The world’s bond market is a $130+ trillion behemoth. And, naturally, the U.S. dominates that market as the single-largest individual player. As such, most investors focus strictly on the U.S. and its IOUs. However, that could be a serious mistake on a lot of fronts.

It turns out, looking beyond U.S. markets could provide plenty of extra oomph.

For investors willing to break out their passports and go global with their bond holdings, an expanded opportunity set can provide greater income, lower volatility and a host of other benefits for portfolios. The best part is that going global with your bonds has never been easier.

A Huge Opportunity Set

It’s easy to see why the U.S. is the top dog in the world’s bond market. As the world’s largest economy, the U.S. is the world’s single-largest bond market, worth roughly $51 trillion dollars. That’s a lot of corporate, municipal and government-backed bonds. For many portfolios – both big and small – this huge size is the only sandbox they play in.

However, investors may be leaving plenty of other opportunities on the table.

It’s true the U.S. is the biggest sandbox, but when looking at the whole picture, it’s not the biggest piece. Overall, more than 52% of the world’s bonds lie outside U.S. borders. Looking at the entire capital markets, including stocks, global bonds make up about 24% of all investable assets.

However, investors are woefully under-invested in bonds outside the U.S. The average investor only has about 5% to 7% of their total portfolio in international assets. Of that, bonds make up less than 2%.

That’s a real shame, as those bonds can offer plenty of benefits for those investors willing to look beyond the U.S. borders.

Numerous Wins

For one thing, the U.S. doesn’t always win on the return and yield front. Individual countries ebb and flow, and thanks to local central bank policies on interest rates, yields tend to be different around the world. This provides opportunities for investors to hedge their U.S. holdings and grab potential extra income.

For example, in the bond rout of 2022 – when the U.S. Federal Reserve started to raise rates – the Bloomberg Aggregate Bond Index (Agg) managed to produce a negative 13% total return. However, not all bond markets did as poorly. Japanese bonds managed to produce only a negative 3.2% return. Canada’s bond market gave a negative 10% return. This underscores how investors can reduce losses within their bond portfolios. Moreover, they could have gotten extra yield as well.

In the above example, Japanese bonds, when hedged into U.S. currency, can provide a yield more than 227 basis points above U.S. Treasuries while maintaining investment-grade credit quality.

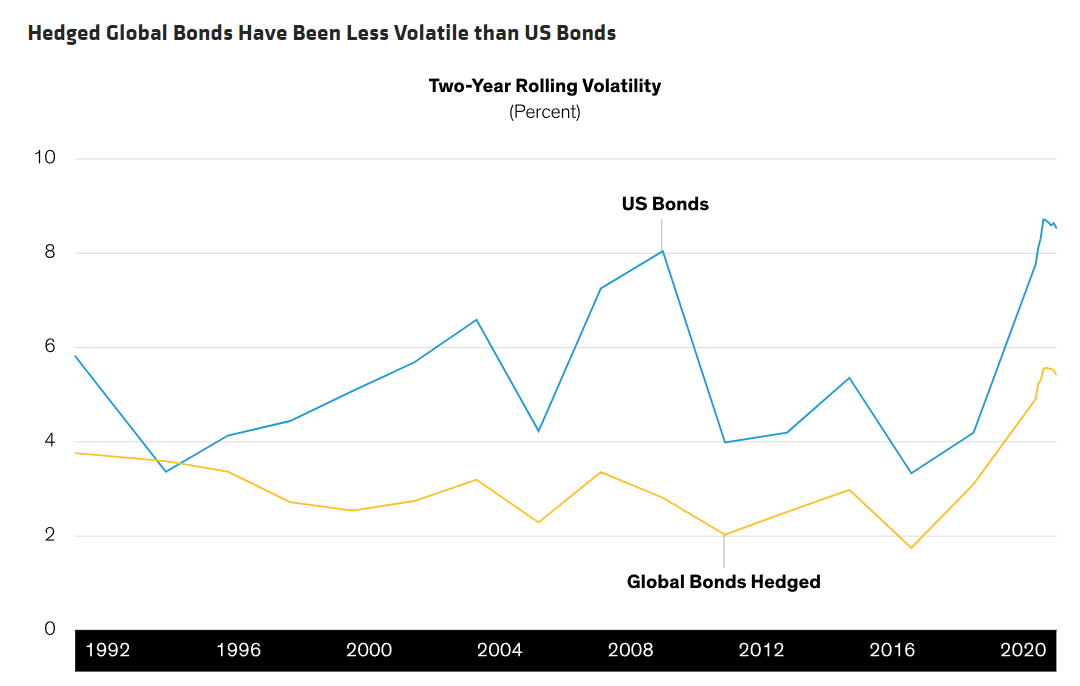

The extra yield comes with lower volatility and extra return as well.

According to AllianceBernstein, global bonds have slightly outperformed bonds focused on U.S. securities. Over the last 30 years, the Bloomberg Global Aggregate Index, which includes U.S. bonds and international ones, has posted an average annualized return of 4.8%. By just looking at the U.S. via the Agg, you get a 4.6% annual return. 1

Better still is that the return comes with lower volatility. As you can see from this chart, global bonds have provided a lower rolling two-year volatility than holding just U.S. ones.

Source: AB.com

Another potential win for portfolios is currency translation.

When we buy an international bond mutual fund or ETF, fund managers must convert dollars into Euros, Loonies or Yen. The exchange rate can help investors during periods of U.S. dollar weakness or strength. During periods of dollar strength, fund managers can buy more international bonds and get them for less. The reverse is that during periods of dollar weakness, the interest payments from international bonds – in Euros, Kiwis, Pesos, etc. – get translated into more greenbacks. This helps boost yields.

Finally, global offers potentially strongrt total returns on the riskier side of the equation as well. Emerging market bonds, international junk bonds and private credit can provide many of the same benefits as their U.S. junk and high-yield counterparts. This can provide stock-like returns with less risk and lower volatility.

Going Global With Your Bonds

Given the benefits and potential diversification of adding international bonds to a portfolio, investors may want to get on board. However, unlike buying a 10-year Treasury or bond from Walmart, getting your hands on them may prove difficult. Some brokerages allow you to buy global sovereign bonds from nations like the U.K. or Canada, but it takes special account permissions.

A better bet could be exchange-traded funds (ETFs). Thanks to the boom in ETFs, international bonds are a breeze to add. With one-ticker access, investors can score everything from international sovereigns to emerging market junk bonds. Just like their U.S. holdings, investors can add international bonds to complete their various holdings. The idea is that they should provide extra yield and return potential.

International Bond ETFs

These ETFs are selected based on their ability to tap into various international and global bond sectors at a low cost. They are sorted by their 1-year total return, which ranges from -2.2% to 9.5%. Their expense ratio ranges from 0.05% to 0.85% and they have AUM between $50M and $86B. They are currently yielding between 2.1% and 5.31%.

| Ticker | Name | AUM | 1-year Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| FEMB | First Trust Emerging Markets Local Currency Bond ETF | $132M | 9.5% | 5.31% | 0.85% | ETF | Yes |

| HYXU | iShares Global ex USD High Yield Corporate Bond ETF | $50M | 7.5% | 3.49% | 0.40% | ETF | No |

| CEMB | iShares Emerging Markets Corporate Bond ETF | $422M | 5.2% | 4.84% | 0.50% | ETF | Yes |

| BNDX | Vanguard Total International Bond ETF | $85.7B | 5% | 2.1% | 0.07% | ETF | No |

| IBND | SPDR Bloomberg International Corporate Bond ETF | $235M | 3.5% | 2.7% | 0.50% | ETF | No |

| BNDW | Vanguard Total World Bond ETF | $670M | 3.2% | 2.8% | 0.05% | ETF | No |

| BWX | SPDR Bloomberg International Treasury Bond ETF | $836M | -2.2% | 2.1% | 0.35% | ETF | No |

Overall, the lesson is clear. For investors, they should break out their passports and go global with their bond portfolios. Lower volatility and better returns are all benefits of seeking bonds outside the U.S. The best part is that thanks to ETFs, adding exposure to global bonds is a snap. With one or two tickers, investors can instantly diversify their bond holdings and add an international flair.

The Bottom Line

When it comes to bonds, investors have a real hometown bias and tend to overweight U.S. bonds. This is a real shame, as going global with their fixed-income holdings can provide plenty of benefits to portfolios. For investors looking to take the plunge, better returns and more income opportunities are on the horizon.

1 AllianceBernstein (September 2023). Why Global Bonds Make Sense for US Investors