For fixed income investors, these could be the halcyon days. Thanks to the Federal Reserve’s continued path higher for interest rates, bonds and other fixed income assets are now providing the best yields in decades. Investors truly have their pick of the litter.

That is, if they could only get off the sidelines. The amount of cash sitting in money market funds continues to grow amid the rise in short-term rates.

However, according to asset manager Capital Group, this is a huge problem. There are many paths to income potential in the current market that will ultimately be better for investors over the long run than sitting in cash. For investors, real income is outside of money market funds.

Investors Have a Cash Problem

Investors have one mantra these days: “Cash is king.” According to the latest Investment Company Institute (ICI) data, investors are sitting on a mountain of cash—$5.53 trillion to be exact. That’s higher than the peaks of the Great Recession and COVID-19 pandemic. This record amount of cash doesn’t include holdings of T-bills and other ultra-short-term fixed income assets. 1

It’s easy to see why investors have gone gaga for cash and money market assets.

Inflation and the Fed’s monetary tightening has pushed short-term yields to highs not seen in about a decade. These days, money market funds are yielding from 4.5% to 5%. That’s a good deal considering a year ago they were paying close to zero.

It’s also a good deal considering some of the worries plaguing the market. The Fed’s tightening has zapped growth potential for the economy, increased uncertainty, and increased volatility in equities. Why take the risk when you can make an easy risk-free 5%?

However, for investors looking for income, that 5% yield on cash may be too good of a thing to last. According to asset manager and sponsor of American Funds, Capital Group, the mixed economic picture and falling inflation will have the Fed pausing and thinking twice about raising rates. To that end, the yield on cash may not last.

With that in mind, there are many paths to finding good income today that will last when the Fed finally pauses or even cuts rates.

Lock-in Income NOW!

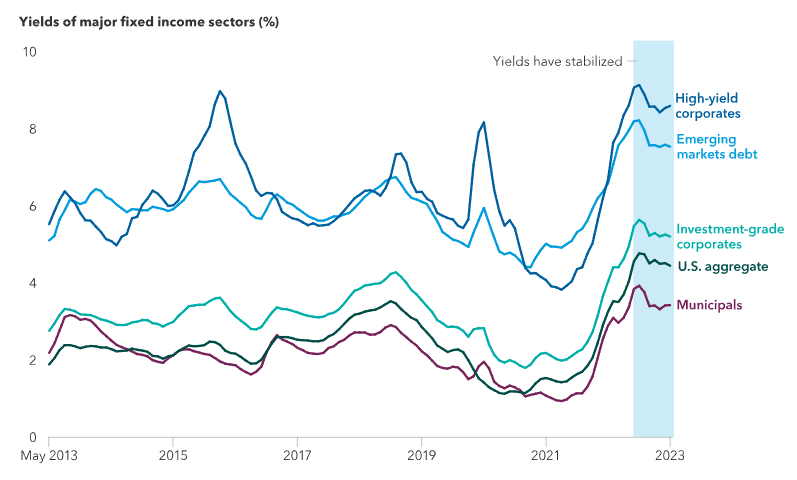

For starters, investors should lock-in yields today. While 2022 was painful—with the Bloomberg U.S. Aggregate Index falling by over 13%, the dip in bond prices, and the Fed’s moves to raise benchmark rates—bond yields are very juicy and have been reset to levels found before the Great Recession. In fact, you’d have to go all the way back to 2007 to match the current yield on the 10-year Treasury. This chart from Capital Group shows the current yields for many popular fixed income sectors and just how much they’ve increased.

Source: Capital Group

The key, according to the investment manager, is yields have stabilized. Many high yield sectors haven’t seen their prices make dramatic movements since the Fed has started to slowly increase rates. These current higher yields make bonds better suited to absorb price and interest rate volatility. Buying today locks-in high yields for tomorrow. However, cash will quickly provide less yield when the Fed cuts rates.

High-Grade Corporate Bonds

Investors may want to start their search for quality investment-grade corporate bonds. While recessionary risks are there, many corporate balance sheets are flush with cash and consumers continue to spend. This makes investment-grade corporate bonds and their 5.57% average yield a top draw for income seekers.

Overall, the Fed may actually achieve a so-called soft-landing and avoid a bad recession. And with calls for recession continuing to dip and get pushed further out on the horizon, corporate bonds remain a steady source of high yield without that much more credit risk.

Junk Isn’t So Junky

Another choice for investors’ cash is high yield or junk bonds. After last year’s route, junk is yielding north of 8%. This high starting yield has provided plenty of volatility, buffering against current rate increases. At the same time, credit quality has improved for the junk bond sector.

Nearly half of the junk bonds issued now feature credit ratings of BB/Ba. This is the highest level in the current universe. Many firms with the riskiest financial profiles have sought private credit or leveraged loans for their funding needs. This makes junk less junky overall and the high 8% yield ‘safer’ than a decade ago. 2

Support Your Local State Government Via Muni Bonds

Finally, municipal bonds offer a wonderful opportunity to not only have a high yield, but one that is tax-advantaged. Today, many Munis are offering a tax equivalent yield that is above Treasuries with a similar credit risk profile.

Thanks to the surge in pandemic era stimulus, many state and local governments are flush with cash and have moved to budget surpluses. According to the National Association of State Budget Officers, both 2021 and 2022 provided record-breaking increases to cash flows. Today, balances remain stronger than previous tightening cycles. This provides muni bonds with strong credit risk profiles. And yet yields are better than government bonds.

Playing the Many Paths to Income

Given the amount of cash sitting on the sidelines and the potential for that cash to return less-than-expected over the long haul, investors may want to follow Capital Group’s advice and move into the world of bonds. The trio of corporates, junk, and muni bonds make for an ideal parking place.

You certainly could just index. The iShares Aaa – A Rated Corporate Bond ETF, iShares National Muni Bond ETF, and iShares BB Rated Corporate Bond ETF could be all you need to play Capital Group’s recommendations and focus on credit quality.

Another choice could be to go active. Given the plethora of top bonds and opportunities in the sector, active management can play a significant role in boosting returns and limiting losses. A fine play could be Capital Group’s American Funds Multi-Sector Income Fund. The go to anywhere fund is allowed to purchase a variety of bonds and has been positioning itself according to this framework. The Capital Group Municipal Income ETF could be used to get Muni exposure within the active framework.

Active & Index Bond ETFs & Mutual Funds

These funds are selected based on YTD total return. Their expense ratios range from 0.07% to 0.84%. They are yielding between 2.5% to 7% and have AUM ranging between $150mn to $33bn.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| CGMS | Capital Group US Multi-Sector Inc. ETF | $187.5M | 4.9% | 6.6% | 0.39% | ETF | Yes |

| MIAQX | American Funds Multi-Sector Income Fund A | $12.1B | 4.7% | 6.6% | 0.84% | MF | Yes |

| HYBB | iShares BB Rated Corporate Bond ETF | $254.5M | 4.3% | 6.1% | 0.25% | ETF | No |

| CGMU | Capital Group Municipal Income ETF | $228M | 2% | 3.5% | 0.27% | ETF | Yes |

| CGCP | Capital Group Core Plus Income ETF | $1.046B | 1.4% | 5.8% | 0.34% | ETF | Yes |

| QLTA | iShares Aaa - A Rated Corporate Bond ETF | $935.1M | 1.4% | 3.8% | 0.15% | ETF | No |

| MUB | iShares National Muni Bond ETF | $33B | 1.2% | 2.7% | 0.07% | ETF | No |

Ultimately, Capital Group’s message is for investors to get out of cash and into bonds. The outlook for cash is getting less picturesque and it’s time to lock-in some yield for the long haul. Corporate bonds, junk, and muni bonds offer the best values right now for that cash that’s sitting on the sidelines.

The Bottom Line

All in all, investors have flocked to cash with yields now close to 5%. However, according to Capital Group, this is a major disservice. Longer term, the risk in cash is growing and investors need to lock-in income. Luckily, there are many paths to do just that.

1 Capital Group (August 2023). 4 high-income seeking investment strategies for a high-rate world

2 Capital Group (June 2023). Bond outlook: Fed pause leaves many paths to income potential