Nearly all the recessions since the 1970s have been caused by one thing: an overzealous Federal Reserve. In attempts to cool the economy, the Fed has typically pushed rates too high for too long, thus sending the economy into recession. With the Fed pausing and keeping rates at 5.50%, some pundits have started to speculate that a recession could be around the corner.

There is at least one good thing about higher rates and recession, however. Fixed income and bond assets are great performers.

Digging into the data, fixed income assets outperform both stocks and cash as recession hits and moves through its phases. And with yields already high, it looks like bonds have plenty of return potential if and when the next downturn hits. For investors, that’s another reason why bonds are the asset class to own now.

Higher Rates = Recession

Recessions and economic downturns are part of the natural business cycle. According to the National Bureau of Economic Research, there have been eight official recessions since 1969: four mild and four severe. Severe recessions are defined as those with year-on-year GDP declines greater than 2%, a 3% increase in the unemployment rate, and a decline in the output gap that exceeds 4%.

Digging into the data, more often than not they are caused by outside forces—namely the Federal Reserve—at the end of tightening cycles, which is easy to understand. The economy gets too hot and the Fed raises rates to cool the growth. Unfortunately, moving a ship as large as the United States is no easy task and the Fed typically tightens too much and for too long.

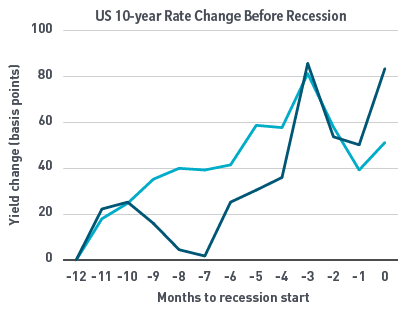

This chart from MFS Investments shows the average rate change 12 months before the recession. As you can see, for both mild and severe recessions, the Fed’s path to tightening is often the cause.

Source: MFS

This is what is so troubling today. The Fed has continued to raise rates and is now sitting at benchmarks not seen in decades. The central bank has paused, but we can already see the effects of higher rates on the economy. Data has begun to shift lower on a variety of fronts, while stubbornly high inflation is keeping those rates higher for longer.

Recession and a hard landing are still very much in the cards.

Bonds Win Big

Perhaps one of the positive side effects is that bonds win big during these environments. The reason is a one-two punch combination.

For starters, higher interest rates mean that bonds yield more in just before/at the beginning of a recession. This allows investors to lock in high yields. This is what is going on today. The second piece is that the Fed will cut rates—sometimes very aggressively—to jumpstart growth again. This causes investors to push up bond prices as already issued bonds yield more than newly issued ones.

The result is strong returns for fixed income assets. Looking at Treasury bonds via the Bloomberg U.S. Treasury Index, MFS found that six months after a recession ends, the index manages to produce a 7.31% total return, while rolling six-month returns during recessions produce returns between 3.58% to 7.5%. The best is that these returns beat both cash and the S&P 500. 1

Bonds win big in other ways according to MFS’s research, namely when it comes to drawdowns and recovery periods. Of the seven recessions in the modern era, U.S. Treasury bonds have lost an average of just 3.6% and have recovered that loss within 10 months. This compares with an average equity maximum drawdown of 38.4% and a recovery time of 44 months.

Bonds Make Sense Today

As they say, history doesn’t repeat, but it sure does rhyme. With today’s environment being eerily similar to those recessions of the past, bonds can be a real driver of returns going forward.

The key to MFS’s study was the usage of Treasury bonds, specifically the 10-year. As the benchmark for the fixed income sector, the 10-year is seen as the holy grail. Buying the 10-year instrument individually is pretty easy via any brokerage or directly through the Treasury. Similar results could be found via intermediate Treasury bonds or those with seven to 10 years left to maturity.

Intermediate Treasury Bond ETFs

These funds are selected based on exposure to intermediate Treasury bonds and the 10-year note. They are sorted by their one-year total return, which ranges from 0.4% to 4%. Their expense ratio ranges from 0.03% to 0.15%, while they have AUM between $58M and $28B. They are currently yielding between 3% and 4.5%.

| Ticker | Name | AUM | 1-Year Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| IEI | iShares 3-7 Year Treasury Bond ETF | $13.4B | 4% | 3% | 0.15% | ETF | No |

| SCHR | Schwab Intermediate-Term U.S. Treasury ETF | $7.4B | 3.7% | 3.7% | 0.03% | ETF | No |

| SPTI | SPDR Portfolio Intermediate Term Treasury ETF | $4.38B | 3.6% | 3.7% | 0.03% | ETF | No |

| VGIT | Vanguard Intermediate-Term Treasury ETF | $23.2B | 2.9% | 3.4% | 0.04% | ETF | No |

| IEF | iShares 7-10 Year Treasury Bond ETF | $27.6B | 2.2% | 3% | 0.15% | ETF | No |

| UTEN | US Treasury 10 Year Note ETF | $58M | 0.4% | 4.5% | 0.15% | ETF | Yes |

All in all, bonds are wonderful performers during recessions. Offering better returns than stocks or cash, they can form some decent ballast when things get rocky. And with the environment starting to show the early signs of recession, the time to buy bonds is today.

The Bottom Line

When it comes to recessions, bonds are where it’s at. Thanks to the Fed, bonds offer plenty of current yield, total returns, portfolio ballast, and other benefits during downturns. And with data starting to slip, bonds are a big buy today.

1 MFS (November 2023). Fixed Income Investing in US Recessions