back. There’s no such guarantee for investors in equity investments. The end result is that bonds as a category tend to move less than stocks. This provides the ballast.

It turns out this could be a wonderful time to find that ballast.

High Yields and a Small Equity Risk Premium

That’s the gist of a new missive from State Street. According to the asset manager, a combination of factors has once again made bonds a perfect complement to stocks and could help buoy a portfolio while driving returns over the next year or so.

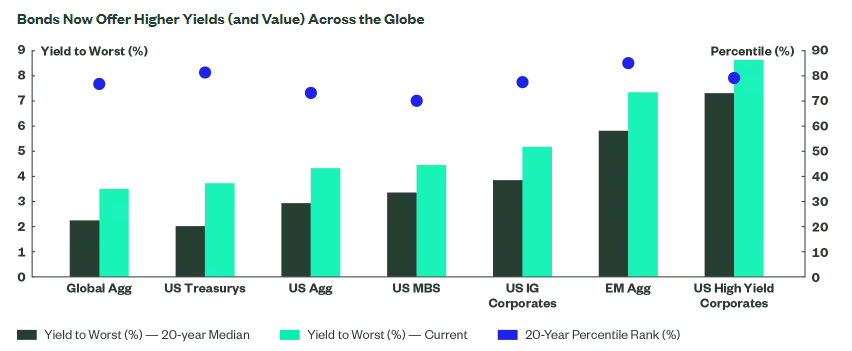

For starters, yields are around their juiciest levels in recent history. Thanks to the rise in rates and last year’s plunge in bonds—which was a rare market event—investors can score some real income these days. Looking at the major bond sectors for the last 20 years, current yields are now in the 80th percentile. Even junk debt and high-yield bonds offer yields in the 77th percentile. This is especially interesting because yields typically come with ‘severe financial distress.’ However, those conditions aren’t currently happening. 1

This chart from the asset manager highlights the current yields and percentile rankings.

Source: State Street.

Those high yields are advantageous when considering the so-called Equity Risk Premium (ERP), which is typically calculated by taking the earnings yield on the S&P 500 Index minus the yield to the worst on the U.S. 10-year bond. This provides a measure of how much ‘extra’ return stocks will provide over bonds and just how good a hedged fixed income could be.

Right now, the current earnings yield on the S&P 500 is 5.39%, while the 10-year Treasury bond yield is 3.44%. This produces an ERP of just 1.95%, below the historical median of 3.16%. The kicker is when the ERP is below this number, stocks have a 10-year annualized return of 3.11%, and when it’s above this number, stocks produce an 11% annual 10-year return.

Bonds are now providing a better value and potential return. This means they will be able to ballast a portfolio and reduce potential equity risk/low returns.

Adding Bonds for the Ballast Potential

With the ERP below norms and bond yields above them, investors are being given a wonderful chance to add bonds to their portfolios and regain much of their portfolio balancing power. To that end, State Street recommends doing three things.

First, get active with core bond strategies and high yield bonds. State Street predicts that active credit management and moving beyond the constraints of indexes will be fruitful for investors and provide the most bang for their buck. The asset manager recommends the SPDR DoubleLine Total Return Tactical ETF and SPDR Blackstone High Income ETF to accomplish this goal.

Second, focus on short term. Here, investors have plenty of opportunity for income and managing duration risk. For example, short-term corporate bonds now yield over 5% and have ERP spread levels within 20-year averages. The SPDR Portfolio Short Term Corporate Bond ETF or iShares 0-5 Year Investment Grade Corporate Bond ETF can be tapped for this exposure.

Finally, State Street recommends betting big on mortgages. Right now, MBS bonds offer some of the most compelling/safe yields and ERP data of any sector. Investors looking for the biggest ballast and return opportunity should focus on funds like the SPDR® Portfolio Mortgage-Backed Bond ETF or DoubleLine Mortgage ETF.

Short-term & High-yielding Bond ETFs

| Ticker | Name | AUM | YTD Price Ret (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|

| HYBL | Spdr Blackstone High Income ETF | $125.7M | 1.5% | 0.70% | ETF | Yes |

| SLQD | iShares 0-5 Year Investment Grade Corporate Bd ETF | $2.52B | 0.6% | 0.06% | ETF | No |

| TOTL | SPDR DoubleLine Total Return Tactical ETF | $2.985B | 0.5% | 0.55% | ETF | Yes |

| SPSB | SPDR Portfolio Short Term Corporate Bond ETF | $8.001B | 0.1% | 0.05% | ETF | No |

| DMBS | DoubleLine Mortgage ETF | $99.6M | NA | 0.49% | ETF | Yes |

| SPMB | SPDR Portfolio Mortgage Backed Bond ETF | $4.38B | NA | 0.03% | ETF | No |

All in all, bonds as a whole are attractive at this point for investors looking to balance their equity risk. Even adding the broader indexes could provide the right combination of returns.

The Bottom Line

Balancing equity risk in a portfolio has long fallen on bonds and fixed income assets. And today, investors may have a real chance to add that ballast. According to State Street, yields and the current ERP makes bonds a big buy and big value today. Adding any bond could do the trick, with active management, short-term corporates, and MBS delivering the best potential to find that balance.

1 State Street (June 2023). Seek Income and Balance Risks with Bond ETFs